The euro continued to stumble against the US dollar as the bearish trend dominated the pair. Euro looks destined to test the 12 year lows found earlier this year especially with the ECB meeting this week and US nonfarm payrolls.

The euro continued to drift lower against the US dollar last week as the expected diverging monetary policies look to be taking shape and will do so until mid-December. The ECB suffered a leak which gave the market an insight into the potential stimulus when they meet later this week. The leak suggested deflation was a reality and that split-level interest rates depending on deposit size may be implemented. Certainly all will be answered when they meet on Thursday.

This week will be huge for the euro and will certainly see volatility step up a level. The ECB meet on Thursday and are widely expected to cut interest rates. Friday will see the monthly US nonfarm payrolls which always leads to a spike in volumes. Also watch for a number of FOMC members speaking, with the expected hawkish rhetoric likely to keep the bearish pressure on the pair.

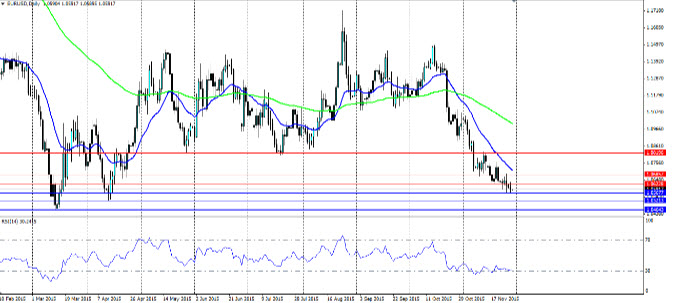

Technicals show the bearish trend well in control, however it’s more of a dynamic one than a linear one. Divergence in the RSI forming higher lows with price forming lower lows could indicate a bottom is near, but this week will see fundamentals in the driving seat. The 12 year lows found earlier this year will be a main downside target and are likely to be tested. Watch for support at 1.0567, 1.0521 and 1.0464 with resistance at 1.0622, 1.0685 and 1.0819.