Kathy Lien is the Managing Director of FX Strategy for BK Asset Management.

- Will the ECB Crush the Euro?

- Euro Extends Losses Ahead of ECB Meeting

- Sterling Remains Under Pressure Despite Stronger Data

- Dollar Hangs Tight, Barrage of Labor Market Reports Due

- AUD Erases Losses on Stronger GDP

- NZD: Supported by Uptick in Chinese PMI

- JPY: No Changes Expected from BoJ

Will the ECB Crush the Euro?

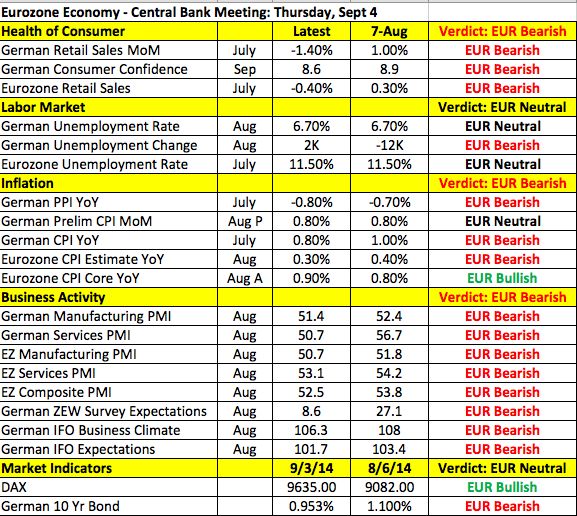

Thursday’s European Central Bank meeting is the most important event risk this week. The ECB is one of the very few central banks at the cusp of easing monetary policy and based upon the recent decline in EUR/USD and the CFTC’s report on IMM positioning, the market is positioned for a big announcement. Over the past 2 months, EUR/USD lost more than 4% of its value or approximately 600 pips and going into Thursday’s meeting, euro short positions are at a 2-year high. So the ECB really needs to deliver, otherwise is risks triggering a massive short squeeze in the currency. At the Jackson Hole meeting last month, Mario Draghi’s concerns about lower inflation expectations led economists and investors to believe that the central bank will announce additional easing this month and these expectations were reinforced by back to back weakness in Eurozone data. The following table shows how widespread the deterioration in the Eurozone economy has been since the last monetary policy meeting. Everything from inflation to retail sales and economic activity weakened, hardening the case for additional easing.

However Draghi faces a tough choice because stimulus is already in the pipeline in the form of the TLTRO programs due in September and December. The euro also weakened quite a bit, providing support for inflation and growth. Ideally he would prefer to see how the market responds to the new 4-year loans due later this month before increasing stimulus. But unfortunately, the economy and the market may not be willing to wait. Given the trend of recent data, it is not a question of 'if' but of 'when' further easing is needed. Sending a strong message on Thursday could help solidify the foundation for recovery by ensuring that rates remain low and the euro weak. Since the bar is set very high for the ECB announcement, if they want to drive EUR/USD to 1.30, the ECB will need to over-deliver.

One-Two Punch with ABS Purchases and Rate Cut – The strongest message that the ECB could send to the market would be a one-two punch of Asset Backed Securities purchases and a 10bp rate cut. While the central bank is not fully prepared to buy ABS, it could preannounce its plans and say that details will follow. A 10bp rate cut would also be an aggressive move but most likely the ECB would prefer to save this option for a future time because with rates already at zero, the impact would be more psychological. Also, Draghi previously indicated that rates have reached the lower bound, so lowering them again would be inconsistent with his previous views. Any one of these options without the other should still be enough to drive EUR/USD below 1.31, but if the ECB fails to announce any new measures, a massive short squeeze could send the euro back to 1.33. At this time, Quantitative Easing is not legally or practically possible but Draghi will certainly leave this option open. The staff forecasts will be updated this month and we expect the central bank to lower their inflation and growth forecasts.

Dollar Hangs Tight, Barrage of Labor Market Reports Due

The US Dollar traded lower against most of the major currencies Wednesday. Factory orders rebounded strongly in July but the increase fell short of expectations. The Beige book also contained a slightly more optimistic tone, with 10 out 12 districts reporting moderate to modest growth. The main focus Thursday will be on the ECB’s monetary policy announcement but with Challenger Layoffs, ADP, Jobless Claims and Non-Manufacturing ISM reports scheduled for release non-farm payrolls will also be on everyone’s minds. Since we anticipate stronger job growth in the month of August, we will be looking for further improvements in Thursday’s labor-market reports. Jobless claims could tick higher but healthy readings over the past few weeks give us the confidence to believe that job growth exceeded 200k last month. A pick up in service sector activity and rise ADP would be enough to revive the uptrend in the dollar ahead of the non-farm payrolls report. Fed President Mester who is a voting member of the FOMC is also scheduled to speak on Thursday and having just joined the monetary policy committee in June, her bias is still unclear, making her speech on monetary policy particularly important. We continue to look for the dollar to extend its gains on the back of U.S. data and monetary policy direction. If Mester expresses a more hawkish bias, it could revive the rally in U.S. rates and, in turn, the dollar.

Sterling Remains Under Pressure Despite Stronger Data

The British pound fell to a fresh 6-month low against the U.S. dollar despite stronger-than-expected U.K. data. Service sector activity expanded at a faster pace in the month of August, helping to lift the overall PMI index from 58.6 to 59.3, the highest level in 9 months. Although manufacturing activity slowed, the expansion in the service and construction sectors along with the economy in general bodes well for the Bank of England’s monetary policy decision. We do not expect any changes from the BoE, which means Thursday’s central-bank decision will be a nonevent for the currency. Still, when the minutes are released 2 weeks hence, this month’s PMI numbers should give policymakers a stronger reason to consider an earlier rate rise. However none of that seems to matter to sterling right now as the currency continues to come under pressure from concerns about the upcoming Scottish referendum. The vote to remain apart of the U.K. still dominates but the gap is narrowing. If support for Scottish Independence continues to rise, the uncertainty could keep sterling from recovering.

USD/CAD Drops on BoC Optimism

The best performing currency Wednesday was the Australian dollar but all 3 commodity currencies traded higher. Stronger-than-expected second quarter GDP growth and an uptick in service sector activity in Australia and China helped the Australian dollar erase all of Tuesday’s losses. The upside surprises in both reports ensures that the Reserve Bank of Australia will leave interest rates unchanged for the rest of the year. The market is now pricing in a less than 15% chance of additional easing from the central bank. The trade balance and retail sales report was scheduled for release Wednesday evening and given the rise in the sale component of the PMI services index, there existed a good chance that retail sales increased at a faster pace in July. Meanwhile, USD/CAD dropped sharply on the back of the Bank of Canada’s monetary policy announcement. The central bank left monetary policy unchanged but the slightly more optimistic tone of the BoC statement drove the Canadian dollar sharply higher. According to the BoC, the housing market has been stronger than anticipated and with the U.S. recovery back on track, they believe that the Canadian economy will return to capacity in the next 2 years. There was nothing in Wednesday’s statement that suggests that the central bank is considering lowering rates and in fact, the BoC appears to be fully comfortable with the current level of monetary policy. Canadian trade numbers are scheduled for release Thursday but the impact on USD/CAD should be limited. No economic data was released from New Zealand but stronger Chinese and Australian data prevented further losses in the currency.

JPY: No Changes Expected from BoJ

The Japanese Yen ended the day unchanged against most of the major currencies. The only meaningful movement was in AUD/JPY, which climbed to its strongest level in 15 months. This was due entirely to AUD strength and not Yen weakness. Tuesday night’s Japanese economic reports were mixed with a decrease in the service sector PMI index offset by an increase in the composite PMI index. However the big story overnight was the Cabinet reshuffle. Plus the fact that Amari retained its current posts as Finance and Economy Minister and Shiozaki was appointed as Health Minister, overseeing the investment strategy of the Government’s Pension Investment Fund. As mentioned in Tuesday’s note, Shiozaki is a major advocate of more aggressive investing by the GPIF. Tanigaki was appointed to Secretary General, which is also important because he was a proponent of the sales tax hike and his appointment implies that the government will move forward with its next hike. The Bank of Japan had a monetary policy announcement scheduled Wednesday evening and while no changes were expected, Kuroda’s press conference is worth watching. The big question is whether he will temper his optimism given the recent trend of Japanese data and how this could affect their plans for easing.