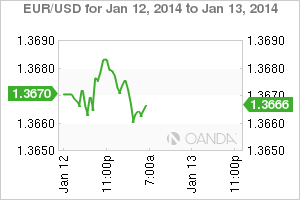

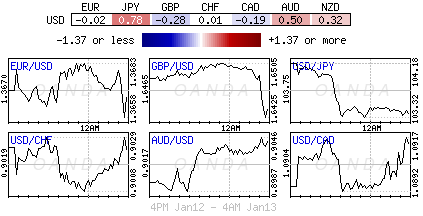

It seems that investors are not quiet comfortable with market direction as stocks, yields and the dollar to an extent were mixed in the first full week of trading in 2014. Investor concerns continue to be dominated by the powerhouse of two, China and the US. Last week, weak data from China in the form of continuing decline of producer prices and listless exports and in the US, the surprisingly weak employment report, has only boosted these concerns. Friday's NFP report revealed that the US was only capable of creating +74k new jobs, way off the highly anticipated target. Although the rate of unemployment declined to 6.7% - the lowest level in years, the few added jobs suggest little improvement in the labor market. Such a weak report could be enough to convince the FOMC from announcing additional tapering of QE3 at the end of the month. Economies are looking for consistency and we are not there just yet. However, the consensuses view is that the weak payroll numbers should not change the Fed's plans for policy tapering ahead just yet. EUR/USD" border="0" height="200" width="300">

EUR/USD" border="0" height="200" width="300">

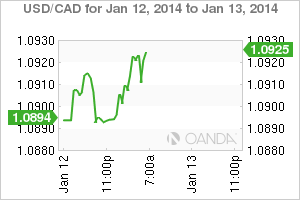

Historically, the first trading day after an NFP release tends to be the quietest workday of the month. Those bullish dollar positions going into last Friday's numbers still need to tend to their wounds. They will be wondering if it's worth considering adding to their core position or should they be cutting any further losses. The near term dollar price action will most certainly be dominated by the weaker-than-expected tone of the employment report, especially in light of the strong yield fuelled dollar rally in the week heading into the report. Currently, there is not enough evidence to really change one's views on a dollar dominating with yield advantage just yet. The markets initial response would probably view this pullback as an opportunity to establish more USD longs again, but at much better levels or at least improve their "core short average." Many investors will again be looking at the weaker trend setting trio of the AUD, JPY and CAD and in particular the more vulnerable EM FX currencies for opportunities. USD/CAD" border="0" height="200" width="300">

USD/CAD" border="0" height="200" width="300">

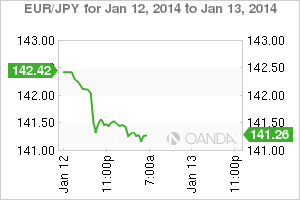

Friday's NFP report seems to have suspended the dollars well documented rally, but do not despair, the technicals would suggest if one looked at the dollars post NFP reaction over the past few years it does take a couple of sessions before the 'mighty buck' is capable of resuming its upwardly mobile direction. Investors will be looking for further market evidence rather than banking just on the technicals. If the US stock market continues to trade higher or at least hold 'in' certainly would be an encouraging sign for buying interest to return to USD/JPY. If NFP was bad, Canadian employment numbers were dismal. The dollars dominance over the loonie is not broken and a short-term dollar bullish view continues to be expressed against this currency (1.0910). Many consider shortening the loonie as one of the go-to trades for 2014. The problem with the trade is that the CAD weakness was not expected so early in the New-Year. The current spot levels are very much straddling many individuals' mid-year targets. With little opportunity for pullbacks would suggest that the USD bullish view remains intact against its largest trading partner at the very least. EUR/JPY" border="0" height="200" width="300">

EUR/JPY" border="0" height="200" width="300">

For the 18-member single currency, the EUR has room for further upside. The techies will tell you that the market's failure to break the EUR down through last week's 1.3540 level probably means investors again face a month of consolidation, until at least the next FOMC meeting at the end of January. The consolidation-trading theme was common throughout last year, especially as the G7 Central Banks monetary policy views handcuffed the forex market. The EUR gains have been limited due to the small size of spec EUR/USD shorts before the NFP data - the market assumed that investors were more dollar long heading into last Friday. But with short-term techies now more bullish EUR's, and coupled with the drop in US yields (the primary motive and supporter of being long dollars for 2014) would suggest that EUR/USD potential dips could be rather shallow. The markets believe that a daily close above 1.3680 opens the 2014 highs (1.3776) and a momentum break there could have Capital Markets challenging last years single currency outright top (1.3895). GBP/USD" border="0" height="200" width="300">

GBP/USD" border="0" height="200" width="300">

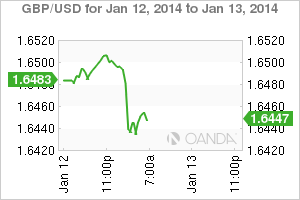

Sterling is in a different boat. The problem for the pound is that everyone has loved the note, and that has been the currency's current undoing, certainly outright (1.6453). Last Fridays North American dismal jobs report has reduced even further some of the markets risk appetite for the moment. This has clipped equities and forced some of those GBP risk positions to be pared even more. Domestically, its own data has not been favoring long the 'pound.' The vulnerability of longs was evident in the big drop that followed a "small undershoot for Industrial Production data." The pre-NFP low of 1.6381 is very much in the techie's sights.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will The Dollar Resume Its' Rise?

Published 01/13/2014, 07:41 AM

Updated 03/05/2019, 07:15 AM

Will The Dollar Resume Its' Rise?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.