Key Points:

- Cable under pressure as rate cut volatility still in play.

- NIESR predict 50% chance of UK recession.

- Downside risks dominate.

The Cable had an extremely busy week that ultimately turned sour after the Bank of England decided to loosen their monetary policy and cut the bank rate 25bps to 0.25% and introduce a range of stimulus into the bond market. Subsequently, the Cable was under pressure early and fell relatively sharply to close the week around the 1.3061 mark. Given the bearish activity around the pair it is salient to review last week and assess what lays ahead for the embattled currency.

The Cable had one of its busiest weeks since the Brexit result as the Bank of England MPC chose decisively to cut the official bank rate 25bps to 0.25% whilst also introducing monetary stimulus to the economy via the corporate and government bond markets. Although the rate cut was largely expected, the additional stimulus was not and saw the currency careening lower to close the week around the 1.3061 mark.

In addition, adding to the selling sentiment late in the week was the announcement from NIESR that pointed to increased risks of a recession for the UK in the coming months. The well regarded institute actually forecast the risk of the UK economy falling into contraction at 50% due largely to the Post-Brexit shock. Subsequently, it is ultimately no surprise that the BoE is seeking to reduce nominal interest rates and stimulate the economy over the short term.

The week ahead is likely to provide more of the same as the UK Manufacturing Production and NIESR GDP estimates fall due. Given the sharp shock to the UK economy Post-Brexit a sharp reduction in both indicators is likely, and in fact, estimates have them at -0.2% m/m and 0.4% q/q respectively. Subsequently, there is plenty of scope for volatility from the fundamental events on the market this week.

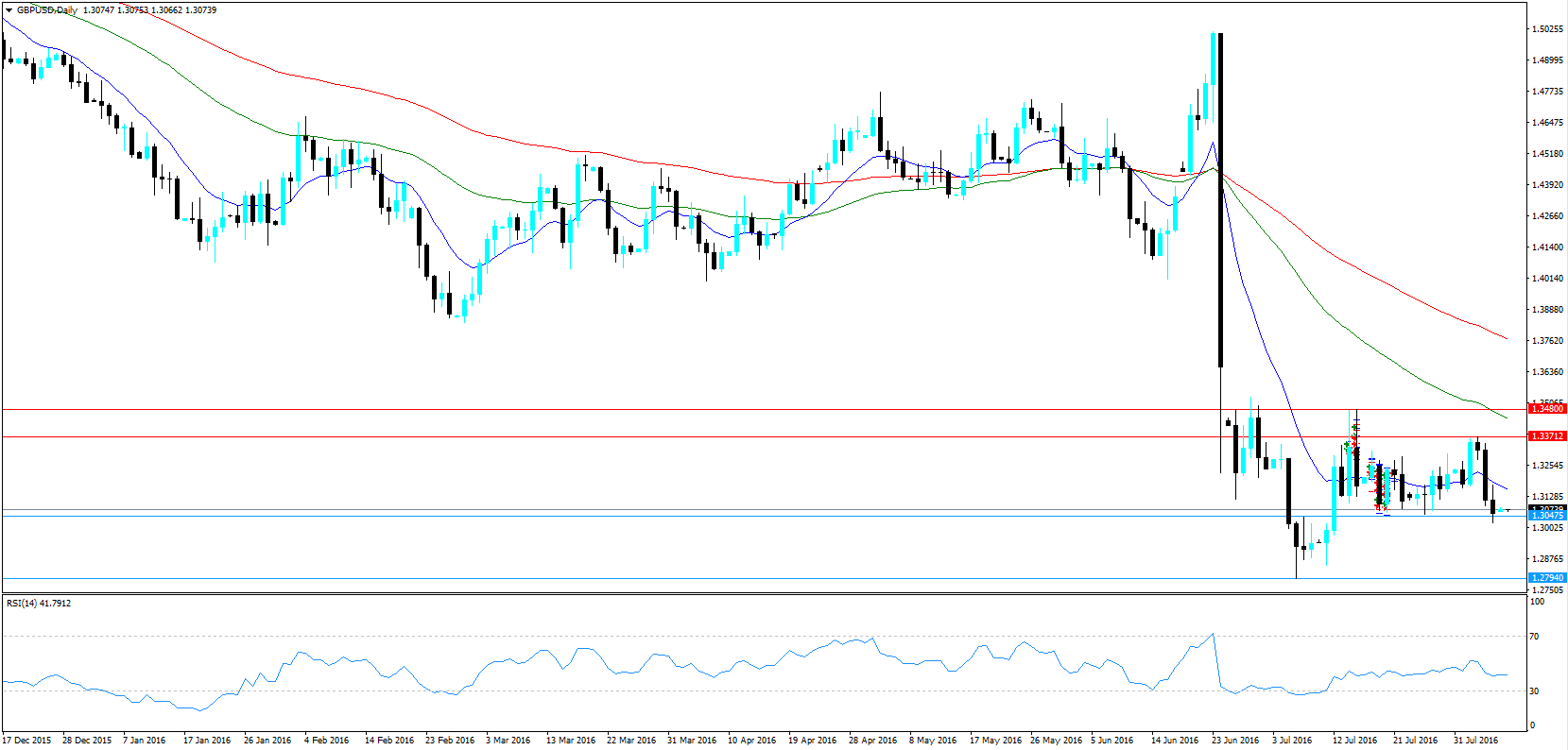

From a technical perspective, despite last week’s decline, price action still remains heading in a relative sideways direction. However, the break of minor support at 1.3056 is concerning as any moves below the 1.30 handle could predispose the pair to recommencing a bearish run. Regardless, our bias remains neutral this week until either a breach of the 1.30 handle or a rally above 1.31 occurs. Support is currently in place for the pair at 1.3047, and 1.2794. Resistance exists on the upside at 1.3371 and 1.3480.

Ultimately, the Cable is largely at a cross roads with a mounting range of downside risks which could have a sharp impact upon the GBP’s valuation. Although the pair is currently holding above the key 1.30 handle any further shocks could see that evaporate and a commencement of a downtrend towards the 1.2794 support zone. Subsequently, keep a close eye on the pair in the coming days as there is likely to be a sharp move away from the current sideways direction.