Last week was a bit of a watershed for the cable as the pair continued its general trend and remained fairly lacklustre as price action drifted lower throughout the week. Initially the pair was under pressure following a weaker than expected UK Manufacturing Production and NIESR GDP figures of 0.1% m/m and 0.3% y/y respectively.

However, the pair saw some concerted selling following the Bank of England’s decision to hold rates steady at 0.50%. This was largely forecast but a dovish statement followed from the bank which stated that they expect rates to remain depressed in the medium term. Subsequently, the pair fell sharply to pierce the 1.44 handle and finished the week around the 1.4354 mark.

The week ahead will be a busy one for the cable as it is facing another round of important UK economic data in the guise of the CPI, Core Retail Sales, and the Claimant Count data. In particular, any demonstrated weakness within the UK labour market figures could see the cable depreciating strongly against the US dollar. Subsequently, Wednesday could be a key point for the currency pair and the results are likely to dictate the fundamental trend direction moving forward. However, also keep a watch on the US Unemployment Claims results as a strong result could also depress the pair sharply.

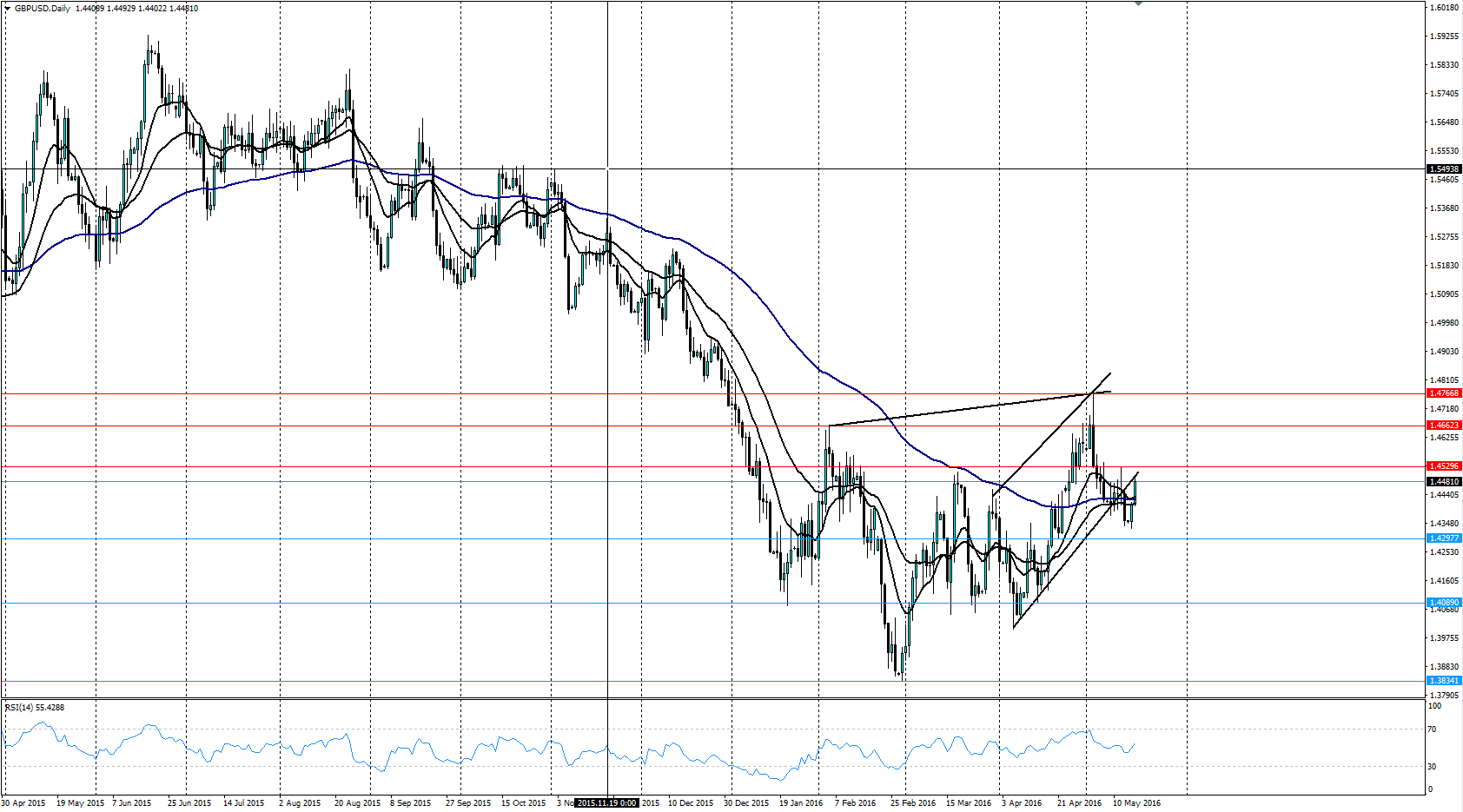

From a technical perspective, our bias for the cable remains fairly neutral given that the 12 and 30 EMA’s have largely moderated; however, the RSI Oscillator has recently turned the corner and continues to tick higher. In addition, despite yesterday’s pullback from a zone of support, the pair is likely awaiting a strong trend to develop. Subsequently, price action will need to break through either resistance at 1.4529 or support at 1.4089 to cement a trend direction hence our currently neutral bias.

Ultimately, the action is likely to take place around the release of the UK CPI figures in the coming hours. Subsequently, keep a sharp eye on that data point as it could very well set the pair up for its trend direction in the coming session.