Welcome to Episode #51 of the Zacks Market Edge Podcast.

Every week, host and Zacks stock strategist, Tracey Ryniec, will be joined by guests to discuss the hottest investing topics in stocks, bonds and ETFs and how it impacts your life.

In this episode, Tracey is joined by Kevin Cook, Zacks Senior Strategist and Editor of Zacks Tactical Trader portfolio service, to talk about the bond market. Surprisingly, this is the first episode of Zacks Market Edge to cover the bond market.

How could that be?

Bonds have been in a bull market for over 20 years so there hasn’t been much to get excited about. For years, some bond investors have warned that it was a bubble and it was finally bursting, yet a bond bust hasn’t materialized.

Mom and pop investors continue to pour their money into bond mutual funds and ETFs, with $157 billion flowing into those funds through mid-September 2016 versus an outflow in stock funds during that same time. Apparently all of those investors aren’t worried.

Bond Bears Warn Again

Yet, some big names, such as BlackRock’s Global Chief Investment Strategist Richard Turnhill and Paul Singer of Elliott Management, have warned that the path of US treasuries might soon change.

Even former Fed Chairman Alan Greenspan recently got into the act, telling Bloomberg TV that the bull market in treasuries is “unsustainable.”

But There Are Some Bulls

Yet, there are still some bond bulls who believe yields will go lower still.

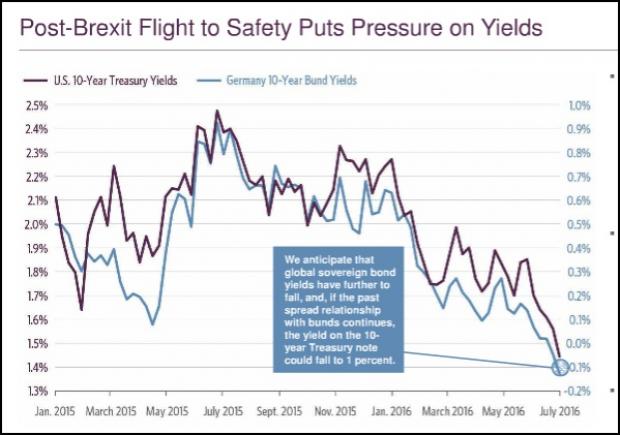

Kevin takes a look at Guggenheim Partners recent Fixed Income Outlook report where it compared the German 10-Year Bund Yields with US 10-Year Treasuries and hypothesized that US treasuries could still go to 1%.

So how do you play the bond market if you’re a mom and pop investor?

If you believe that treasury yields could go lower, then these are some bond ETFs to check out:

1. iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT)

2. iShares 7-10 Year Treasury Bond ETF (NYSE:IEF)

3. iShares 1-3 Year Treasury Bond ETF (SHY)

If you believe the bubble is finally going to burst, and soon, then look at:

1. ProShares UltraShort 20+ Year Treasury (NYSE:TBT)

2. ProShares UltraShort 7-10 Year Treasury (PST)

What else should you know about the bond market?

Tune into this week’s podcast to find out.

Think that bonds are the only bubble out there?

Wrong.

Tracey and John Blank discuss all the new apartment high rises being built and muse on the “next” housing bubble.

Watch Below:

Tracey Ryniec is the Value Stock Strategist for Zacks.com. She is also the Editor of the Insider Trader and Value Investor services. You can follow her on twitter at @TraceyRyniec and she also hosts the Zacks Market Edge Podcast on iTunes.

ISHARS-20+YTB (TLT): ETF Research Reports

ISHARS-7-10YTB (IEF): ETF Research Reports

PRO-ULS L20+YRT (TBT): ETF Research Reports

PRO-ULS L7-10YT (PST): ETF Research Reports

ISHARS-1-3YTB (SHY): ETF Research Reports

Original post

Zacks Investment Research