Investing.com’s stocks of the week

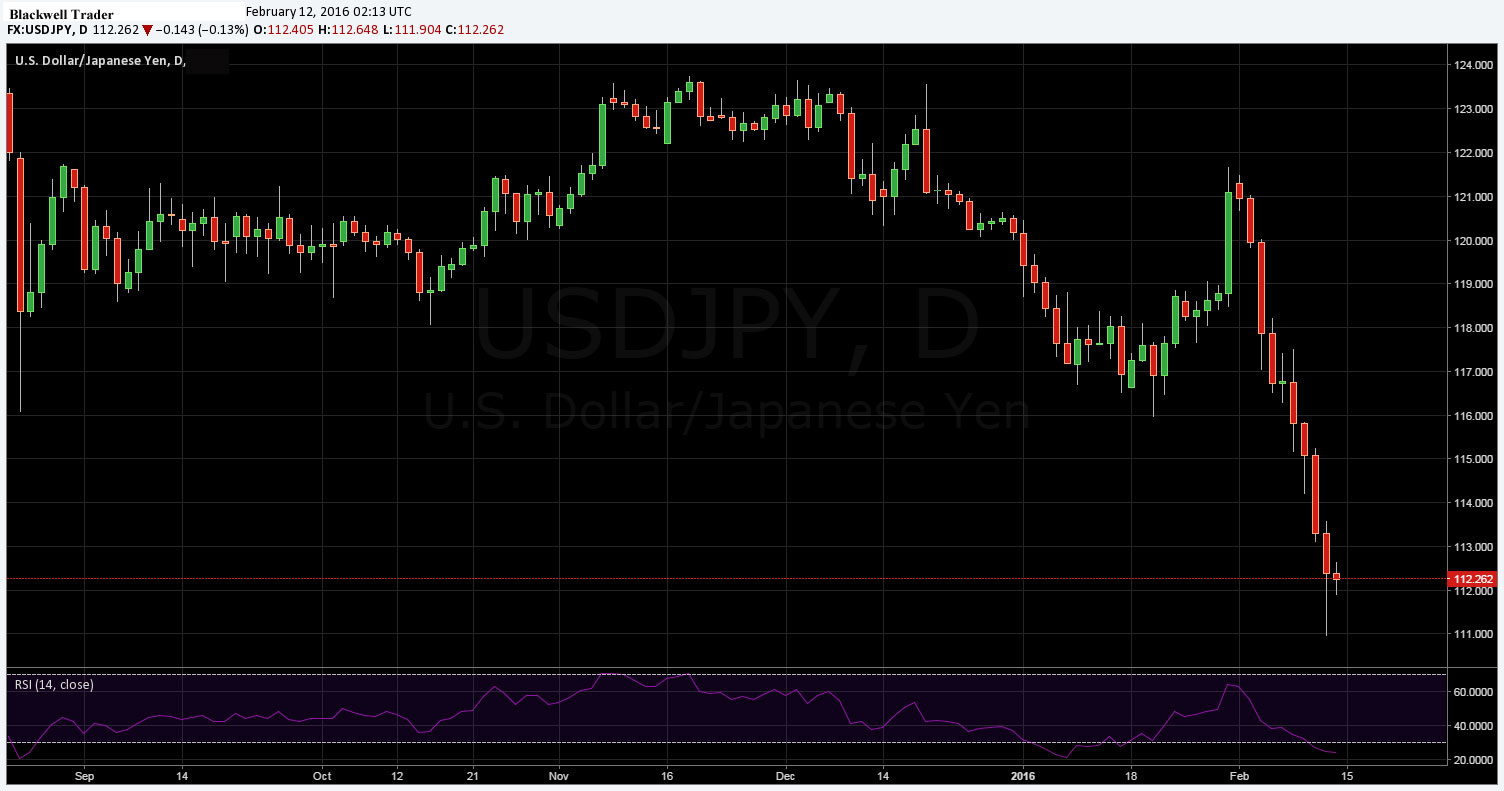

As the USD/JPY price continues to collapse towards the 110.00 level the probability of the Bank of Japan intervening to depreciate the yen is increasing. However, the question remains: what price represents the BoJ’s line in the sand, and can it be defended against a rabidly USD negative market?

Since the start of February, the USD/JPY has faced a range of deteriorating conditions that are causing significant consternation in Tokyo. As the USD continues to depreciate sharply against the yen so too does the affordability of Japanese goods which will have a sharp impact upon Japan’s shrinking export accounts.

Subsequently, the rhetoric emanating from Tokyo today has largely focussed around setting expectations that the government and/or central bank will likely choose to intervene to impact currency valuations in the coming weeks. In fact, Japanese Finance Minister Aso has suggested that the government is standing ready to take appropriate measures in the forex markets, given the recent falls.

The overarching establishment view is that markets are currently much too pessimistic on the US dollar and that a revaluation is therefore appropriate to support the Japanese economy. Throughout both Minister Aso, and Ishihara’s speeches, it was made patently clear that sudden, sharp FX moves were undesirable and the expectation was subsequently set that any action would be decisive.

The response to the recent strengthening of the yen has been typical for the Japanese government and central bank as they attempt a ‘verbal intervention’ to alter market expectations. However, given much of the current capital flight within the markets, it is unlikely that this will have much in the way of an impact in the current bearish USD sentiment.

Typically, the Bank of Japan would next attempt to alter expectations by undertaking a round of `rate checks’ with FX dealers with the implication that they could possibly be seeking to sell down the yen. Subsequently, during yesterday’s Asian session there were some unconfirmed reports of the central bank having done exactly this. However, as expected, the market has been largely focused on the USD fear trade and there has been little in the way of a sentiment change for the yen.

Subsequently, it is almost a given that the Bank of Japan will now be driven to decisive action and intervene in the currency markets to depreciate the yen. Last time the markets saw a public intervention from the BoJ was 2011, which saw the bank selling the yen to re-establish a more appropriate valuation.

Given the continuing falls it’s clear that the central bank will have no choice but to act before the pair faces levels below the psychological 110.00 handle. However, the question remains as to what level the BoJ will attempt to target and some anecdotal rumours doing the rounds point to 116.00 as the forecasted key battleground.

Ultimately, given the unpredictability of the BoJ, predicting a price floor for the yen is tantamount to selecting the correct power ball numbers. However, regardless of the bank’s targeted level, it will likely cause some sharp volatility and catch plenty of traders unaware. Subsequently, watch your long side risk exposure to the pair closely in the coming days.