Key Points:

- Bank of England likely to cut between 25bps and 40bps.

- Downside risks dominate.

- Pound outlook remains bearish.

Financial markets have seen some sharp volatility over the past few weeks as the shock waves created by the Brexit continue to ricochet. Subsequently, the Bank of England’s pending MPC meeting is firming as a critical fundamental event for the pound.

However, predicting the decision has largely been problematic for economists and market strategists given the recency of the Brexit event and the lack of backward looking data.

Subsequently, there has been plenty of speculation as to how much the central bank is likely to cut the official bank rate. Although there may be a lack of formal economic data to yet suggest a downturn one only needs to take a look at the relative volatility surrounding the pound to see the changing market expectations.

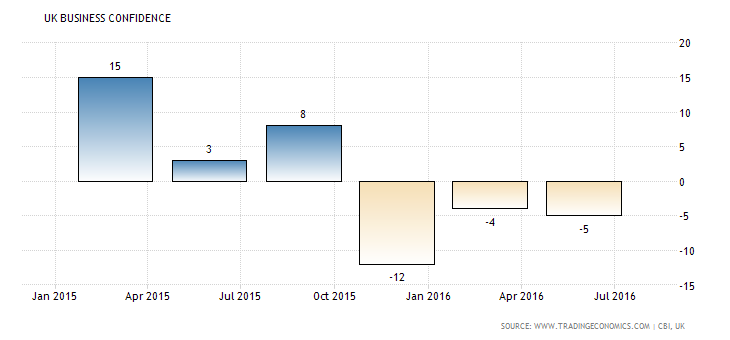

In fact, a whole raft of major consumer confidence surveys are demonstrating declines post-Brexit which are highly likely to impact UK output in the near term. In addition, there was plenty of evidence of a slowing UK economy even before the event with some major indicators falling into bearish territory.

Chief amongst these was the pullback in UK Retail Sales from 1.9% to 0.9% m/m with the Services PMI (along with most of the major PMI’s) also following suit and declining to 52.3 for June. Subsequently, there are plenty of reasons for the Bank of England to be concerned about the nation’s economic robustness without even considering the impact of the Brexit.

It should therefore be no surprise to anyone that rate cuts are likely to be a highly probable policy response for the central bank in the coming hours. Given the sharp shock to both consumer and business confidence the BoE will likely want to get ahead of any contractionary effects regardless of the absence of current growth data.

This is especially salient given that there is still plenty of uncertainty being injected into markets whilst the lack of an Article 50 notice hangs over the economy.

However, many pundits have opined that the central bank will look to save their ammunition in case it’s needed for a near term deterioration due to the closeness of the zero lower bound. This argument fails to take into account that the required shock has already arrived and that the Brexit’s potential drag on GDP is likely already here but not yet reported.

In fact, the Bank of England is clearly already aware of the mounting downside risks given some of the rhetoric from MPC members over the past few days. I suspect that the nearness to the zero lower bound is less of a concern then getting ahead of a downturn in the economy and a collapse in consumer confidence.

In the event of a deeper decline or a recession, expect that central bank to move quickly to cut rates to zero and institute a QE program rather than any form of negative interest rates.

Arguably, the risks of the central bank awaiting any further economic deterioration is outweighed by the benefits of acting early to arrest the slide in confidence. Subsequently, look for the BoE to cut rates decisively by 25bps at their MPC meeting (Thursday 1100 gmt).