We’ve seen NZD go from strength to strength since breaking its channel, so we’re intrigued to see if AUD/USD can now play catch-up.

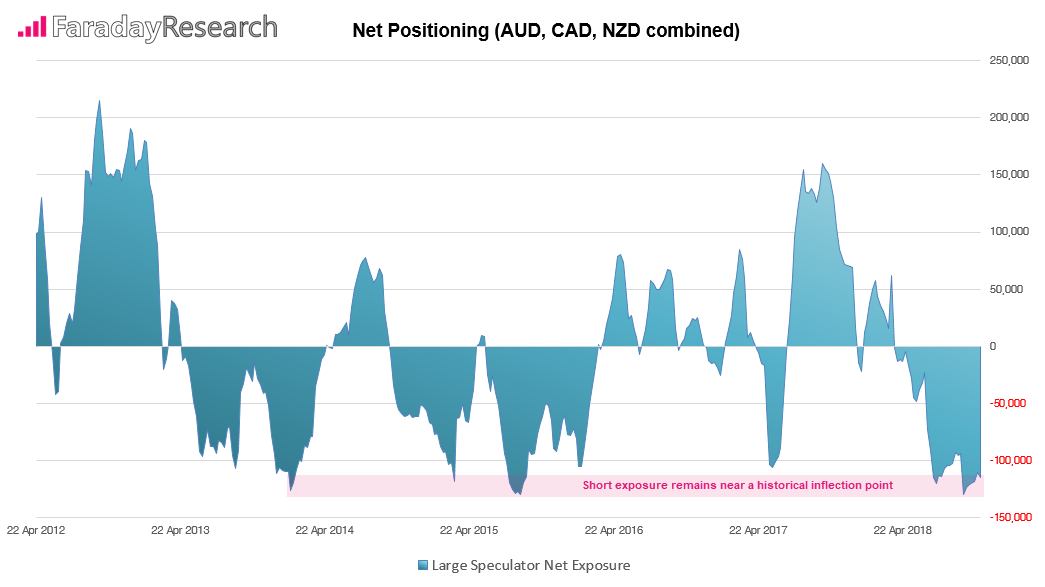

Sentiment-wise, there’s an argument for AUD to carve out a low. Using the weekly COTS report, combined net positioning for AUD, CAD and NZD shows traders remain near a record level of short exposure for commodity currencies. With exposure near a sentiment extreme, each tick higher for these pairs runs the risk of short-covering which could add further fuel to a bullish fire.

We can see on the AUD/USD weekly chart that, despite its multi-month downtrend, traders failed to push AUD/USD down to 70c. A bullish divergence warned of weaker momentum ahead of a bullish hammer reversal, which marked a fakeout at the lows before breaking its long-term bearish channel. Still, the 20-week MA is currently capping as resistance, so there’s still plenty of work for bulls to do before claiming victory.

We can see on the daily chart that the broken channel provided support for another leg higher. Although yesterday’s bearish hammer, which failed to test a bearish pinbar at 0.7315 warns of near-term weakness. However, given that this is (potentially) the first leg of a reversal, then a retracement from recent highs wouldn’t go unexpected.

A support zone likely awaits around 0.7160/82 (20-day MA, trendline and structural levels), so we could see AUD carve out a new range between 0.7160 - 0.7315. So for now, AUD may be better suited to range trading strategies (sell high, buy low) but we’ll continue to keep a close eye for a break above 0.7315 to signal the next bullish leg on the daily. And, if recent developments on NZD/USD are anything to go by, we may not have to wait too long.