Brazilian telecom carrier, Telefonica (MC:TEF) Brasil SA (NYSE:VIV) is expected to report second-quarter 2017 financial numbers on Jul 26, before market opens.

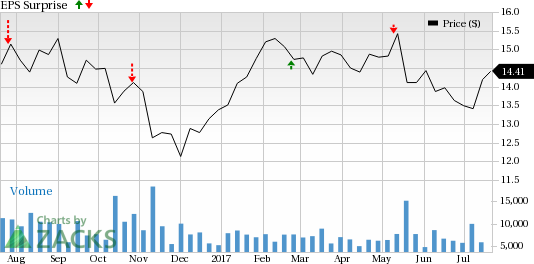

Last quarter, the company posted a negative earnings surprise of 5.00%. Moreover, earnings failed to surpass the Zacks Consensus Estimate in three of the last four quarters, with an average negative surprise of 13.04%.

The price performance of Telefonica Brasil was depressing for the last six months. The stock witnessed a loss of 1.9% as opposed to the 4.5% growth of its industry.

Let’s see how things are shaping up for this announcement.

Factors at Play

Telefonica Brasil continues to face numerous hurdles in its fixed-line voice and wireless businesses. The fixed-line voice business is facing competition from alternative service offerings like wireless telephony, VoIP (voice over Internet Protocol) and cable services (voice, video and broadband).

Customers in the wireless segment are opting for discounted calling rates offered by national wireless operators. The company is also experiencing revenue loss, especially in Pay-TV and Fixed access business units. It is caused by a rise in MMDS (Multichannel Multipoint Distribution Service) customer churn following spectrum acquisition by 4G operators.

Furthermore, the telecom carrier shares competitive space with the likes of America Movil SAB (NYSE:AMX) in Brazil. U.S. telecom giant, AT&T Inc. (NYSE:T) , may also enter the Brazilian market in the future and intensify competition. Moreover, the combined company operates in a highly-regulated industry and is subject to changes in regulatory measures.

However, Telefonica Brasil continues to rule the Brazilian wireless market following the establishment of Vivo as a commercial brand for all services. The company’s increased investments in technology upgrades and broadband network infrastructure has helped it to sustain in a competitive and rapidly changing market. It continues to fortify its leadership in data and post-paid segments through attractive data plans and intends to launch more such schemes in the near future.

The company’s efforts have been attracting customers, leading to subscriber growth and higher data usage.

Earnings Whispers

Our proven model does not conclusively show that Telefonica Brasil is likely to beat on earnings this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Zacks ESP: Telefonica Brasil has an Earnings ESP of 0.00%. This is because both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 23 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Telefonica Brasil has a Zacks Rank #3, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult.

We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stock to Consider

Atmos Energy Corporation (NYSE:ATO) from the broader industry has the right combination of elements to post an earnings beat when it reports third-quarter 2017 results on Aug 02. The company has an Earnings ESP of +4.55% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Atmos Energy Corporation (ATO): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

America Movil, S.A.B. de C.V. (AMX): Free Stock Analysis Report

Telefonica Brasil S.A. (VIV): Free Stock Analysis Report

Original post

Zacks Investment Research