- Swiss voters to decide on massive central bank Gold purchase Sunday

- Swiss Peoples' Party claims increased gold holdings will boost economic stability

- Ballot reflects isolationist, Eurosceptic trends

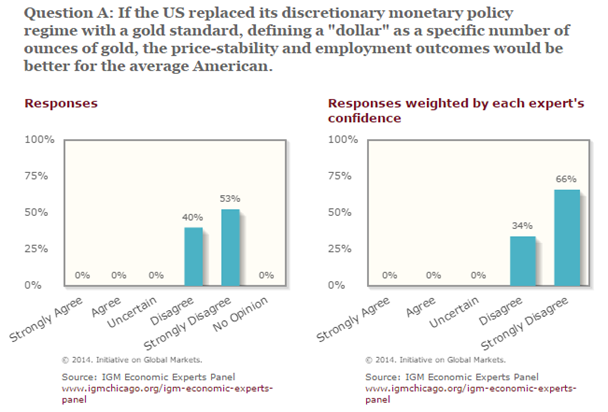

- Many were asked.

- Zero agreed.

- Source: The Atlantic Monthly

"Truth, like gold, is to be obtained not by its growth, but by washing away from it all that is not gold." — Tolstoy

This Sunday, Swiss voters will cast their ballots to decide whether the Swiss National Bank should cast its lot with the world’s gold bugs. More precisely, the vote would compel the Alpine nation’s central bank to cease selling any more gold and to instead boost its holdings by up to 20%.

At the moment, and after an early surge in voter interest, analysts say that they expect the initiative to be unsuccessful. With gold sitting at a four-and-a-half-year low, precious metals traders expect a severe rally in the event that the vote succeeds, but trading remains light on the expectation that a majority of Swiss citizens will reject the proposal.

More interesting than this specific vote’s probability of success, though, is the reasoning behind its conception. As a political symbol, gold is essentially a proxy for fear – fear of inflation, fear of geopolitical instability and fear of currency manipulation. As a commodity that has maintained a stubborn but abstract (unlike grains or oil, it is not needed for any particular biological or infrastructural reason) value since the dawn of civilisation, gold represents a safe harbour in times of unrest and instability.

According to Matterhorn Asset Management, a Swiss asset management company that supports the right-wing Swiss Peoples’ Party’s stance on gold, voting No on Sunday’s ballot will mean “Switzerland’s economic policy will be tied to the EU [and] inflation and cost of living will increase dramatically.” If voters choose to embrace the proposal, “Switzerland will remain a strong independent nation not influenced by EU or USA”.

The battle lines are evidently quite clearly drawn, at least in the minds of Swiss gold bugs. In keeping with Switzerland’s ancient self-definition as a neutral and isolationist nation, the gold vote represents an opportunity to retain Swiss independence from the interests of external empires, particularly those -- like the European Union – whose economic outlooks are both grim-seeming and outside Swiss control.

Leaving the realm of symbol for that of economics, however, it is far from clear that enforcing a giant boost in a country’s gold holdings will necessarily produce the stability and independence that the Swiss Peoples’ Party are seeking. In the United States, where the final link between the dollar’s value and that of gold was severed by president Richard Nixon in 1971, calls for a return to “the gold standard” have been a staple of isolationist political thought ever since.

In 2012, following presidential candidate Ron Paul’s repeated calls to end the Federal Reserve system and return to a gold-backed currency, the US Republican Party added a plank to its official platform, which called for an inquiry into this possibility. In response, the IGM Economic Experts Panel conducted a survey of its members, asking them whether a gold-based dollar would improve the lives of ordinary Americans.

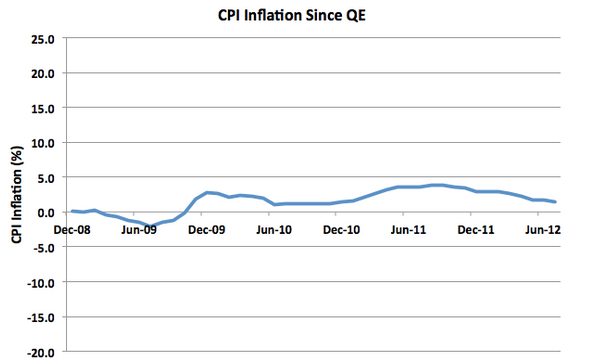

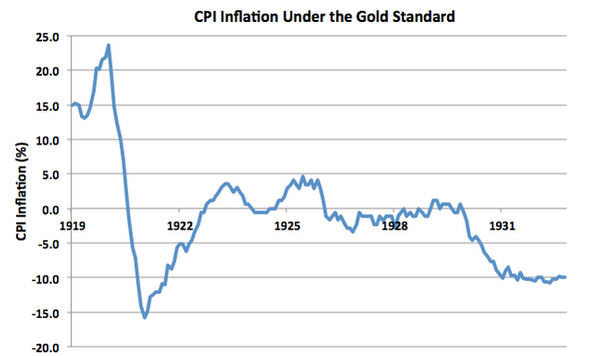

In an article published by the Atlantic Monthly that same year, Matthew O’Brien also pointed to a few studies that appeared to undermine gold bugs’ belief that a yellow metal-based currency would lead to lower inflation. Comparing CPI inflation under the gold standard in the 1920s with its progress after the 2008-launched quantitative easing programme, O’Brien illustrated that the latter era saw 23 times less price variance than its gold-backed antecedent.

Source: The Atlantic Monthly

Ultimately, said O’ Brien, “The gold standard is a solution in search of a problem. Actually, it's worse than that. It's a problem in search of a problem.”

The Swiss ballot, it must be noted, is not a call to fully return to a gold-pegged franc, but it is a vote whose theoretical roots lie in the view that gold-denominated holdings will provide a nation with greater stability and economic control than do the machinations of central banks and forex markets. But even this equation is likely to be flawed.

According to Ambrose Evans-Pritchard, international business editor for The Daily Telegraph, the “Save Our Swiss Gold” referendum is not only an attempt to “lead the world back to the halcyon days of the international Gold Standard,” it is also “a primordial scream against a quantitative easing and money creation a l’outrance by the leading central banks”.

The defining qualities of primordial screams are that they are both satisfying and ultimately purposeless. According to Evans-Pritchard, the Swiss Peoples’ Party’s fear of money-printing and worthless foreign bonds does not stand up to scrutiny when we consider the Swiss National Bank’s extraordinary history in both of these areas.

Given that, at one stage, the SNB was purchasing up to half of the Eurozone’s entire bond issuance each month, says Evans-Pritchard, “you have to smile when you hear Swiss gold enthusiasts complaining that these foreign bonds — bought with electronic fiat francs created out of thin air — are now losing value as the euro slides against the dollar.”

Perhaps even more pertinent, given the Peoples’ Party’s intent to change course from such practices and return to the presumedly safe haven of gold, is the party’s plan to prevent the SNB from ever selling any of its newly expanded gold holdings.

“Making it illegal to ever sell any of the gold the central bank has now or acquires in the future,” says Citigroup (NYSE:C) chief economist Willem Buiter, “would make the gold useless as an international reserve. The gold stock can never be used for foreign exchange market interventions and it cannot be used as collateral. The gold becomes useless as a store of value of any kind. Its value is therefore zero.”

Even if the Swiss gold referendum is both likely to fail and less-than-useful as a solution to Switzerland’s economic woes, this does not mean that it is unimportant. Though economics may be “the dismal science”, politics, with all its ritualised manipulation of ancient symbols, is something closer to a black art.

Though gold may not hold the answers for nations seeking price stability and economic independence, its value as a symbol has been far more stable than its value as a commodity. In the realm of symbol, gold stands for all things weighty and timeless, and against the (presumedly) arcane and evanescent nature of central bank policy.

Across the European continent, voters are coalescing into groups and parties that are deeply opposed to the dominant-since-the-1990s “Third Way” consensus. In some areas, the dissent focuses on immigration, in others on Euroscepticism. In Switzerland, it has seized upon gold as its standard, and though the economic solution advanced by the Peoples’ Party may be illusory, the dissatisfaction that gained it the 100,000 signatures necessary for a referendum is very real.

If there is any rule that can be said to define European politics over the past decade, it is that voters abandoned by the mainstream will reappear on the fringes, placards and petitions in hand. They can be dismissed as ignorant, as nativists, as bigots, as Luddites, or as gold bugs entranced by shining metals, but their presence does point to problems in the current order, even if their solutions do not convince.

Michael McKenna is a consulting editor at TradingFloor.com. Comment below to engage with Saxo Bank's social trading platform.