All is well with the U.S. economy, right?

I mean, the war-torn housing market is finally ready to check out of the rehabilitation center. Prices are up for 21 consecutive months (and counting).

The slumbering manufacturing sector is springing back to life, too. The latest Philly Fed Manufacturing report jumped three points higher, well ahead of economists’ projections.

Even more encouraging, overeating at the debt buffet is no longer trendy. Instead, consumers appear dead set on getting their financial houses in order.

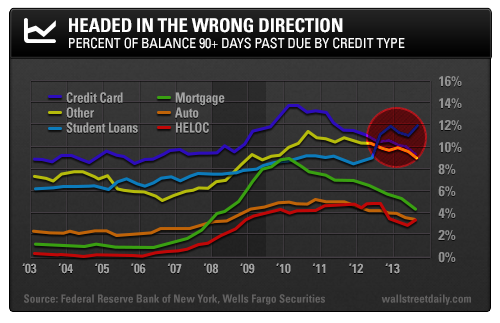

Case in point: Economists from Wells Fargo Securities note that “delinquencies have trended lower across nearly every type of consumer credit category.”

I hope you caught that…

They specifically said “nearly every type of consumer credit category.”

Now, don’t kill the messenger, but the lone exception here could end up torpedoing the tenuous recovery.

I warned that it was a concern over a year ago. But now, we could be on the cusp of a full-blown crisis. And there’s one sector you definitely don’t want to own if disaster strikes…

Student Loans: A $1-Trillion Clear and Present Danger

A single chart reveals the clear and present danger that the U.S. economy is facing right now – student loans.

While delinquency rates on every imaginable type of consumer credit (home, credit card, auto, etc.) keep trending lower, student loan rates are headed in the opposite direction.

At the end of the third quarter of 2013, student loan delinquency rates rose to 11.8%, according to the Federal Reserve Bank of New York.

If that’s not alarming enough, chew on this…

The delinquency rate is most likely understated. As Rohit Chopra of the Consumer Financial Protection Bureau told Bloomberg recently, “Compared to other financial products, performance data on student loans is much more opaque.”

Making matters worse, the Department of Education, which makes calculations on an annual basis, reveals that 14.7% of students flat-out defaulted on their federal loans in the first three years. That’s up from 13.4% the year earlier.

No Quick Fix

What’s going on?

Well, according to the top minds at Wells Fargo (WFC), “The continued upward trend is reflective of the unique characteristics of the student loan market – such as lack of credit history for most borrowers and the government sector being the dominant provider – as well as the weak recovery in jobs and wages.”

In other words, it’s déjà vu all over again.

Institutions, including the government, recklessly lent money without taking into account creditworthiness or anyone’s ability to repay their obligations. Just like they did during the run-up to the housing bubble.

And now we’re shocked there’s a problem?

Come on, people! Anyone with a basic understanding of math could have predicted this.

For over a decade now, the average cost of a college education has been climbing. Meanwhile, the average earnings for a college grad have been declining.

Specifically, the average tuition and fees at a public, four-year college are up 87.5% since 2000. Whereas the average earnings for a full-time worker (age 25 to 34) with a bachelor’s degree are down 13.7% over the same period.

Taking on more debt to secure a job that pays less and less doesn’t make fiscal sense. Not in the real world, at least.

More Than Meets the Eye

Now, at face value, the $1.03 trillion in outstanding student loans might not seem like a big deal.

Not when you consider that outstanding real estate loans check in at more than $13 trillion.

But don’t be fooled into complacency just because we’ve weathered bigger debt crises before.

The potential economic damage here extends far beyond the loan amounts.

The crushing weight of student debt has many recent grads still shacking up with mom and pop. For obvious reasons, that’s not good for marriage or birth rates, which have direct implications for economic growth.

Plus, people with onerous student loan debt burdens – or worse, defaults – aren’t in a position to buy cars, homes, or any other big-ticket items.

It’ll be Rent-A-Center, Inc. (RCII) or bust.

I’m not kidding, either. Jobs remain scarce. Even for more “educated” Americans.

In fact, college grads have been leaving the workforce every month at an equal, if not faster, rate than workers without a high school education since the end of the recession.

And without a job, there’s no way they can make payments on their student loans. So default rates are bound to spike even higher.

How high?

One of ITT Educational Services’ (ESI) private loan pools, the Peaks Private Student Loan Program, carries an eye-popping default rate of 59%.

If that’s a harbinger of things to come, we could be in store for a mega-default before long, which would put a meaningful dent in economic growth.

Profit educators like ITT, Apollo Education Group, Inc. (APOL), Corinthian Colleges Inc. (COCO) and DeVry Education Group Inc. (DV) could be the hardest hit, as access to lending freezes up and/or the value of a college education (at current prices) comes increasingly into question.

Bottom line: As Forbes’ Brett Nelson plainly states, “Like it or not, the student loan crisis is everyone’s crisis now.” Indeed!

It could prove formidable enough to put an end to the budding recovery. So, no, all is not well with the U.S. economy. The student loan crisis is a trend we need to be monitoring very closely.