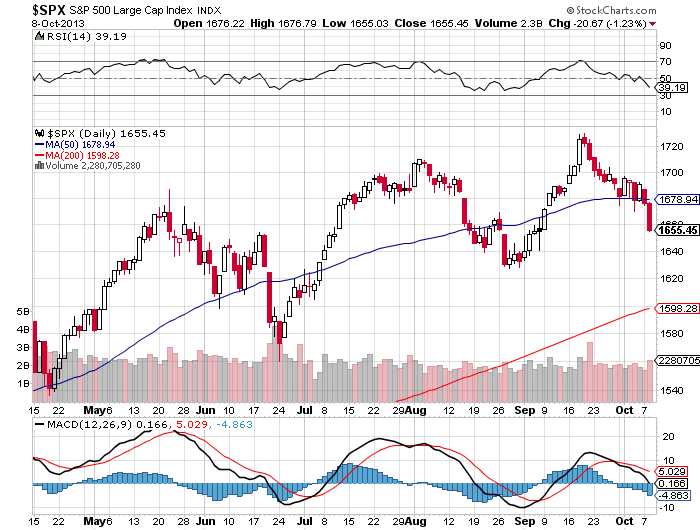

The first is the Harmonic pattern playing out. The SPX has run through harmonic after harmonic after harmonic since the November 2012 low. The latest is the reversal on the bearish Shark. Having broken the 61.8% retracement of the pattern, the next target lower is now at 1627.47, a full retracement. This is now a key level.

Looking left on the chart you will notice that there are several Fibonacci levels nestled in that area with the 1626.17 50% level from the 3 Drives pattern and the 1634.46 50% level from the previous Shark very near the 100% level of the current Shark at 1627.41. These also become more important now.

On a more qualitative basis, notice that the last two bottoms have occurred when the price has moved just slightly below the 100 day Simple Moving Average (SMA). About as much as it did Tuesday. The Marubozu candle suggests more downside but you must be cognizant that this is a measure where it has reversed before.

Finally keep an eye on the price relative to the Bollinger Bands®. The price does not like to stay outside of them for more than a couple of days at a time. The June 24 low saw a sharp reversal to get back within them. This led to the S&P 500 making a new all time high. This does not have to happen again but a sharp move higher would sure gather some buyers.

There are indicators that can be used to point in either direction. These are a few. Don’t try to predict what will happen, but rather react to it, but with as much information as you can be prepared with.

Internationally, European markets finished in the red yesterday and Asian markets were a mixed bag with the Nikkei finishing in positive territory and the Hang Seng finishing in negative territory.

US Futures Markets are currently rising at the time of this writing, likely in anticipation of our new Federal dove named Janet Yellen.

Our famous fear indicator, the VIX Index, is also on a slow down, albeit its 4% rise yesterday. Compared to its over 15% rise the day before, I think we could say that the VIX momentum is slowing down, at least for now.

Wednesday also brings us the FOMC Minutes from last week, which could add to the potential Fed euphoria, and we are due out for a Wholesale Inventories report, although that report will likely not be released due to the shutdown.

And, for our fun fact of the day: several Congressmen were arrested yesterday in Washington DC during an Immigration Reform rally. Among those arrested included Representatives John Lewis, Jan Schakowsky, Luis Gutierrez, Joseph Crowley, Al Green, and Charlie Rangel.

Bottom line: I am expecting a typical Fed induced euphoria for Wednesday, due to the fact that Janet Yellen is supposed to fill the punchbowl really, really full. But, considering the negative MACD and large sell-offs as of late for the S&P 500 (NYSEARCA:SPY), I could be dead wrong. Happy trading!

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector's Disclaimer, Terms of Use, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Stock Market Rise On News Of Janet Yellen?

Published 10/09/2013, 08:22 AM

Will Stock Market Rise On News Of Janet Yellen?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.