Major blow to the EU! The populist Five Star Movement won about one-third of the votes in the Italian general elections. It’s another negative shock for the European establishment. Will these stars shine on gold?

Five Star Movement Triumphs

We live in strange times. To be a hairstylist, you need a license. But you can become a politician being just a comedian and telling jokes. We refer here to Beppe Grillo who co-founded the Five Star Movement a decade ago. Although the party was initially perceived as a harmless prank, it quickly became a serious threat for mainstream politicians in Italy. In 2013, it reached 25.55 percent of the vote, introducing 109 out of the 630 deputies in the Parliament. It would obtain even more members, but it refused to form a coalition. Fast forward to 2018 – the Five Star Movement won about one third of the votes. It means that it will likely be the largest single party – and the pillar of the next legislature.

Another Hung Parliament?

However, a center-right bloc – which includes the Forza Italia party of former Italian prime minister Silvio Berlusconi famous for his sex parties – attracted about 37 percent of the votes. The center-left coalition built around the ruling Democratic party, led by another former prime minister Matteo Renzi, got only about 23 percent of votes. The results imply that no party won 40 percent of the vote, which would have allowed it to form a government outright. So we could have a hung parliament (especially that the Five Star Movement in principle opposes a coalition with other parties), which would add to the political uncertainty about Italy – and the whole Eurozone.

Eurosceptics Win Again

The results also mean that the eurosceptic and nationalistic parties have strengthened their hands. After Brexit, Trump’s victory, Le Pen’s advance to the second round of the French presidential election, populists took Italy. For example, the League, which has campaigned on an anti-immigration stance, ended with a higher share of the vote than Berlusconi’s Forza Italia. It was a negative surprise for Italy’s financial markets. Stocks declined, while the yields on sovereign debt rose.

Implications for Gold

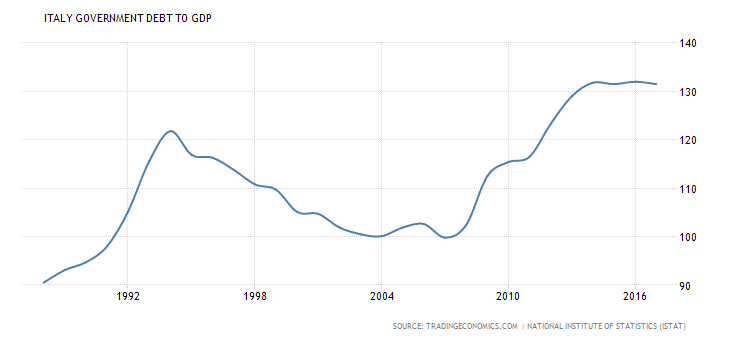

The Italian election could affect the gold market via two channels. First, it could increase the safe-haven demand for the yellow metal, as the vote strengthened the populist parties. As a reminder, Italy is the Eurozone’s third-largest economy, struggling with a high debt-to-GDP ratio (see the chart below) and a vast amount of non-performing loans. The triumph of eurosceptics could add to the uncertainty about the economic future of Italy.

Chart 1: Italy’s government debt to GDP ratio from 1988 to 2018 (as %).

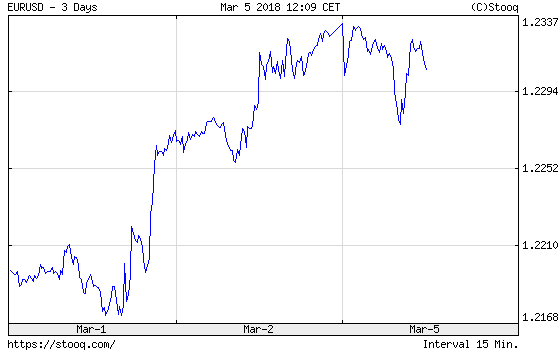

Second, the results may also affect the EUR/USD exchange rate and, thus, the price of gold. So far, the euro has declined, but rebounded quickly, as one can see in the chart below. However, given the surprising results, we could see declines in the short run. It would be negative for gold prices.

Chart 2: EUR/USD exchange rate over the last three days.

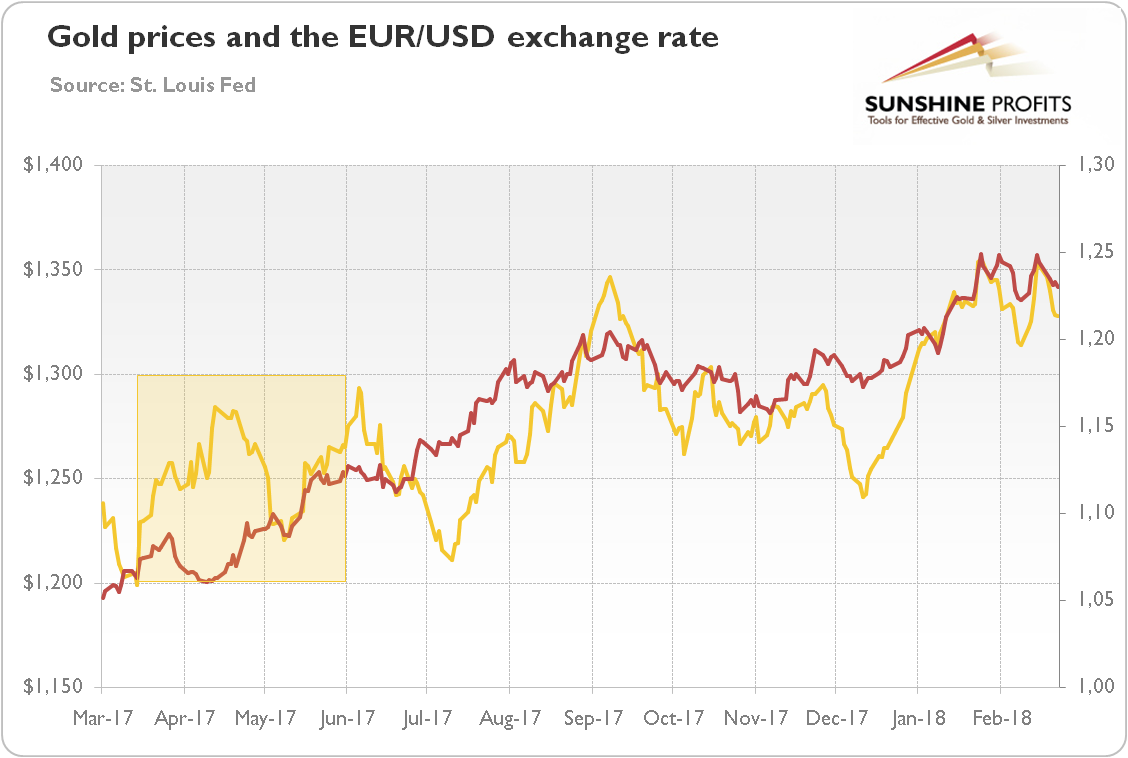

If history is any guide, the currency channel should eventually outweigh the safe-haven channel. Look at the chart below, which shows gold prices around the 2017 French presidential election.

Chart 3: Gold prices (yellow line, left axis, London P.M. Fix, in $) and the EUR/USD exchange rate (red line, right axis) from March 2017 to February 2018.

As one can see, the price of gold rose before the first round of the French presidential election at the end of April, while the euro weakened. But when Macron advanced to the second round, the price of gold dropped, while the euro rebounded. In May, when Macron finally won, the yellow metal rallied in tandem with the euro.

What does it mean for the current gold market? Well, we could see some safe-haven bids in the short term (until the new government forms), but the overall effect in the long run should be detrimental, at least if we agree that the populist’s victory in the third largest economy in the Eurozone is bad for the currency. Given that gold has benefited recently from the rebound in the euro and the weakness in the dollar, if the EUR/USD declines, gold may suffer. Indeed, gold prices declined yesterday, as the chart below shows.

Chart 4. Gold prices over the last three days.

However, investors should not forget that populists are strong not only in Europe, but also in the U.S. President Trump does what he can to weaken the U.S. dollar. Moreover, the Eurozone economy is healthier today than one year ago. It means that markets may shrug off geopolitical factors and focus on macroeconomics. Please note that investors are used to political turmoil in Italy – actually, forming a government is a national sport in that beautiful country. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.