Genesco Inc. (NYSE:GCO) is slated to release second-quarter fiscal 2018 results on Aug 31. The question lingering in investors’ minds is whether this specialty retailer of sports apparel ad accessories will be able to post a positive earnings surprise in the quarter to be reported. Though Genesco reported negative earnings surprise of 78.6% in the last quarter, it has surpassed the Zacks Consensus Estimate by an average of 3.2% in the trailing four quarters. So, let’s see how things are shaping up prior to this announcement.

What to Expect?

The current Zacks Consensus Estimate for the quarter under review is pegged at a loss of 5 cents, against earnings of 34 cents reported in the year-ago period. We note that the Zacks Consensus estimate has remained stable over the last 30 days. Nevertheless, analysts polled by Zacks expect revenues of roughly $633.3 million, up 1.2% from the year-ago quarter.

Factors at Play

Like most retailers, Genesco is also bearing the brunt of consumers’ rapid shift toward online shopping. The company’s store traffic was hit hard in the last quarter, and both the top and bottom lines fell year over year and lagged the Zacks Consensus Estimate. While the company is undertaking significant efforts to boost e-Commerce sales, it calls for high shipping and picking costs. In fact, these expenses dented the gross margin in the last quarter. Apart from this, results continued being hurt by adverse currency fluctuations, which is also expected to linger in fiscal 2018. Further, management stated that it expects the year to remain quite challenging, which including all aforementioned factors compelled it to lower its bottom-line view for fiscal 2018.

As for the upcoming results, the company stated that its second quarter typically witnesses the lowest earnings among all other quarters. In fact, management remains unsure about generating any profit this quarter, as it expects sluggish traffic to weigh upon comparable store sales. While prospects from the back-to-school selling season may provide some respite, we still remain apprehensive about Genesco’s upcoming results.

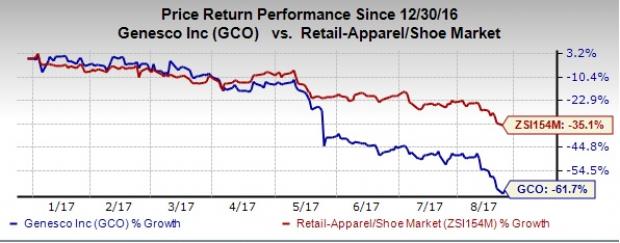

Notably, the company has lost about 11.2% in the last five trading sessions, clearly reflecting investors’ bearish stance on the stock. Also, this takes Genesco’s year-to-date performance to a slump of 61.7%, wider than the industry’s 35.1% plunge.

What the Zacks Model Unveils?

Our proven model does not conclusively show that Genescois likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with ourEarnings ESP Filter.

Genesco has an Earnings ESP of 0.00%, as the Most Accurate Estimate and the Zacks Consensus Estimate are both pegged at a loss of 5 cents. Further, the company currently carries a Zacks Rank #4 (Sell). Note that we caution against Sell-rated stocks (#4 or 5) going into the earnings announcement, especially when the company is seeing negative estimate revisions. The combination of Genesco’s unfavorable Zacks Rank and Earnings ESP of 0.00% makes surprise prediction difficult.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +3.23% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Big Lots, Inc. (NYSE:BIG) has an Earnings ESP of +0.72% and a Zacks Rank #2.

Ollie's Bargain Outlet Holdings, Inc. (NASDAQ:OLLI) has an Earnings ESP of +1.35% and a Zacks Rank #2.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

See Stocks Now>>

Ollie's Bargain Outlet Holdings, Inc. (OLLI): Free Stock Analysis Report

Genesco Inc. (GCO): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post