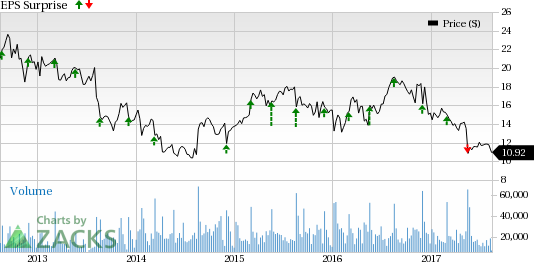

American Eagle Outfitters, Inc. (NYSE:AEO) is scheduled to release second-quarter fiscal 2017 results on Aug 23. Last quarter, the company delivered negative earnings surprise of 5.9%.

However, American Eagle has outperformed the Zacks Consensus Estimate in two of the trailing four quarters, with an average positive surprise of 1.6%. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The question lingering in investors’ minds now is whether American Eagle will be able to post positive earnings surprise in the quarter to be reported. The Zacks Consensus Estimate for the quarter under review is 16 cents per share, reflecting a 29.9% year-over-year decline. We note that the Zacks Consensus Estimate for the current quarter has been stable ahead of the earnings release, while estimates for fiscal 2017 and 2018 have witnessed a downtrend in the last seven days. Analysts polled by Zacks expect revenues of $829.4 million, up 0.8% from the year-ago quarter.

Furthermore, we note that the stock has underperformed the industry in the last one month. The company’s shares have declined 8.8%, while the industry dropped 5.1%.

Factors at Play

American Eagle too has fallen prey to the trend of soft store traffic and stiff competition that has been looming over the retail space for quite some time now. Plagued by these factors, the company posted dismal earnings performance in first-quarter fiscal 2017. Further, margins remained pressurized due to intense promotions undertaken by the company to counter sluggish demand. Further, its soft second-quarter view and recently announced store closure plans have been deterrents.

Intense industry competition are likely compel American Eagle to offer major discounts and incur high shipping expenses on online sales. In the second quarter, the company anticipates comps to range from flat to low single-digits decrease. Further, the company expects weak merchandise margins due to intense promotional activities. SG&A expenses are forecasted to increase in low-single digits. Finally, the company envisions earnings in the band of 15-17 cents per share, which is pegged considerably lower than the year-ago earnings of 23 cents.

Moreover, the company has been closing down stores to combat the decline in sales and higher store operating costs as traffic continues to remain soft. The company plans to shut down 25-40 stores in fiscal 2017.

However, the company’s solid online sales, which were backed by omni-channel initiatives and efforts to enhance customer experience, continue to boost comps. In fact, the aerie brand posted double-digit comps growth for the 13th straight time the first quarter. Additionally, the company is making efforts to enhance brands through innovations while also remaining committed toward enriching consumer experience. We believe these efforts can help the company overcome the current turmoil in the retail space.

Nonetheless, we cannot be certain whether the company’s efforts will be effective in bringing about a recovery in second-quarter results.

What the Zacks Model Unveils?

Our proven model does not conclusively show that American Eagle is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. American Eagle has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 16 cents per share. Further, the company carries a Zacks Rank #4 (Sell), which when combined with an ESP of 0.00% makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores Inc. (NYSE:BURL) currently has an Earnings ESP of +4.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Wal-Mart Stores Inc. (NYSE:WMT) currently has an Earnings ESP of +0.94% and a Zacks Rank #2.

Zumiez Inc. (NASDAQ:ZUMZ) has an Earnings ESP of +16.67% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research