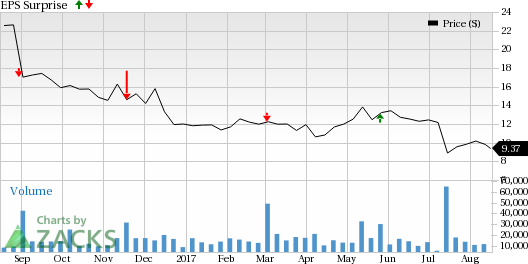

Abercrombie & Fitch Co. (NYSE:ANF) is slated to release second-quarter fiscal 2017 results on Aug 24. The question lingering in investors’ minds is whether this specialty retailer of premium, high-quality casual apparel will be able to deliver a positive earnings surprise in the quarter to be reported. The company’s bottom line has lagged the Zacks Consensus Estimate in four of the past five quarters. So, let’s see how things are shaping up prior to this announcement.

What to Expect?

The current Zacks Consensus Estimate for the quarter under review is pegged at a loss of 33 cents, compared with a loss of 25 cents reported in the year-ago period. We note that the Zacks Consensus estimate has remained stable over the last 30 days. Further, analysts polled by Zacks expect revenues of roughly $761.6 million, down 2.8% from the year-ago quarter.

Factors at Play

In the last reported quarter, Abercrombie’s top and bottom line fell year over year. Results were battered by a tough retail environment characterized by heightened promotional activity and soft comparable store sales (comps). Management expects second-quarter comps to remain challenging and gross margin to be pressurized. Moreover, currency headwinds are expected to hurt performance throughout fiscal 2017. While strength at the company’s Hollister brand and direct-to-consumer operations provide some respite, the aforementioned obstacles cannot be ignored.

Further, investors seem jittery about Abercrombie’s upcoming performance, as reflected by a nearly 7% drop in its shares over the last five trading sessions. In fact, the company has slumped 21.9% so far this year, while it fared better than the industry’s 28.2% decline.

What the Zacks Model Unveils?

Our proven model does not conclusively show that Abercrombieis likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Abercrombie currently carries a Zacks Rank #3, which increases the predictive power of ESP. However, the company has an Earnings ESP of -21.21% as the Most Accurate estimate of a loss of 40 cents is wider than the Zacks Consensus Estimate. The combination of Abercrombie’s Zacks Rank #3 and negative ESP makes surprise prediction difficult.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +4.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Big Lots, Inc. (NYSE:BIG) has an Earnings ESP of +6.56% and a Zacks Rank #3.

DSW Inc. (NYSE:DSW) has an Earnings ESP of +3.45% and a Zacks Rank #3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

DSW Inc. (DSW): Free Stock Analysis Report

Big Lots, Inc. (BIG): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research