Equity markets have had a tremendous move higher off of the lows established on Christmas Eve. They have retraced almost all of the December drop and last week took a pause as they reached their 100-day SMAs. All of the major market indexes held above their 20-day SMA during the pause and all look to be headed higher Tuesday.

One, the Russell 2000, looks ready to take the lead now. The small-cap index looked to open above its early February high on Tuesday morning, the first to do so. Perhaps it is time for the ‘small child’ to lead them all higher.

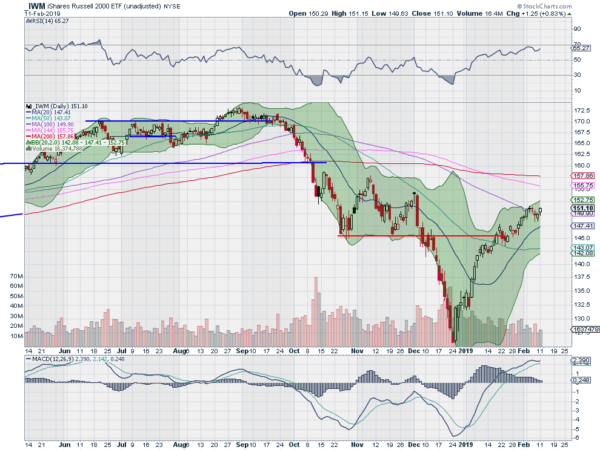

The chart above shows the Russell 2000 ETF, (NYSE:IWM), price action over the last 9 months. The price remains below the November and December highs, when it was consolidating the initial move down, but the momentum is holding strong for more upside. The RSI is running just under overbought and the MACD is avoiding a cross down.

The Bollinger Bands® are also pointing higher. The child is not back to safety yet, though. The 200-day SMA remains overhead and it is yet to make a major higher high. Getting over the December high on this next leg would be a major plus on the road to recovery.