Key Points:

- Fed likely to embark on monetary tightening.

- Industrial Silver demand remains strong.

- Watch for sharp volatility and declines if the central bank hikes rates.

Silver continues to see concerted selling pressure as price action remains trapped within the confines of the bearish channel. The past few days has seen price action trending strongly towards the upper channel constraint which now threatens a breakout of the medium term bearish trend. However, the question remains as to whether this is a definite breakout or simply a dead cat bounce ahead of the Fed potentially normalising interest rates.

In particular, the metal could potentially be facing a relatively large rout as the US economy continues to gear up for a range of monetary tightening. The risk of the Fed normalising rates was always ever present but as we move towards sustained economic growth and job gains it becomes relatively clear that the central bank will need to take action sooner, rather than later. Subsequently, the market is likely to focus upon the near term risk that a cycle of potential interest rate hikes poses.

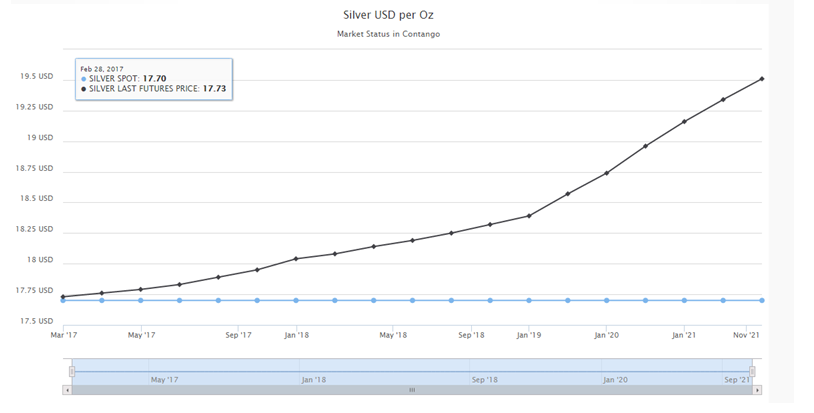

Any such move by the Fed would potentially send Silver reeling from its current level and forward forecasting shows that 75bps of hikes to the FFR, over the next year, would see the metal trading around the $14.00 an ounce mark. However, that risk might yet to be reflected within the Silver futures curve which is still showing rising prices throughout most of 2017 and 2018. Subsequently, if the Fed does indeed embark upon an adventure it could lead to the air escaping rapidly from the balloon which is currently financial markets.

Fortunately, the one fundamental factor which appears to be holding relatively static is the industrial demand for Silver. Physical demand continued to soar throughout most of 2016 which bodes well for the overall price direction and may be what much of the futures curve is based on. However, this ignores the impact of the waterfall effect as large institutions, such as JP Morgan, seek to continue floating derivative paper to ensure the metal remains depressed. Subsequently, it’s relatively unlikely that any of us will see a fair quote on COMEX any time soon.

Ultimately, Silver is in for a rough few months ahead as the volatility is likely to be fairly severe when the Fed tightening cycle eventually commences. That rate hikes are coming is largely inevitable, especially given some of the gains in inflation and the tightening of the job market, so it is imperative that position holders assess their reaction now before the madness of a ‘live’ FOMC meeting arrives.