On Wednesday, I covered target-date mutual funds, which automatically reduce their equity exposure as time progresses.

Target-date funds are becoming very popular for retirement accounts, but their elegant simplicity has a major shortcoming.

By design, they group people together based on an estimated retirement year. But in reality, everyone has a different risk tolerance, even those planning on retiring within the same timeframe.

Unsurprisingly, a technological solution to this problem has emerged. And many people, including the prominent venture capital backers, believe this is the next major disruptive force within the financial services industry.

Here’s how the process works…

You fill out an online questionnaire, which is used to gauge your risk tolerance. Then, a computer algorithm utilizes this information to determine an appropriate mix of relatively uncorrelated asset class categories. Your customized portfolio is created using exchange-traded funds (ETFs) and is periodically rebalanced. Throw in some bells and whistles such as tax loss harvesting, and presto… you have what’s known as a robo-advisor.

These software-based financial advisors are marketed as a less-expensive alternative to human financial advisors.

So, is this really the asteroid that will kill off the dinosaur advisors?

Could one of these robo-advisors even become as successful as Charles Schwab (NYSE:SCHW)?

Let’s take a closer look to find out…

Automated, Index Based, Low Cost

Wealthfront, the largest robo-advisor, reached $1 billion in assets under management in June 2014, only 2.5 years after inception.

It’s aimed at a younger, tech-savvy demographic that may be uncomfortable with professional money managers.

The firm even states on its website, “Why trust your money to a Wall Street money manager who charges steep fees when well-designed software can do a better job for a lot less?… Wealthfront is an appealing alternative to putting your money with a Goldman Sachs, UBS, or other private wealth manager.”

Shots fired!

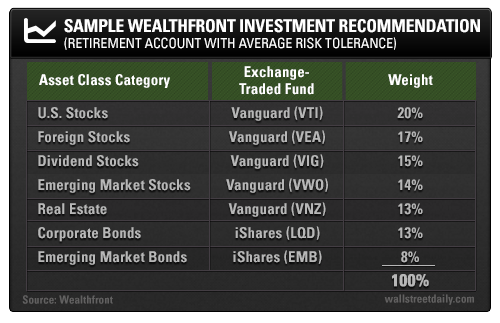

Wealthfront charges 0.25% of assets (no charge for accounts under $10,000) for its automated investment solutions. There are no commissions or other account fees, but you still pay the individual ETF management fees, which is why low-cost Vanguard ETFs are often selected.

Below is a sample Wealthfront portfolio:

As you can see, it’s broadly diversified among various asset class categories.

The lack of Treasuries or a cash component is certainly noteworthy, and this will make it even more interesting to see how the clients respond in a bear market for stocks.

Without a human to calm their fears, will they close their account when faced with losses?

Naturally, many traditional financial advisors are critical of robo-advisors. That’s probably because they see them as a threat, whether they’ll admit it or not.

But financial advisors are facing an even bigger problem…

In a response to the rise of the robo-advisors, Vanguard has made a huge announcement.

The fund giant recently rolled out the Vanguard Personal Advisor Services, which basically includes everything you get from a robo-advisor for a flat 0.3% fee… but you also get access to a flesh-and-blood certified financial planner!

Vanguard has managed to integrate the human element for a very low cost.

The only catch is that you need a minimum account value of $100,000… but it’s rumored that this threshold may be lowered in the future. Also, this is still much lower than the $500,000 minimum for the firm’s existing Vanguard Asset Management Services, which carries a 0.7% fee.

You see, one of Vanguard’s advantages is its mutual ownership structure. The fund’s shareholders effectively own Vanguard through its funds, and this motivates the firm to operate at cost, rather than for profit.

This means the robo-advisors are going to have to compete with a firm that has $2.86 trillion in assets under management, but which also has a structure that inherently prioritizes the interests of the client. That’s going to be a tough slog.

Vanguard reminds us that it – not the robo-advisors – is the main disruptor, and the robo-advisors are simply expediting a commoditization of basic investment services by introducing even more competition.

Competition is Beautiful

Ultimately, investors are the real winners because of lower prices.

Think of it this way…

There’s a continuum of solutions out there to solve your investment needs, from simple target-date funds to full-service private wealth management.

Whether they’re fully automated or there’s a lot of personal touch, all of the options are getting less expensive due to competition.

Gone are the days of a financial advisor charging 1% per year for basic portfolio construction and little else. Many advisors use in-house software similar to that of the robo-advisors anyway.

Financial advisors will need to be much more than investment advisors to justify their additional cost. They’ll need to provide planning services addressing more complex issues such as taxes, estate planning, and insurance.

Yes, weak advisors will be eliminated, and many registered investment advisory (RIA) firms may shutter. But the wealthy will always tend to desire a human advisor.

Regardless, competition may be bad for financial advisors, but it’s ultimately good for investors in the form of lower prices and more choices.

Even though robo-advisors are essentially glorified target-date funds, there’s little doubt that the average retail investor can benefit from these online investment advisory platforms.

Robo-advisors may not be perfect, but to paraphrase Voltaire, let’s not allow the perfect to be the enemy of the good.

Luckily, we don’t have to sit around and figure out how robo-advisors will attract a sufficient number of clients. Perhaps one (or all) will be acquired and melded into a full-service brokerage model.

Whatever the outcome, we have and will continue to benefit from the competition in the financial services industry.

Efficient Markets Hypothesis

Robo-advisors operate under the overarching principle that the markets are efficient, or are at least efficient enough to make it extremely difficult to outperform the market.

Burton Malkiel, Efficient Market Hypothesis (EMH) proponent and author of A Random Walk Down Wall Street, is actually on Wealthfront’s investment team.

So, it’s no surprise that the firm’s principles are grounded in modern portfolio theory and passive indexing.

I, on the other hand, firmly believe that the markets are inefficient enough to provide opportunities to outperform based on well-informed insights and active management.

I’m also of the opinion that the providers of sound investment ideas and analysis will never go extinct.

Safe investing,

Alan Gula, CFA