Visa Inc.’s (NYSE:V) fiscal first-quarter results scheduled for Feb 1, should see an upside from increased revenues.

Visa has witnessed a revenue CAGR of 12.7% from 2008-2017. We strongly believe that the company will retain its revenue momentum in the fiscal first quarter on the back of its strong market position and attractive core business that continues to be driven by new deals, renewed agreements, accretive acquisitions, increasing spending via cards, shift to digital form of payments and expansion of service offerings.

The company expects annual net revenue growth of high single digits on a nominal dollar basis for fiscal 2018. We expect increase in revenues from each of its business lines — Data Processing, International Transaction and Service. The Zacks Consensus Estimate for each of these segments is pegged at $2.1 billion, $1.67 billion and $2.1 billion, up 13.3%, 12.4% and 11.2% year over year, respectively.

The company resolved approximately 75% of contract conversions by the end of fiscal 2017, and the remainder will be done primarily in the first half of fiscal 2018. As a result, client incentives in the first half of 2018 will be significantly higher than fiscal 2017. Thus the quarter should enclose higher client incentives.

Payment volumes should grow in the fiscal first quarter from the Costco (NASDAQ:COST) and USAA deal wins. These deals drove U.S. payment volume growth up to the double-digit range in fiscal 2017. The Zacks Consensus Estimate of $1.97 trillion payment volumes is up 9.3% year over year.

The company’s cross-border business and cross-border volumes are dependent on global economic conditions and the relative strength of key currencies, in particular the U.S. dollar, the euro, and the pound. In the fourth quarter, these trends started to change as the dollar weakened, especially versus the euro and the pound. Assuming these trends will continue, the company anticipates a slowdown in U.S. outbound commerce, with a step up in commerce coming into the U.S. and vice-versa for Europe and the UK.

The adjusted expense growth rate is expected to be highest in the first quarter led by numerous investment initiatives.

The company has accelerated share buyback activity to offset the equity dilution from the Visa Europe transaction. Increased share buyback will provide an added shield to its bottom line.

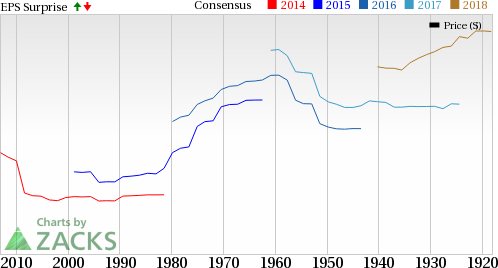

Earnings Surprise History

The company boasts an attractive earnings surprise history. It beat estimates in each of the trailing four quarters, with an average positive surprise of 8.13%.

Visa Inc. Price and EPS Surprise

Here is what our quantitative model predicts:

Our proven model shows that Visa has the right combination of the two key ingredients to beat earnings estimates.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +0.27%.

The positive ESP is a meaningful indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Visa carries a Zacks Rank #3 (Hold). Note that stocks with a Zacks Rank of #1, 2 or 3 have a significantly higher chance of beating on earnings.

Other Stocks to Consider

Here are some other companies from the same space that are poised for a beat based on our model.

FleetCor Techologies, Inc. (NYSE:FLT) is expected to report fourth-quarter 2017 earnings results on Feb 14. The company has an Earnings ESP of +0.02% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Mastercard (NYSE:MA) will report fourth-quarter 2017 earnings results on Feb 1. The company has an Earnings ESP of +0.3% and a Zacks Rank #2.

WEX Inc. (NYSE:WEX) has an Earnings ESP of +1.16% and a Zacks Rank of 2. The company is expected to report fourth-quarter earnings results on Feb 21.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

FleetCor Technologies, Inc. (FLT): Free Stock Analysis Report

WEX Inc. (WEX): Free Stock Analysis Report

Mastercard Incorporated (MA): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Original post

Zacks Investment Research