The U.S. dollar extended lower against most of the major currencies on Wednesday despite a stronger Empire State manufacturing survey. According to this report, activity in the New York region soared in September, with the index rising to 34.3 from 18.3 (a modest decline was anticipated). Strong gains were seen in new orders, employment, shipment, delivery and unfilled orders. While the index has seen some recent volatility, today’s report eases some concerns about the recovery.

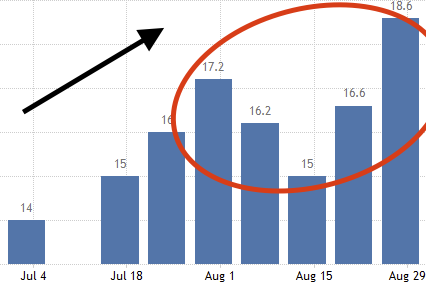

Retail sales tomorrow will go a long way in setting expectations for next week’s Federal Reserve monetary policy announcement and the market’s appetite for U.S. dollars. Economists are looking for consumer spending to fall for the third time in four months. In July, car shortages and AAmazon Prime Day hangover drove spending lower, but there’s back-to-school spending in August and final summer vacations. This means spending could be stronger than anticipated, especially with larger percentage increases in Johnson Redbook retail sales in August compared to July (see chart below).

The rebound in Treasury yields is a sign that investors haven’t given up on a taper announcement this month. For example, EUR/USD is trading not far from pre-CPI levels. If retail sales surprise to the upside, the U.S. dollar will rally against all of the major currencies. Given recent price action, EUR/USD and AUD/USD are particularly vulnerable to losses. If spending prints positive, we could see a very strong rally. However, if economist predictions are accurate and consumer spending falls for the second month in a row, taper expectations will recede quickly, which will translate into renewed losses for the U.S. dollar. The biggest beneficiaries should be sterling, the Canadian and New Zealand dollars. The best performing currency today was the Canadian dollar, which rallied on the back of 2% rise in crude prices and stronger CPI.

The U.S. dollar won’t be the only currency in focus for the next 24 hours. New Zealand releases its second quarter GDP report, which will be followed by Australia’s labor market numbers. Q2 was a good period for many countries, and New Zealand was no exception. With virtually zero COVID-19 cases in the spring, economic activity was returning to pre-pandemic levels. A lot has changed since then, however, with the country back in lockdown. The prospect of significantly weaker Q3 growth should lead many investors to overlook a positive report.

Meanwhile, investors should be prepared for ugly Australian labor market numbers. Stay-at-home orders in many Australian states means job losses. Economists are looking for employment to fall by 90,000, which would be the single biggest monthly decline since June of last year. Full- and part-time work is expected to fall with the unemployment rate rising to 4.9% from 4.6%. With vaccination rates on the rise, we can finally see the light at the end of tunnel, but for now, it should be difficult for investors to look past such a weak jobs report.