Platinum price has been trading in a tight range the previous sessions. And as of today, the commodity is likely moving lower. Platinum is highly used for industrial and commercial purposes and aside from copper, gold and silver. Sometimes called “little silver, platinum is also among the commodities, which is traded and has caught the attention of investors in the past few years.

As of 09:37 UTC, the gray metal opened at 1.108.30, with an intraday high of 1109.80 and intraday low of 1107.80. The commodity closed at 1109.10, a bit higher from 1107.10 during the late trading session on Monday. It found support at 1101.65 and resistance at 1110.08.

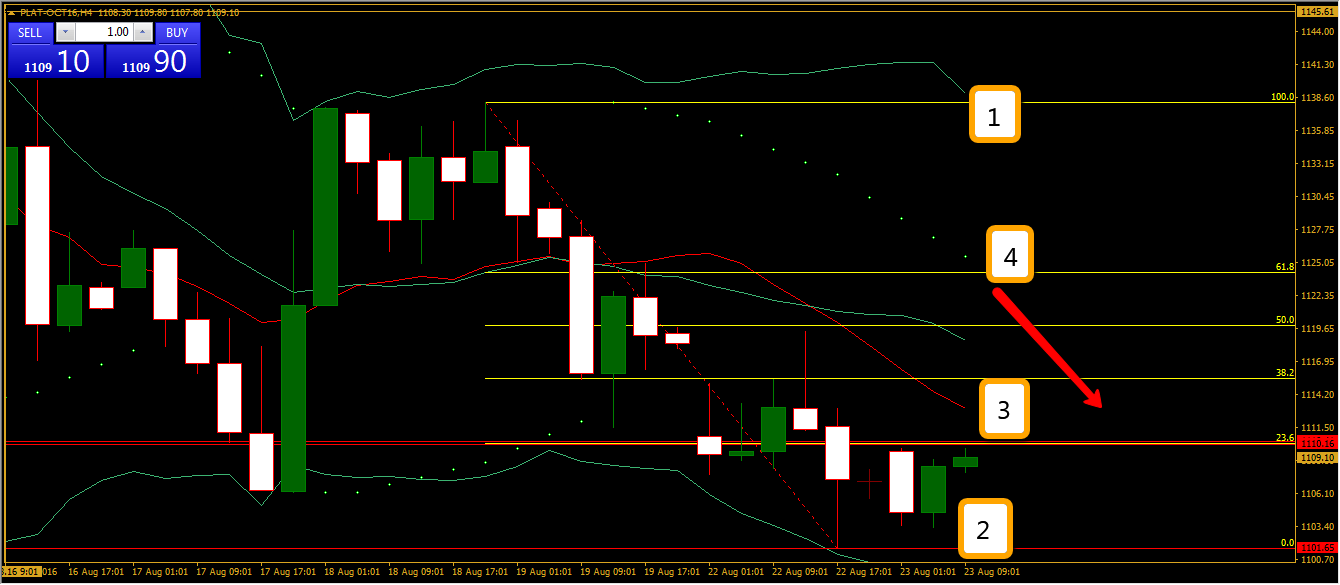

As seen in the image below, the gray metal was trading near to its resistance and may have a false breakout. However, In case the band will continue to expand, expect a change of trend (1). Considering the price was away from the outer band (2), the momentum could be fading and if the price movement broke the moving average of 1113.11 (3), then this could an indication that the trend is ending.

For short-term traders, be watchful on the Parabolic Sar (4), if the trend continue to go down for one more dot, then this could be a sign of downtrend in the rest of the day.

Looking through the price of the gray metal, it went $1.108.20 per ounce, $35.63 per gram and $35,629.43.

Among the precious metal, platinum is considered to be the most expensive and rare. The gray metal is highly influenced by the technological developments, auto-industry, production in South Africa, replacement and catalysts purposes.

SUPPLY AND DEMAND

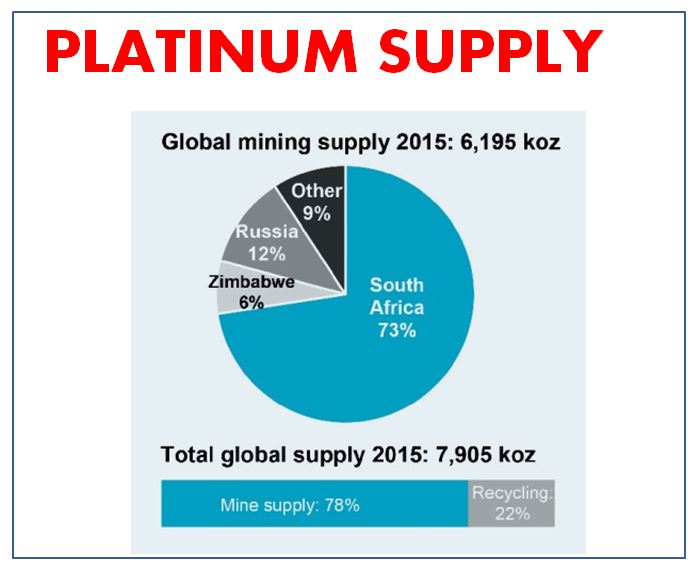

South Africa covers around 73 percent of the total output of platinum globally, and research showed that it has been declining alongside with the drop of prices. As seen on the graph below, apart from South Africa, Russia and Zimbabwe are the other major producers.

In light of its rarity, the commodity is owned by investors who manage to come up with higher returns on investments after including it in their respective portfolios. The gray metal is considered to be a liquid investment as well whereas it has an immediate access to either the ability to buy or sell, in short it can be readily converted to cash.

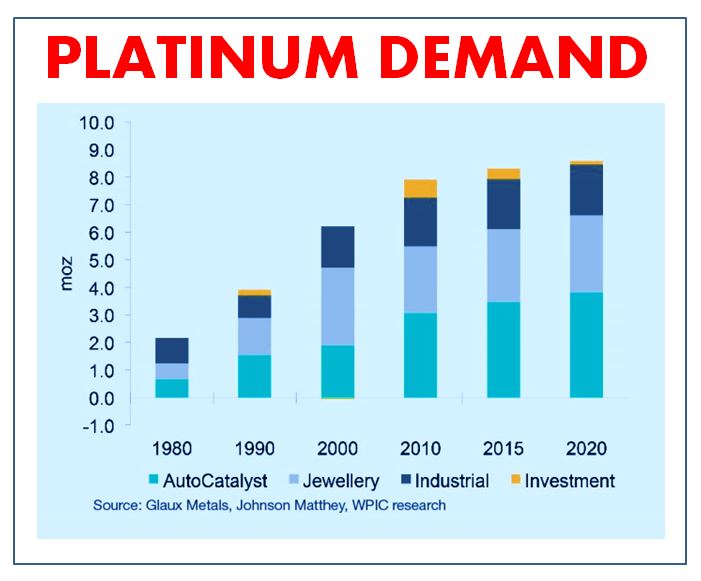

The demand for the metal has been stable over the years. As seen on the graph provided by the Glaux Metals, Johnson Matthey (LON:JMAT), WPIC research, platinum acquired demand more on auto sector and followed by jewelry sector.

AUTO INDUSTRY

As an auto catalyst, the demand for the gray metal might be affected if the auto industry couldn’t maintain the stability. Last quarter, most of the auto companies reported a disappointing earnings report as the financial sector was hit by Brexit and the strength of the yen. Surely, the health of the auto industry would play a significant role in the demand for platinum.

Further, platinum catalysts can be used in computer hard disks, electronic components, crucibles, glass and sensors. There are platinum based drugs as well and it is used in medical field. In case, the sectors which call for greater demand for platinum surge, then producers may come up with better output figures. It is always about balance.

Conclusion

Platinum may end the day lower, however, it is possible that it can find recovery. The only thing that matters here is the stability of its demand and supply. If the forecasts of the auto makers turn out to be right, then we should expect a greater demand. The U.S. central bank was expecting an improvement of the economy as the labor market showed a significant increase. In case the emerging economies find even just a slight recovery, then the relative market sectors can find a breather and this could be the momentum that most of the precious metal have been waiting for.