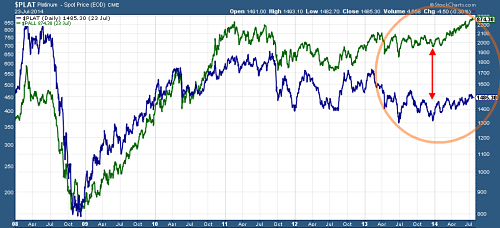

Platinum prices have increased modestly but consistently since the start of the year. However, platinum has performed poorly compared to Palladium, which recently reached an all-time high. These two precious metals tend to move together as they share commonalities.

However, since last year we can see a divergence between the two metals, as platinum is still far from reaching its 2011 levels. The question is: Is palladium pointing the way for platinum?

Platinum reached a 10-month high in July at $1,500/oz, after surging 10 percent this year. On the supply side, concerns due to the South African platinum miners’ strike helped push these two metals higher this year. Meanwhile, stronger auto sales this year increased demand for platinum and palladium as 50% of their use goes to the auto sector, particularly for catalytic converters.

What This Means For Metal Buyers

The picture for palladium is bullish. Meanwhile, platinum is lagging but finally showing some strength after recently hitting a 10-month high. The fundamental picture looks tight for both metals and platinum likely won’t be left behind if palladium continues its way up.

by Raul de Frutos