PACCAR Inc. (NASDAQ:PCAR) is set to report second-quarter 2017 results before the market opens on Jul 25. In the last quarter, the company reported in-line earnings.

The company delivered a positive earnings surprise in two of the trailing four quarters, with a negative average surprise of 0.96%.

The company has a long-term growth rate of 10%.

Let’s see how things are shaping up for this announcement.

PACCAR Inc. Price and EPS Surprise

Why a Likely Positive Surprise?

Our proven model shows that PACCAR is likely to beat estimates this quarter because it has the right combination of two key ingredients.

Zacks ESP: The Earnings ESP for PACCAR is +2.04% because the Most Accurate Estimate of $1 is pegged above the Zacks Consensus Estimate of 98 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PACCAR currently carries a Zacks Rank #2 (Buy). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) have a significantly higher chance of an earnings beat. Conversely, the Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement.

Factors to Drive Better-than-Expected Results

PACCAR benefits from a sizeable market share in the U.S. and Canada. Also, the company undertakes active capital deployment. It has achieved Class 8 retail market share of 27.4% in the U.S. and Canada in 2015 and 28.5% in 2016. Additionally, the above 16-ton market share increased to 15.5% in 2016, from 14.6% in 2015.

PACCAR is well-positioned in key markets due to its strategic investments. For 2017, the company targets capital investments in the range of $375–$425 million besides research and development expenses of $250–$280 million.

The company continues to expand its global network of strategically located parts distribution centers (PDC). PACCAR is optimistic about its expansion plans in South America and Russia. The DAF factory in Ponta Grossa and the establishment of a subsidiary named DAF Trucks in Russia are expected to boost earnings.

The company also opened a new distribution center in Renton, WA, in Apr 2016 to support the rising demand for its TRP branded parts. Further, it is expanding the 35-year old truck factory in Denton, TX and adding a new automated storage system for painted components. This will increase both productivity and capacity at the plant.

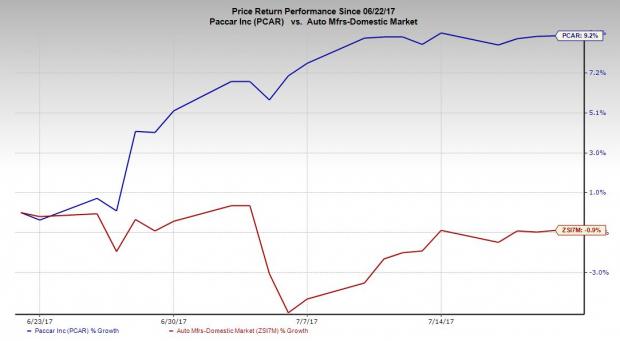

Price Performance

PACCAR’s shares have gained 9.2% in the last one month, substantially outperforming the 0.9% decline of the industry it belongs to.

Stocks to Consider

Here are a few other top-ranked companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Cummins Inc. (NYSE:CMI) has an Earnings ESP of +3.1% and carries a Zacks Rank #2. The company is likely to report its second-quarter 2017 results on Aug 8. You can see the complete list of today’s Zacks #1 Rank stocks here.

CNH Industrial N.V. (NYSE:CNHI) has an Earnings ESP of +12.5% and carries a Zacks Rank #2. The company’s second-quarter 2017 financial results are expected to release on Jul 26.

BorgWarner Inc. (NYSE:BWA) has an Earnings ESP of +1.12% and carries a Zacks Rank #3. The company’s second-quarter 2017 financial results are scheduled to release on Jul 27.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

PACCAR Inc. (PCAR): Free Stock Analysis Report

CNH Industrial N.V. (CNHI): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research