“The increasing supply from Libya and the potential slowdown in China promoted the sale of Brent oil, while the WTI gained the stimulus of growth due to the news that the southern section of the Keystone XL pipeline had been launched (capacity 300,000 barrels per day) by the TransCanada Corp.," informed the Masterforex-V World Academy’s experts.

The nearest oil futures support is located on the lower line of the upward weekly channel.

"West Texas Intermediate oil remains on the weekly low level amid the speculation according to the crude oil and petroleum products inventories rising in the U.S. last week," said the analysts of the Forex Broker HY Markets.

According to the latest estimates, a rise to the level of 2 million barrels is expected, while gasoline stocks are forecast to increase by 1.7 million barrels and distillate stocks will decline, in particular diesel fuel, heating oil and others will be reduce by 2.5 million," said the analyst of Masterforex-V World Academy.

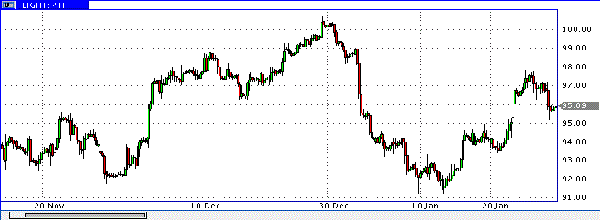

The March contract for the WTI crude oil was trading in the range of $95.89 a barrel on January 28th 2014, having gained 18 cents after the falling 1% to its lowest level since January 21st - $95.72 per barrel.

As it was stated by the OPEC General Secretary, El Badri, oil price in the range of $ 100 to $ 110 per barrel was acceptable for both, the producers and the consumers of raw materials. In his view, the market is balanced, and stocks are at the appropriate levels.

According to the analysts of Masterforex-V World Academy, from a technical point of view, the immediate support is located on the lower limit of the upward weekly channel, which is currently taking place in the area of 95.20.The breakout of this area will open the way to the 90.50 area. In the case of the zone of resistance 98-99 visit, the "black gold" can rise up to the area of 100.10. The breakout of this level will open the way to 101.40.