Natural gas futures reach caution area

Market structure sends encouraging signals

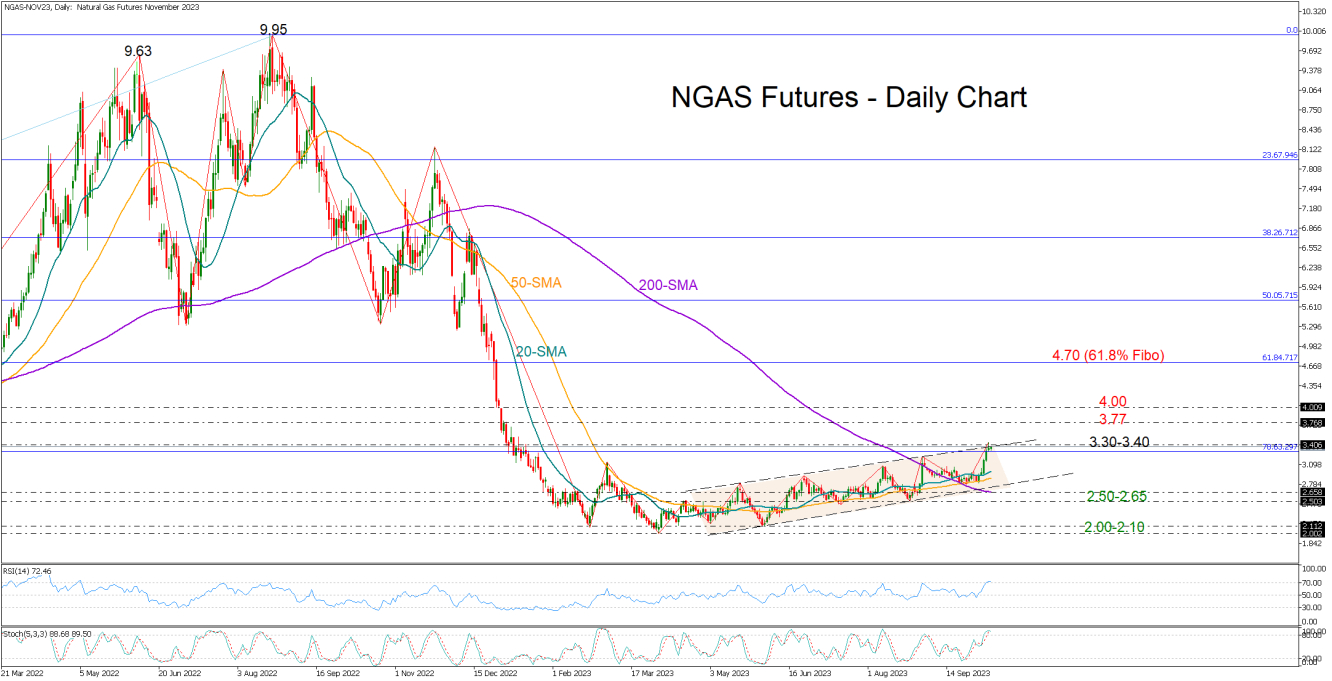

Natural gas futures (November delivery) have been gently trending up since April’s 32-month lows, marking new higher highs and higher lows at a soft pace.

The recent upturn in the price brought the January 2023 resistance territory at 3.40 under the spotlight. Interestingly, this is where the bulls faced confluence at the end of October 2020 and it took them seven months to crack that wall and stage an impressive rally to 6.44 in October 2021.

Monday’s candlestick, with a small body at the top of an upward channel, has raised concerns about an upcoming bearish wave. Note that the RSI and the stochastic oscillator have entered overbought waters. Yet, the positive crossings of the short and long-term SMAs show an upward trend forming.

The 78.6% Fibonacci retracement of the 2020-2022 uptrend is currently buffering downside pressures around 3.30. If that floor stays firm, with the price ascending above the channel too, resistance could next emerge somewhere between 3.77 and the 2023 high of 4.00. A successful battle there could activate new buying orders up to the 61.8% Fibonacci of 4.70.

Alternatively, a slide below 3.30 could see a test of the 20- and 50-day SMAs, while the channel’s lower band and the 200-day SMA could reject any declines towards the 2.50 base. Should the latter give way, the bears may re-challenge the 2023 floor of 2.10-2.00 with scope to expand the downtrend to the 2020 base of 1.50.

In a nutshell, natural gas futures could experience some profit taking in the short-term following a week of gains. As regards the market trend though, there are signs of improvement.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Natural Gas: Is a Bull Market on the Horizon?

ByXM Group

AuthorTrading Point

Published 10/10/2023, 08:15 AM

Updated 05/01/2024, 03:15 AM

Natural Gas: Is a Bull Market on the Horizon?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.