Yesterday Netflix (NASDAQ:NFLX) stock dropped more than 7% due to decreasing subscriber growth. It has essentially gone nowhere since July 7 last year. What gives?

Since NFLX is a growth stock, such a reaction to disappointing growth numbers is often not favorable by investors. Thus, investor sentiment plays a significant role here, and that is what the Elliott Wave Principle (EWP) precisely tracks. Therefore, the EWP is a great tool to help assess what is most likely next for NFLX.

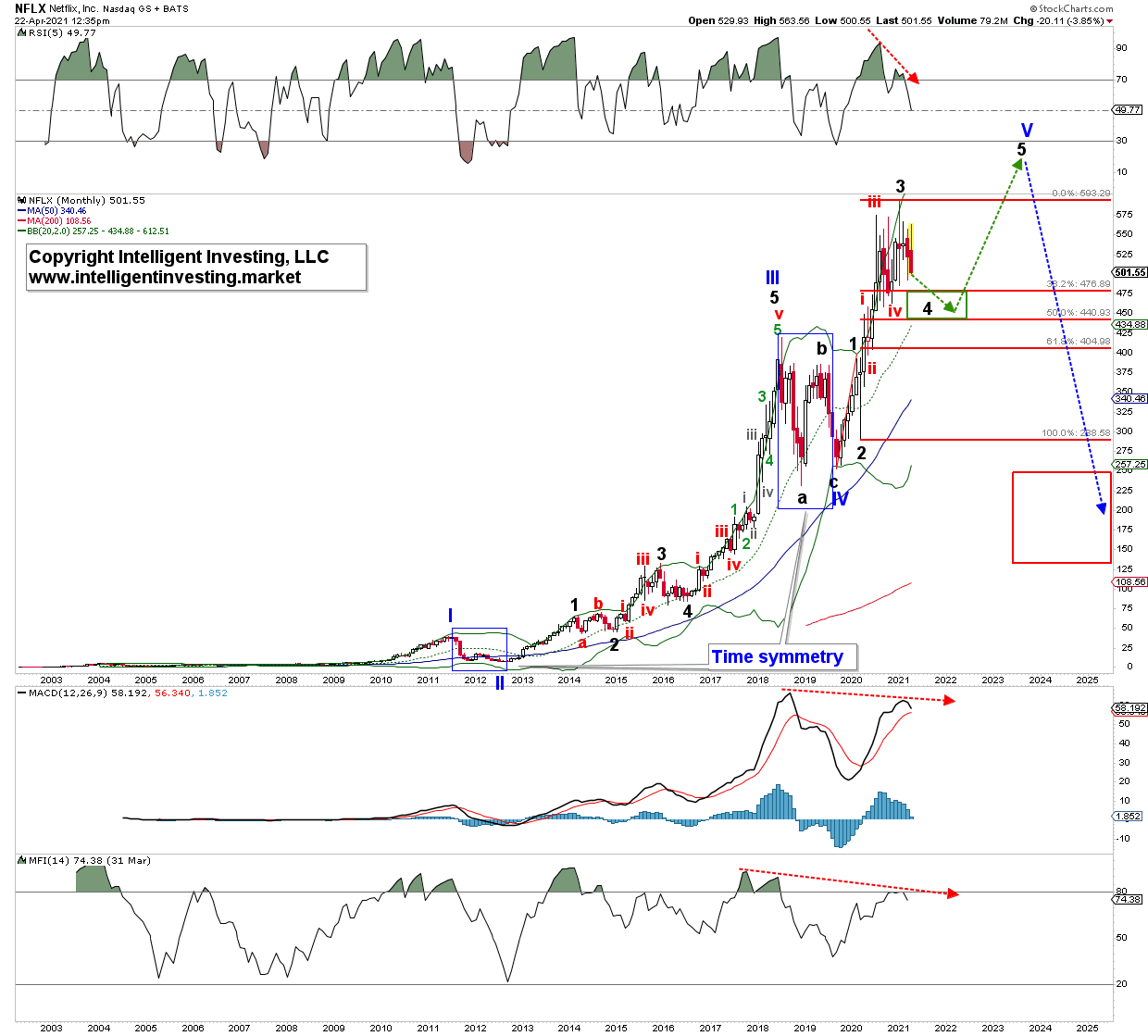

The monthly chart below shows the big picture EWP count for NFLX since its IPO in 2002. The blue waves are the more giant primary waves, with wave-II and IV being equal in time. Now NFLX is in its last more significant primary wave, wave V, up. But this wave is subdividing into five smaller waves: black major waves 1, 2, 3, 4, 5. The fractal nature of the EWP and markets are visibly at work.

Figure 1. NFLX monthly candlestick chart with EWP Count and Technical Indicators:

If my EWP count is correct, then NFLX should stay range bound and bottom around $440-$475 for (black) major wave-4 and then rally one last time for wave-5 to new all-time highs (green dotted arrows highlight the anticipated path). Once wave-5 of V is complete, I expect a long-lasting (think years) bear market bringing NFLX back to more sane levels of around $150-$250, depending on where it will exactly top (blue arrow and target zone).

Sides a drawn-out sideways months’ prolonged congestion, i.e., stuck between $450-550, is often regarded as a healthy consolidation, aka bull flag pattern, after a strong run-up as NFLX rallied from $250 in September 2019 to $590 by January 2021. That is an almost 140% gain in 15 months, nearly 10% per month! In EWP terms, such a consolidation is often the 4th wave after a solid 3rd wave. What does it take to invalidate my preferred POV: a move below the February 2020 high at $392. If that happens for NFLX, without the stock making a new all-time high first, then wave-V has already topped, and the decline to the $150-250 zone is entirely underway.

Thus, from a trading perspective, waiting for NFLX to drop into the ideal $440-475 zone for entering a long position targeting $600+, with a stop at just below $390 would be a great possible way to try to capitalize on the next rally.