As interest in cryptocurrencies has grown, there's been a corresponding rise in mining activity by enthusiasts. Sounds promising for the asset class, right? But there's a significant downside to this seemingly positive development.

Mining pools, in which groups of miners combine their resources in order to share both cost and efficacy of network processing power has expanded at the same time. Mining pool participants also split the rewards equally, according to the amount of work they've contributed to the probability of finding a block.

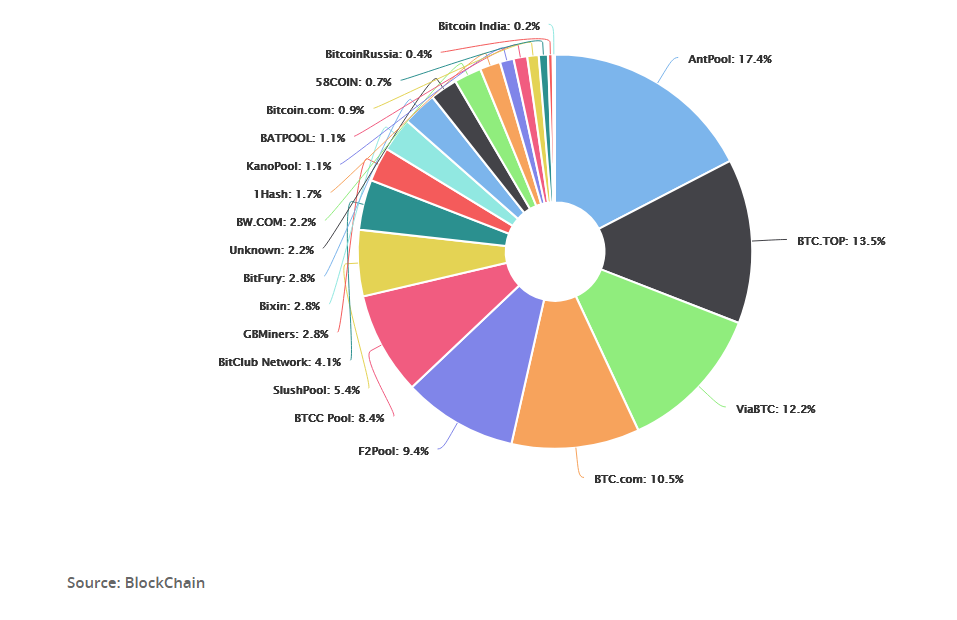

In the Bitcoin space alone, according to stockstotrade.com, based on information compiled at the end of January 2018, all of the 10 largest market players in the crypto world in terms of hashrate were mining pools, with a combined market share, at that time, of 86.5%. AntPool, the worlds' largest mining pool, owned 17.4% of the market, while BitFury, the largest cloud mining service was 11th on the list with just 2.8% of the pie.

Who are are the largest miners in crypto right now? Manish Kumbhare, Co-Founder of Peppermint-Chain says currently, the big five miners are BTC.com, ViaBTC, AntPool, BTC.TOP and Slushpool. Together they have 65% of the hashrate due to their concentrated mining investments. Hashrate is the output of a hash function, the speed at which an operation in the Bitcoin code (or other cryptocurrency) occurs.

For example, a higher hash rate is better for miners since it increases the opportunity of finding the next block and receiving a reward. Bitcoin miners contribute to the mining process by securely verifying transactions and placing blocks of data into a decentralized public ledger which usually requires expensive custom equipment.

But mining pools can narrow, or in worst case scenarios even block opportunities for individual miners. The possibility of colluding towards a 51% attack increases.

Along with skewing the decentralized nature of the cryptocurrency enterprise—one of the founding tenets of the asset class—these pools can also undercut smaller operations, raising concerns of 'a 51% attack.' For those unfamiliar with the notion of '51% attack,' it refers to an assault on a blockchain by a group of miners controlling more than 50% of the network's mining hashrate, or computing power.

As such, there is the very real possibility that crypto security could be seriously undermined. This article is for informational purposes only. It's not our aim to create FUD (fear, uncertainty and doubt). Rather, the point of this post is to address the risks and openly discuss the issue.

In theory, mining pools are a great way for people to work together to mine a specific digital currency says Marc Bernegger, a Switzerland-based web entrepreneur and investor who is also on the board of Falcon Private Bank and an ICO advisor at SwissRealCoin.

Mining pools are indeed an interesting subject. But by centralizing the processes you take away a lot of what makes cryptocurrency so appealing. In turn, this opens miners and enthusiasts to increased levels of security issues by keeping the data of users—and their coins—in one place.”

He concurs that the issue of the 51% attack, as well, is of concern. Essentially, this means that when one pool becomes too large, too powerful, it can theoretically control 51% of the network’s hashing power. By obtaining a majority of the network, issues including preventing new transactions from gaining confirmation, to blocking payments, to double spending become possible.

Just this past Friday, Motherboard reported that AntPool announced on social media that they were 'burning' 12% of the money they make mining Bitcoin Cash, in order to inflate the value of BCH by fixing the supply of the alt-currency, forcing investors to hang on to their supply rather than sell it, thereby forcing an increase in the value of each token.

It's not clear if AntPool's attempt at 'protecting' the market will succeed at raising the price of BCH in the longer term, but it does illustrate the possible ways a strong mining pool could potentially corner the crypto marketplace. It also begs the question, is it possible to consolidate so much computational power in order to perform a 51% attack?

Alexander Demidko, Co-Founder of Fluence as well as its Chief Research Officer believes it's possible but not necessarily probable.

“Anyone with enough resources and determination could do that. Achieving this in practice though is almost an impossible feat. Why? The attacker will require not only to gain control over 51% of the network, which is hard on its own, but to sustain this control long enough to have the opportunity [toperform] any malicious actions. All of that without everyone noticing.”

Ryan Taylor, CEO of Dash Core Group notes that for any blockchain which utilizes a proof-of-work consensus mechanism, the formation of mining pools is inevitable. He points out that the narrative of the threat of a mining pool-led 51% attack tends to be oversimplified, especially when it involves large established networks such as for Bitcoin.

One of the most significant innovations of blockchain technology has been its consensus mechanisms and the way in which it incentivizes trust between parties that know little-to-nothing about each other, Taylor says. Cornering mining activity could have significant negatives not just for the asset, but for the mining pool involved in the action as well:

“Several mining pools could theoretically collude in such a way that grants them the power to execute an attack, but it would be self-defeating. If an attacker were to use their capacity dishonestly to rewrite transaction history, network participants would rapidly lose trust in the effected blockchain. A loss of trust would rapidly translate to price declines, which would erode returns on the massive fixed investment in mining equipment. Because a 51% attack is not without risk to the attacker, the reality is that there might not even be a scenario where a 51% attack is economically feasible for an attacker.”

Corporate groups aren't the only type of mining pools currently existent. China maintains about 60-75% of the mining network says David Fragale, Co-founder of Atonomi. Right now there are over 1500 cryptocurrencies available he says. All of these alt-coins were born from Bitcoin offering different 'flavors,' effectively methods for reaching consensus and incentivizing ecosystem participants.

“While it's still early days for cryptocurrencies, it is important for innovators and governments including the regulatory community to collaborate and adopt the right framework to support the growth and security of the cryptocurrency movement.”

Cost of mining keeps increasing

Security issues aren't the only risks smaller miners face. Though many enthusiasts continue to run mining operations from their bedrooms, the cost for both equipment and energy usage has soared.

There are reports that sales and prices of graphics processing units (GPUs) have been skyrocketing in recent years because crypto miners have been snapping them up to create server farms. According to Computerworld, which cites Gartner’s latest stats on the sales revenue for GPUs that are used as add-on cards for PCs, over the past three years, manufacturers' revenues have nearly doubled from $2.7 billion to $4.7 billion. For GPUs used in data centers, the revenue for chipmakers has skyrocketed from $168 million in 2015 to $1.1 billion.

Perhaps most prohibitive is the rising cost of electricity needed to power the equipment. As the complexity of the blockchain that underpins individual digital currencies grows, it takes more and more computing muscle—and thus more electricity—to validate transactions. MarketWatch, referencing the Bitcoin Energy Consumption Index, says "global energy usage of all Bticoin mining already is equivalent to the power uptake of the country of Denmark, with a population of 5.7 million, and will eventually approach Bangladesh, a country of 163 million people."

In order to remain profitable, many miners have been moving to locations where the cost of electricity is cheapest. Cheap hydroelectric energy has recently made Sweden and Norway places of interest along with Iceland which has been the focus of crypto miners for some time now.

But traversing the globe in order to find cheaper and cheaper energy-friendly locations isn't necessarily desirable, nor does it make sense, particularly for smaller miners. According to an EliteFixtures study, right now, South Korea is the most expensive country for mining a single Bitcoin, with costs coming in at $26,170 per coin whereas Venezuela, where the cost per token is just $531, is the cheapest.

Given the statistics, the growth of mining pools makes a certain kind of sense. And though they may edge out some smaller miners, there are so many other factors in play that make crypto mining ever more prohibitive for the smaller player. But if the economics of mining digital currencies stops being profitable, or governmental regulation hampers the way current mining procedures occur, it's certain the evolution of cryptocurrency mining will likely take another tack. As with so much else in this brave new world, the evolution of the asset class continues to unfold.