Marriott International, Inc. (NASDAQ:MAR) will report fourth-quarter 2017 results on Feb 14, after the bell.

In the quarter, we expect the company to post an encouraging performance on both counts driven mainly by significant RevPAR (revenue per available room) growth. In fact, the company is witnessing increased RevPAR in most markets around the world over the last few quarters.

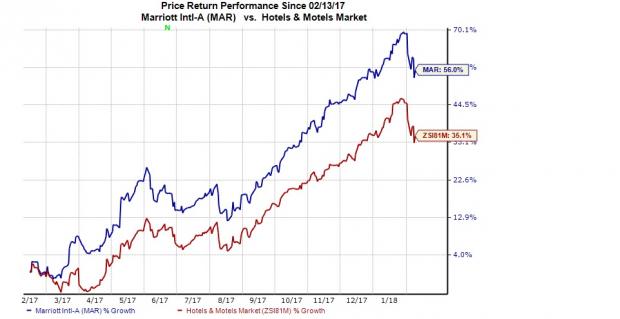

Notably, over the past year, Marriott stock has rallied 56%, significantly outperforming the industry’s 35.1% growth.

Higher RevPAR and Starwood Synergy to Drive the Top Line

The Zacks Consensus Estimate for Marriott’s revenues in the to-be-reported quarter is pegged at $5.6 billion. This, when compared with the year-ago actual figure, reflects growth of 3.1%. We believe that this anticipated growth will mainly be driven by decent RevPAR growth across both domestic as well as international markets owing to increased scale and distribution post Starwood purchase and strong leisure demand. In the last reported quarter, worldwide, system-wide RevPAR rose 2.1%.

Increasing business and leisure travel on the back of improving economic indicators and positive employment numbers, along with strong transient demand is likely to boost performance in the quarter. Rising North American business and large international exposure bode well for the company.

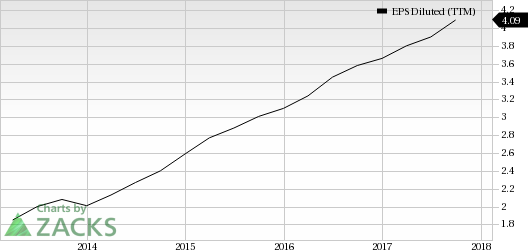

Cost Controls and RevPAR Growth to Boost EPS

The consensus mark for adjusted EPS stands at $1, reflecting an increase of 17.6% from the year-ago actual figure. We expect higher RevPAR, solid cost controls and synergies from Starwood acquisition to contribute significantly to margin improvement, which in turn will boost EPS. In the last reported quarter, adjusted earnings of $1.10 per share increased 26.4% year over year.

Marriott International EPS Diluted (TTM)

Our Model Does Not Suggest a Beat

Please note that according to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. Zacks Rank #4 (Sell) or 5 (Strong Sell) stocks are best avoided, especially, if they have a negative Earnings ESP. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Marriott has a Zacks Rank #2 while its Earnings ESP is -1.11%, a combination that makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here

Stocks to Consider

Here are some stocks from the Consumer Discretionary sector that investors may consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Choice Hotels (NYSE:CHH) has an Earnings ESP of +1.84% and a Zacks Rank #2. The company is scheduled to report its quarterly numbers on Feb 20.

MGM Resorts (NYSE:MGM) has an Earnings ESP of +42.50% and a Zacks Rank #2. The company is scheduled to report its quarterly numbers on Feb 20.

Churchill Downs (NASDAQ:CHDN) has an Earnings ESP of +29.03% and a Zacks Rank #1. The company is expected to report its quarterly numbers on Feb 27.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

MGM Resorts International (MGM): Free Stock Analysis Report

Churchill Downs, Incorporated (CHDN): Free Stock Analysis Report

Marriott International (MAR): Free Stock Analysis Report

Choice Hotels International, Inc. (CHH): Free Stock Analysis Report

Original post

Zacks Investment Research