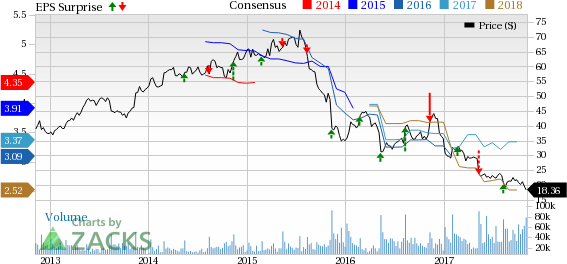

Macy's, Inc. (NYSE:M) is slated to report third-quarter fiscal 2017 results on Nov 9, before the opening bell. In the previous quarter, this department store retailer reported positive earnings surprise of 6.7%. However, the company’s bottom-line lagged the Zacks Consensus Estimate in the trailing four quarters by an average of 19.9%. Let’s analyze the factors influencing the company’s performance.

Factors at Play

Macy’s has announced a slew of measures revolving around stores closures, cost containment, real estate strategy as well as investment in omni-channel capabilities to enhance sales, profitability and cash flows. Additionally, management is developing e-commerce business, Macy’s Backstage off-price business along with expanding Bluemercury and online order fulfillment centers. In the recent past, the company announced the restructuring of its merchandising operations that includes combining of merchandising, planning and private brands divisions into one segment.

These seem inevitable given the challenging retail landscape, aggressive pricing strategy, waning mall traffic and increased online competition that have been weighing on Macy’s performance. The company’s dwindling top and bottom-line results is the reflection of the same.

A look at the company’s performance in fiscal 2016 unveils that net sales declined 7.4%, 3.9%, 4.2% and 4% in the first, second, third and fourth quarters, while earnings per share plunged 28.6%, 15.6%, 69.6% and 3.3% during the respective quarters. During the first and second quarters of fiscal 2017 the scenario was no different, as net sales declined 7.5% and 5.4%, while earnings per share fell 40% and 11.1%, respectively. The company expects comp on an owned plus licensed basis to decline approximately 2.5% in the third quarter.

Analysts polled by Zacks expect third-quarter revenue to be $5,325 million, reflecting a year-over-year decline of 5.4%. However, earnings are projected to improve roughly 12% to 19 cents from the year-ago period.

What Does the Zacks Model Suggest?

Our proven model does not conclusively show that Macy’s is likely to beat earnings estimates this quarter. A stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Macy’s carries a Zacks Rank #3 but has an Earnings ESP of -32.09%, consequently making the surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +1.58% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Home Depot, Inc. (NYSE:HD) has an Earnings ESP of +0.76% and a Zacks Rank #2.

Abercrombie & Fitch Co. (NYSE:ANF) has an Earnings ESP of +6.38% and a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

Original post