Aetna Inc. (NYSE:AET) , scheduled to report fourth-quarter results on Jan 30, is expected to witness a decline in revenues due to lower premiums in its Health Care segment, including lower membership in its ACA compliant individual and small group products, and the temporary suspension of the health insurer fee (HIF) in 2017.

Revenues from Health Care segment is expected to remain under pressure in the fourth quarter owing to the sale of its domestic life insurance group, group disability insurance and absence management business lines; the previously disclosed Medicaid contract termination; exits from individual Commercial products and continued repositioning of its ACA-compliant small group Commercial products. Management has also reduced its 2017 revenue guidance to approximately $60.5 billion from $61 billion earlier.

The Zacks Consensus Estimate for revenues from the Health Care segment for the fourth quarter is $14.5 billion, down 3.7% year over year. Medical Benefit Ratio, a metric used to measure medical costs as a percentage of premium revenues, is expected to increase in the fourth quarter, led by an unfavorable performance of Individual Commercial products.

The company projects an increase in the medical benefit ratio, driven primarily by the suspension of the health insurer fee and experience rating pressure in the company's Group Commercial and Group Medicare Advantage products, partially offset by projected improvement in its Individual Commercial Insured products. The Zacks Consensus Estimate for the same is 85%, up from 82% in the year-ago quarter.

The Zacks Consensus Estimate for total medical membership, one of the key drivers of revenues is 22.18 million, down 4% year over year. We expect medical membership to suffer from declines in the company’s ACA-compliant individual and small group, and Medicaid products. The decrease should be partially offset by increases in its Commercial ASC, International Commercial Insured and Medicare Insured products.

The company's focus on managing costs will keep a check on its operating expenses.

Share repurchases made by the company in the fourth quarter will help to lift its earnings.

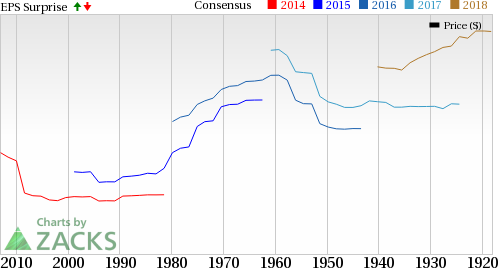

Earnings Surprise History

The company boasts an attractive earnings surprise history. It beat estimates in each of the trailing four quarters, with an average positive surprise of 23.1%. This is depicted in the chart below:

Aetna Inc. Price and EPS Surprise

Why a Likely Positive Surprise?

Our proven model shows that Aetna has the right combination of the two key ingredients to beat estimates this quarter.

Zacks ESP: Aetna has an Earnings ESP of +0.27%, representing the difference between the Most Accurate estimate and the Zacks Consensus Estimate, which indicates a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Aetna carries a Zacks Rank #3 (Hold). Notably, stocks with a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have significantly higher chances of an earnings beat.

Conversely, Sell-rated stocks (#4 or 5) should never be considered going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Other Stocks to Consider

Here are some other companies from the medical sector that you may want to consider as these too have the right combination of elements to beat on earnings this quarter:

Centene Corp. (NYSE:CNC) has an Earnings ESP of +1.24% and a Zacks Rank of 1. The company is set to report earnings on Feb 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

Anthem, Inc. (NYSE:ANTM) is expected to report earnings on Jan 31. It has an Earnings ESP of +1.29% and a Zacks Rank #2.

WellCare Health Plans, Inc. (NYSE:WCG) has an Earnings ESP of +7.49% and a Zacks Rank of 3. The company is set to report fourth-quarter earnings on Feb 6.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Aetna Inc. (AET): Free Stock Analysis Report

WellCare Health Plans, Inc. (WCG): Free Stock Analysis Report

Anthem, Inc. (ANTM): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post