The odds of a US economic contraction in the immediate future remain low, but blowback from the Ukraine war and elevated inflation risk could quickly change the calculus. Data published to date, however, still indicates that the economy will continue to expand for the near term.

New “hard” numbers support last week’s upbeat profile, which featured a survey-based GDP proxy – “soft” data — that reflected stronger growth for March. Specifically, updates of the Philly Fed’s ADS business cycle index and the New York Fed’s Weekly Economic Index point to an ongoing expansion through the middle of this month.

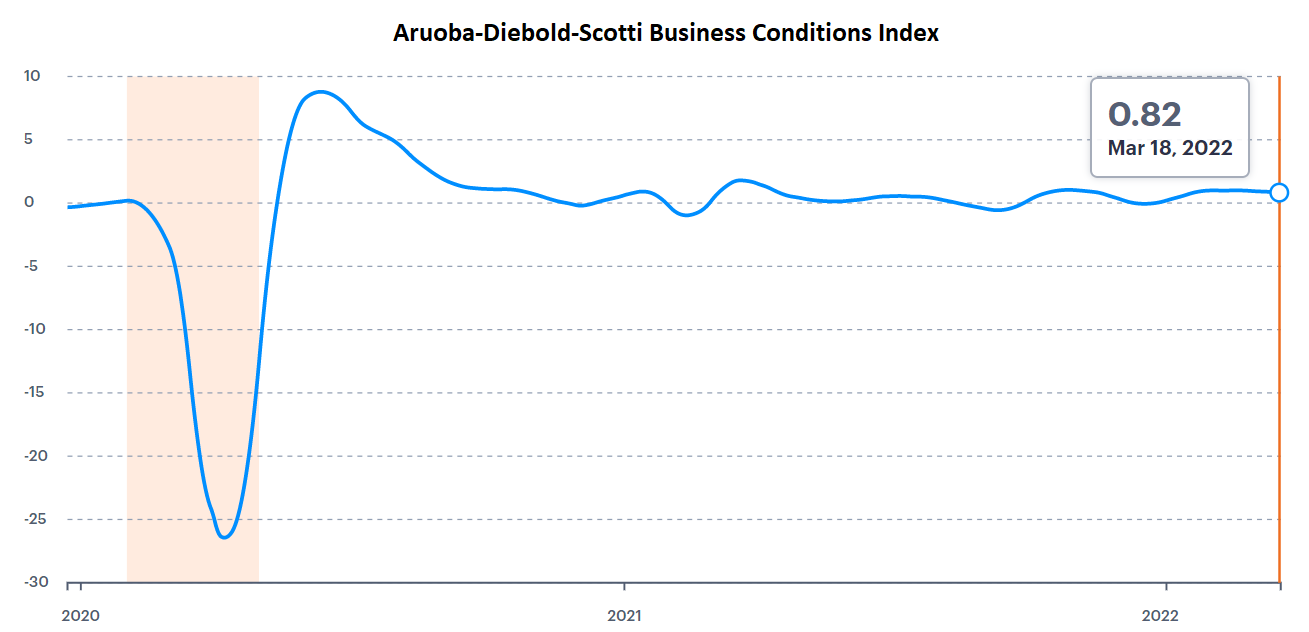

Let’s with the multi-factor ADS data, which indicates moderately better-than-average economic conditions via the current above-zero reading through Mar. 18. Although this index can be noisy in the short term, it’s current print suggests that recession risk is low. A deeply negative reading – below -3.0, according to one estimate – would indicate a contraction, but that tipping point is a distant threat at the moment.

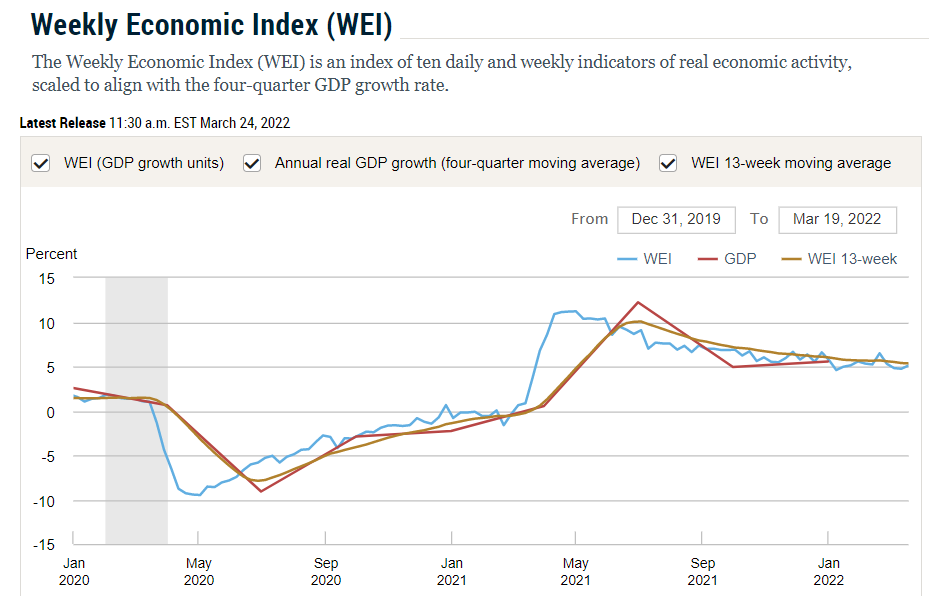

The New York Fed’s Weekly Economic Index, which uses a (mostly) different set of hard numbers, paints a similarly upbeat profile. The current reading (through Mar. 19) suggests that economic output is increasing at a pace in line with recent history. In other words, a moderate expansion remains intact.

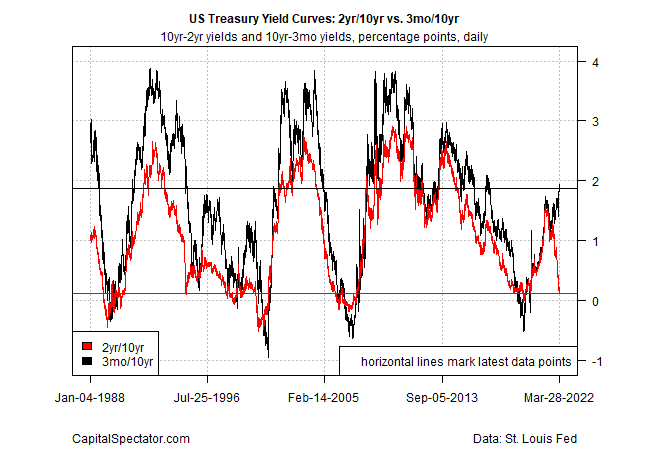

While growth is still conspicuous through mid-March, parts of the Treasury yield curve appear set to invert (short rates above long rates), which would be widely seen as a forecast that a recession is approaching. Notably, the spread for 2- and 10-year rates has been flattening recently and is close to going negative. By contrast, the 3-month/10-year spread is still positive by a relatively wide degree – a conflicting signal that implies the economic outlook remains skewed toward growth.

“Some of the 2-10 shape is down to the fact this is a far more aggressively priced Fed cycle than usual, the notion of how quickly the Fed will move is very front-loaded,” says Timothy Graf, head of EMEA macro strategy, at State Street). “I suspect we will get a growth slowdown but will it lead to recession? It may be next year’s story. Households will want to see the fuel prices coming down but generally household balance sheets are in pretty good shape.”

Incoming data in the weeks ahead could be unusually critical inputs for deciding how or if to change the current low-recession risks analysis. Several updates on tap for this week will draw wide attention, including tomorrow’s estimate (Wed., Mar. 30) of private-sector hiring for March via the ADP Employment Report, followed by the Labor Department’s payrolls update for this month (Friday Apr. 1). On both fronts, economists are expecting another round of solid month gains, based on the consensus forecasts via Econoday.com. If accurate, making the case that a new recession is imminent will need to focus on other indicators.

A key variable that could negatively change the outlook: increasingly hawkish policy tightening by the Federal Reserve as it tries to tamp down elevated inflation risk.

“The Fed is well aware of the tremendous stakes here for sure, but in some ways, these are unknown circumstances,” observes David Wessel, director of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution. “They are aware they may wind up needing to be very aggressive on rate hikes and to do so could be to cause a significant recession.”