- JPMorgan reported blockbuster Q1 earnings

- Can the bank maintain its path and meet expectations in Q2?

- Let's delve into the company's financials, which indicate that looks likely

- InvestingPro Summer Sale is back on: Check out our massive discounts on subscription plans!

JPMorgan (NYSE:JPM) made headlines with its exceptional performance in the first quarter, reporting record-breaking revenue. As the largest bank in the U.S. with $3.74 trillion in assets, the bank achieved revenues of $36.1 billion, showcasing a remarkable year-on-year increase of 23.3%. The primary driver behind this revenue growth was net interest income, which surged by nearly 50% year-on-year, surpassing expectations and setting a new quarterly revenue record.

The bank benefited from the Federal Reserve's decision to raise interest rates as part of its monetary policy tightening, as evident in the latest quarterly figures. JPMorgan disclosed a net profit of $12.6 billion and earnings per share of $4.10 for the first quarter. With these earnings figures significantly surpassing InvestingPro's expectations, attention now turns to JPMorgan's second-quarter financial results, scheduled to be announced on July 14.

The second-quarter data will shed light on how the U.S. banking crisis in March affected JPMorgan's balance sheet. The bankruptcy of regional banks, Silicon Valley Bank and Signature Bank, contributed to the deposit growth of larger banks, particularly benefiting JPMorgan. Despite the crisis initially being seen as a problem for the U.S. economy, JPMorgan experienced an increase in commercial account openings and deposit inflows, reversing the previous quarter's outflow trend.

During this crisis, JPMorgan was further fortified by its strategic acquisition of assets from the bankrupt First Republic Bank at an affordable price. As a result, the bank outperformed its competitors in 2023, driven by advantageous asset purchases and favorable first-quarter results.

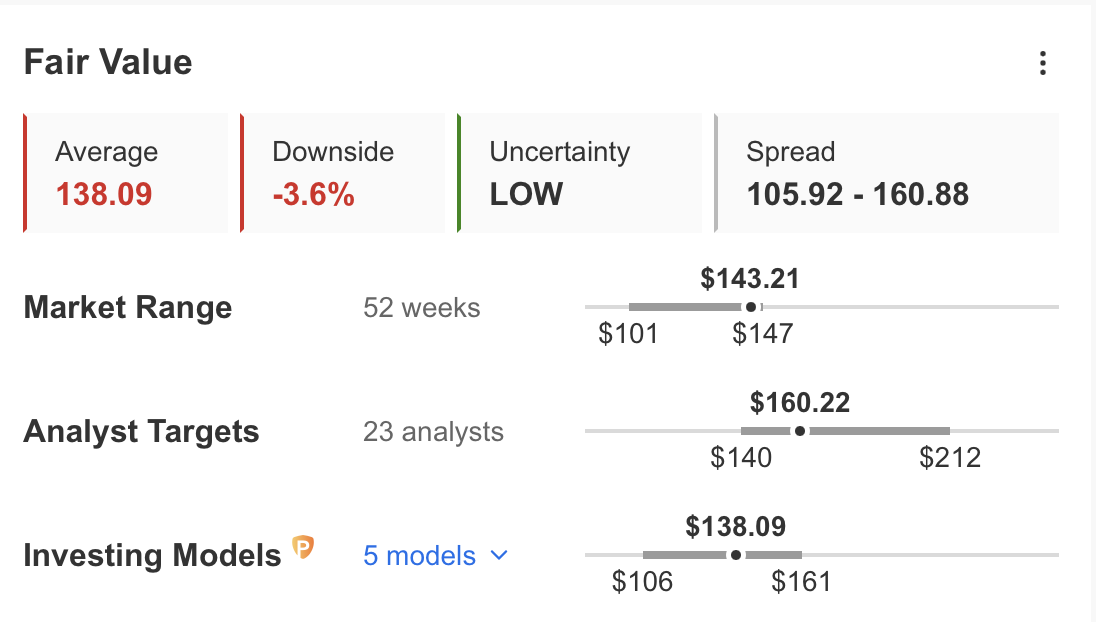

JPMorgan's outstanding performance also translated into its share prices. Despite the turbulence experienced in March, JPMorgan's stock swiftly recovered and maintained its upward trajectory. Presently, JPM stock trades at a premium compared to the banking sector, with a fair value calculated at $138, according to InvestingPro data. However, analysts' opinions diverge, with fair value estimations for JPM stock ranging around $160 based on separate financial models.

Source: InvestingPro

Furthermore, it's worth noting that JPMorgan's stock is currently trading at a high price-to-earnings (P/E) ratio, indicating its significant value. Despite its rapid profit growth in the short term, the elevated F/K ratio suggests that investors perceive the bank's stock as highly valuable.

Source: InvestingPro

One of the positive aspects of JPMorgan is its robust balance sheet, characterized by a high level of liquidity. During the banking crisis in March, the bank demonstrated its resilience by maintaining a substantial portion of its deposits in liquid form, reducing the risk of bankruptcy compared to other financial institutions. This liquidity advantage positions JPMorgan favorably to acquire distressed assets from struggling institutions at attractive prices, as exemplified by its recent acquisition of First Republic Bank.

In addition to its strong balance sheet, JPMorgan stands out from its competitors through its innovative investments. Since 2019, the bank has actively embraced Blockchain technology as a means to reduce costs. Notably, the development of the JPM coin enables efficient fund transfers with international companies at low costs, enhancing fund utilization. The bank also recognizes the potential of artificial intelligence and has established an AI research department in France, aiming to leverage this field effectively in investment consultancy.

However, there are certain risks that JPMorgan may face in the near future, one being the potential continuation of interest rate hikes by the Federal Reserve. While interest rate increases have thus far contributed to higher income from loan products for banks, a sustained rise in interest rates could pose liquidity challenges, which have been regarded as a strength for JPMorgan. Furthermore, as interest rates rise, the valuation of the bank's treasury and bond assets would decrease, resulting in increased unrealized losses.

Another risk factor is the possibility of a recession in the U.S. towards the end of the year. A recession would require banks to allocate more provisions for potential credit risks. In anticipation of such a scenario, JPMorgan has already set aside an additional $1.1 billion in provisions, bringing the total cost of loan loss provisions to $2.3 billion. In the event of a recession, the risk of customer defaults would rise, potentially impacting bank earnings and, consequently, share prices.

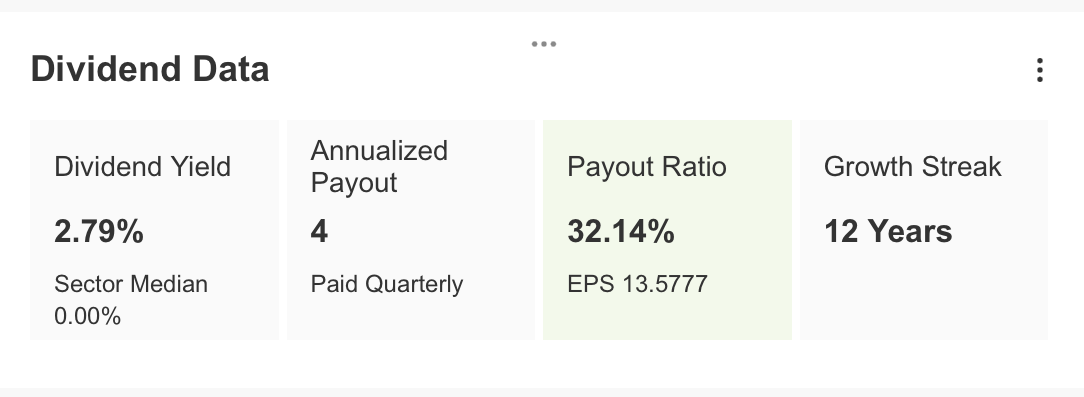

However, it is worth noting that JPMorgan recently passed the Federal Reserve's annual stress test, a significant development for U.S. banks. Successfully passing the stress test allows the bank to proceed with plans to increase quarterly dividends. JPMorgan has announced its intention to raise its dividend payment from $1 per share to $1.05 per share starting in the third quarter.

Source: InvestingPro

Indeed, it is important to note that all 23 banks, including JPMorgan, passed the stress test conducted by the Federal Reserve. This indicates that the U.S. banking sector as a whole has demonstrated resilience and is well-equipped to withstand the impact of a severe global recession.

Source: InvestingPro

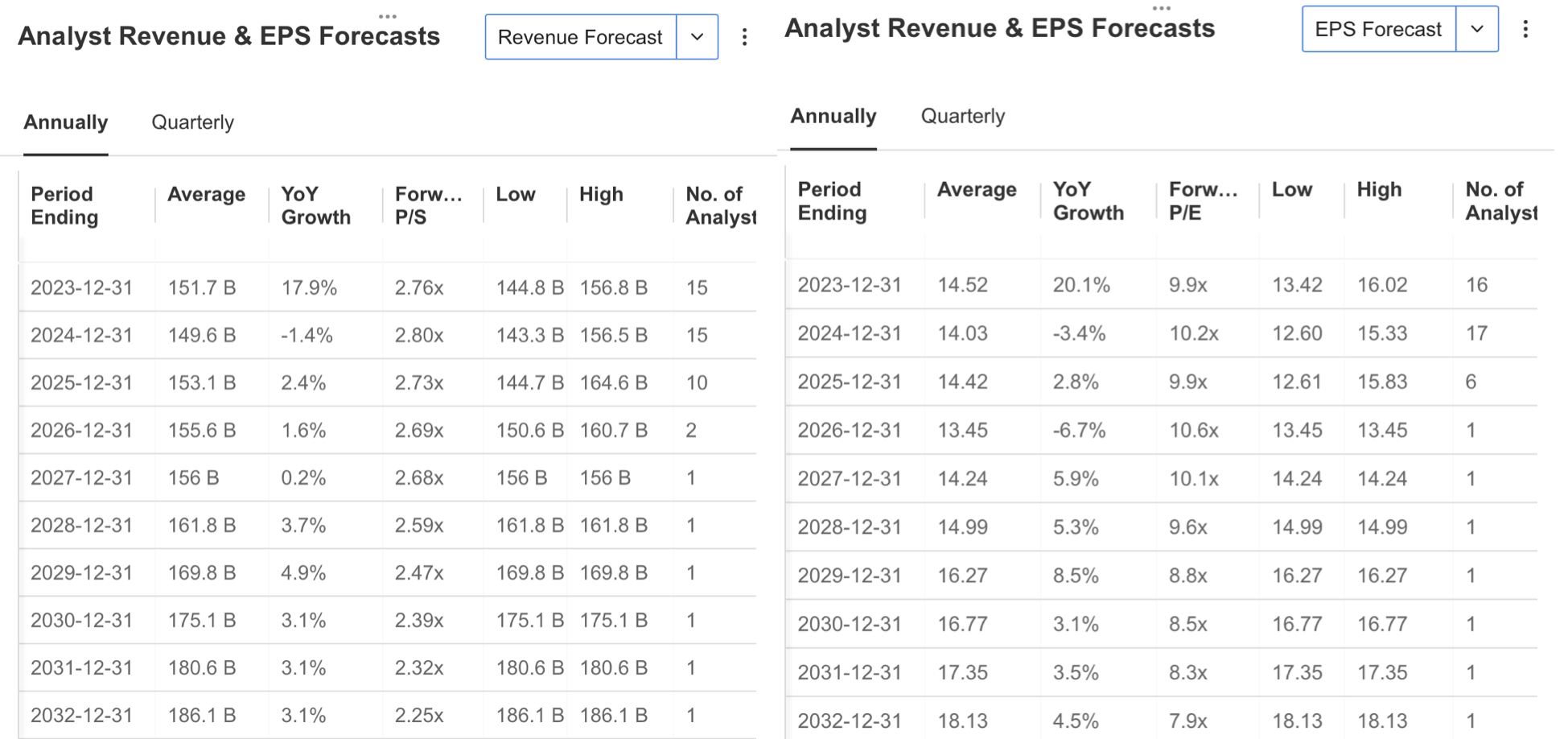

Ahead of JPMorgan's second-quarter financial results, it is noteworthy that 11 analysts have revised their forecasts upward. The expected earnings per share for the second quarter are estimated at $3.75, reflecting a 36% increase compared to the same period last year. Additionally, the revenue forecast for the quarter stands at $38.9 billion, indicating a significant 27% growth compared to the previous year.

Source: InvestingPro

According to the longer-term forecasts available on the InvestingPro platform, JPMorgan is expected to achieve a year-end revenue of $151.7 billion, marking an 18% year-on-year increase. Additionally, the earnings per share forecast for the year-end is projected to reach $14.52, reflecting a 20% year-on-year growth.

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by visiting the link and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article is written for informational purposes only; it is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, advice, counseling or recommendation to invest. We remind you that all assets are considered from different perspectives and are extremely risky, so the investment decision and the associated risk are the investor's own