The are more and more words printed every day on the effects of automation, some even believe in the "tooth fairy", like a British study claiming that automation over the last 15 years created 4 times more jobs than were lost.

Follow up:

If you give me some money, I will produce a study with any conclusion desired. But even if the data and analysis in a study are not biased and accurate - that does not mean you can extrapolate the findings into the future.

I have seen too many contradictions in my career to believe the current form of automation will create as many jobs as it destroys. Now I have read the following from the San Francisco Fed which likely will add to job headwinds:

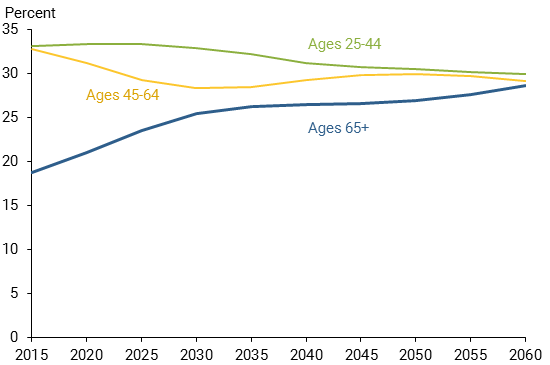

In coming decades, the share of seniors age 65 and older in the U.S. working-age population is projected to rise sharply - from about 19% currently to 29% in the year 2060 - approaching equality with the shares of those aged 25 - 44 and 45 - 64 (Figure 1). With much lower employment among those aged 65 and over, the aging of the population will pose fundamental public policy challenges, as the “dependency ratio" - the ratio of nonworkers to workers - rises sharply and labor force growth slows.

Figure 1

Projection of U.S. working-age population by age group

Source: U.S. Census Bureau (2014).

Policy efforts to boost the labor supply of older Americans have focused on reforms to Social Security, including reducing benefits for those claiming at the early eligibility age of 62, increasing the full retirement age (with additional increases scheduled in the future), and reducing the taxation of earnings after Social Security benefits are claimed - which increases benefit claiming at earlier ages but also increases labor supply post-claim (Martin and Weaver 2005, Figinski and Neumark 2016)......

Stop for a minute and consider the effects on the workforce if people do not retire. Not only does this reduce possibilities for promotion, but the knock-on effect holds down the number of young people joining the workforce - they simply will not be able to find employment.

All economic dynamics are in motion. When a certain point is argued by economists or analysts - all the other issues are assumed to be constant. Yes, automation may have been the friend of the human race in the past, but that does not mean it will be our friend in the future.

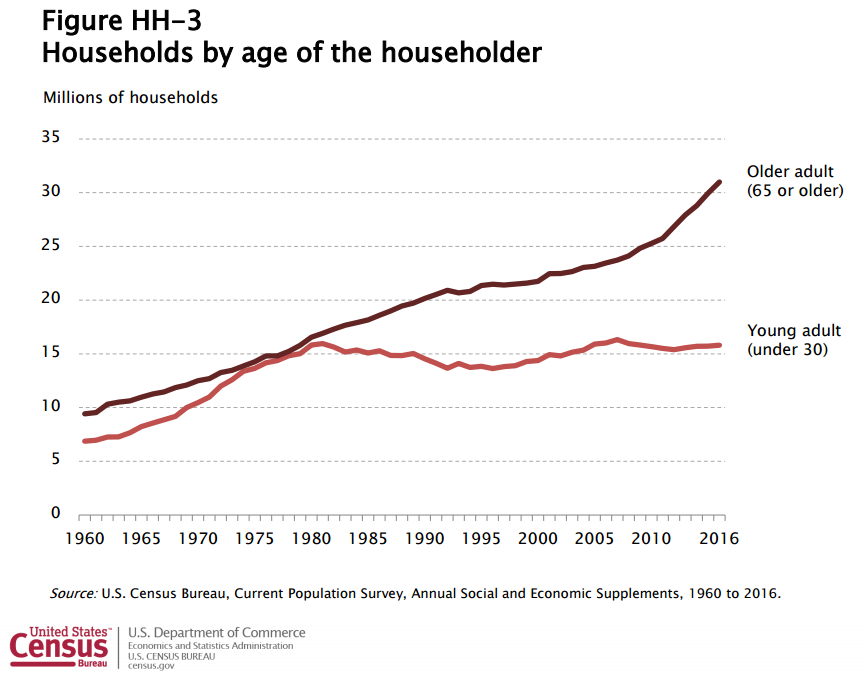

Since 1965, households were growing and were younger. Households are the spending engine of the economy.

Spending money creates jobs. Older households generally replace only things broken, whilst younger households buy items for the first time in addition to replacing broken things.

The USA consumer driven economy is based on having economic dynamics that will not be true in the future. Real median household incomes have again plateaued for the last year, and are little changed this century.

So the consumer end of the economy is faced with headwinds from demographics, stagnating income, and automation. Any single headwind may or may not be that serious. The totality of the headwinds, however, may be creating a stew where the headwinds are much larger than the sum of the parts.

Other Economic News this Week:

The Econintersect Economic Index for March 2017 improvement trend continues although the value remains in the territory of weak growth. The index remains below the median levels seen since the end of the Great Recession. The data continues to suggest better dynamics in the future. Six-month employment growth forecast indicates modest improvement in the rate of growth.

Bankruptcies this Week from bankruptcydata.com: Privately-held Gander Mountain Company, Gordmans Stores, Goodman Networks (f/k/a Multiband), Privately-held Sungevity

Weekly Economic Release Scorecard: