After a relatively stable steel market in China in October and November, the Chinese government’s reforms in the wake of the Third Plenum of the Communist Party could be a wild card.

HSBC’s Chinese manufacturing PMI came in for November at 50.8, down only marginally on October’s 50.9 and, again, not indicative of a trend apart from being steady; but apparently, according to TSI, a separate PMI survey focusing on the steel sector rebounded slightly to 49, up from 47.5 for the same period, indicating continuing slow contraction.

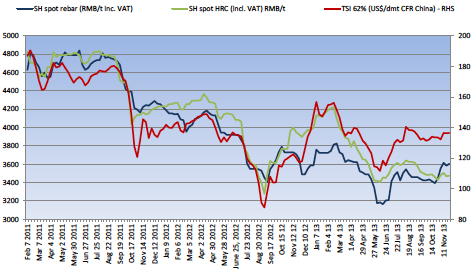

A disconnect has, however, developed this year between finished steel prices and iron ore as this graph from the TSI shows:

What to make of this disconnect?

Prices for finished steel as represented by spot rebar and spot HRC have fallen relative to iron ore as represented by TSI 62% Fines price. Generally the three prices track each other well in terms of direction, but the graph begs the question: will greater availability of iron ore in 2014 encourage iron ore prices to fall and match the finished steel market more closely?

The recent drop in HRC prices relative to rebar may be a reflection of a weakening manufacturing sector compared to a still reasonably robust construction market, but there is only a couple of months of data so it could be too early to tell.

So iron ore has been held up by steel demand, and increased iron ore supply, such as it is, has so far been absorbed by an industry still growing at close to 10% per annum. As new iron ore projects come on stream and if steel demand slows further, an inflection point could arrive next year when prices begin to fall.

Typically Northern Hemisphere summer months see falls in seaborne iron ore prices anyway, but for now, iron ore miners are enjoying a stable market – the first for many years.

by Stuart Burns

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Iron Ore Prices Fall And Match Steel Trends?

Published 12/11/2013, 02:57 AM

Will Iron Ore Prices Fall And Match Steel Trends?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.