Obama's Fed Head current nominee Janet Yellen gets to hang out with the "big boys" later this morning. Does she have the goods to step up to the 'big time' and sit at the head table? Her testimony at this morning's Senate banking confirmation hearing is to be closely followed by all participants in Capital Markets, especially the Q&A portion now that her prepared opening remarks have already been leaked and digested.

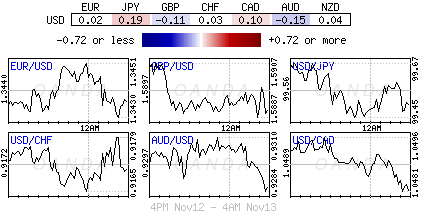

Central Banks rhetoric and action has so far this quarter put the forex market in a chokehold. Will investors get the green light from Yellen on tapering? She will certainly be expected to reaffirm her monetary views and probably reiterate her most recent of messages that "tapering is not tightening."

Ms. Yellen comes forth with all the required credentials – economist, policy maker and a firm negotiator - to successfully become the most powerful of Central Bankers. She currently possesses all the correct attributes to provide for a seamless transition of power from "Helicopter" Ben Bernanke to herself if her nomination is successfully upheld.

She is committed to the current Fed policy approach, as a co-architect of the current phase of the Fed's policy experimentation; she is a strong advocate of continued accommodation. Already her opening remarks, released just after the US close yesterday, were "characteristically dovish," stating that US unemployment remains too high with inflation running below the Fed's +2% target and will continue to do so for some time.

As to be expected, the "mighty" dollar briefly sold off on the leaked statement while US equity futures rallied. Prior to the release, the market had been worried that Ms. Yellen would try to strike a more "moderate tone to generate consensus among the hardline inflation hawks" – that certainly appears to have dissipated when her opening remarks were tabled.

On the back of the unexpected US data last week (GDP growth and employment) had convinced some investors to consider the possibility of a December taper rather than one beginning in March 2014. Is that theory now being put on hold after her dovish comments? The liquidation of the original Yellen inspired long dollar positions are assumed squared in the overnight session.

Now that investors got a peek of her leaked opening remarks, the 'substance' of her monetary views will surely be delivered during today's Senate hearings Q&A's session. Yellen believes the Fed has all the required tools necessary to deliver on its duel mandate even during the era of a dysfunctional Congress. There will be a time to taper and when it does Capital Markets will be looking for that Yellen 'sign post.' Similar with investors, they should probably expect some compensation in the guise of a more "aggressive forward policy guidance."

What to look for? Confirmation that despite, some imperfect tools at the Feds disposable, US policy makers are not yet willing to take their foot off the liquidity pedal. Perception is everything - Bernanke gets to keep his legacy intact and financial markets cannot afford Yellen to stumble just out the gates, global costs and risks are too high for that to occur. Being prudent is the answer – "excessive accommodation over premature tightening" should be winner in today's economic climate.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Investors Get A Green Light From Yellen On Tapering?

Published 11/14/2013, 06:42 AM

Updated 07/09/2023, 06:31 AM

Will Investors Get A Green Light From Yellen On Tapering?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.