Six significant inflation rate figures will keep investors on their toes almost every day of this week, with the most critical data concentrated on Wednesday trading. Bear in mind the expectations for most of the inflation data figures are strongly suggesting that inflationary pressure has already peaked. So, watch out for deviations from these hopeful expectations.

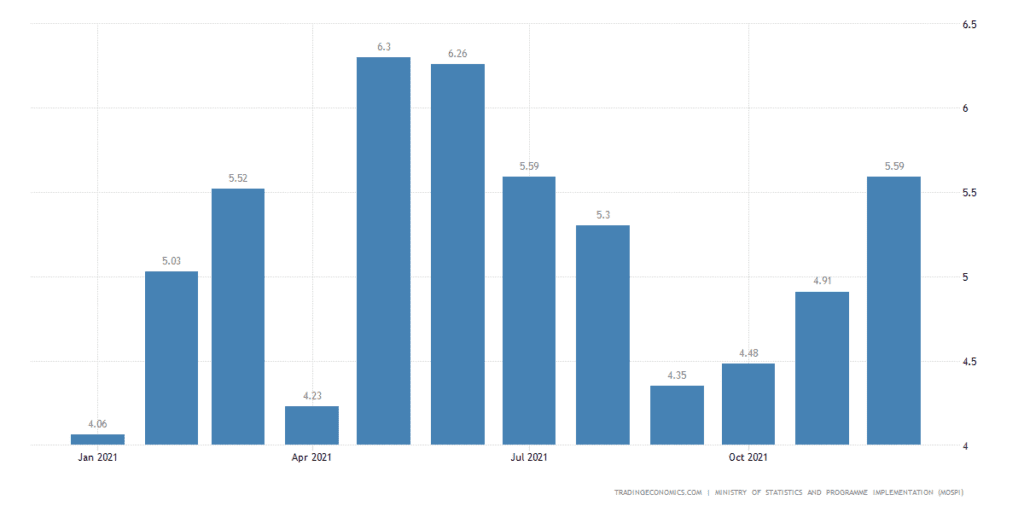

India Inflation Rate

The week opens with India's Inflation Rate YoY to January. The data was released on Tuesday morning, and the market was expecting India's Inflation Rate to rise to 6.0% from the current 5.59%. But it came out to be 6.01%.

The Indian rupee is trading at a 7-week low against the US dollar and a 3 ½- month low against the British pound. The rupee's weakness so far (and possibly to continue after Tuesday's data release) can be explained, in part, by the Reserve Bank of India's less-hawkish stance than the US Federal Reserve and the Bank of England concerning raising interest rates.

India's Inflation Rate hitting 6.0% isn't expected to radically alter the Reserve Bank of India's relatively less-hawkish stance.

China Inflation Rate, UK Inflation Rate, And South Africa Inflation Rate YoY JAN

Expect three inflation rate data releases across Wednesday afternoon that may have the most considerable impact on this week's trading. In order of appearance:

China's Inflation Rate YoY to January is forecast to fall from 1.5% to 1.00%.

The UK's Inflation Rate YoY to January is forecast to remain flat at 5.4%.

The direction that South Africa's Inflation Rate YoY to January is expected to head is contentious. The majority of the market expects the South African Inflation Rate to subdue a fraction of a percentage point from 5.9% to 5.7% or 5.6%. However, TradingEconomics is forecasting a rise to 6.0%.

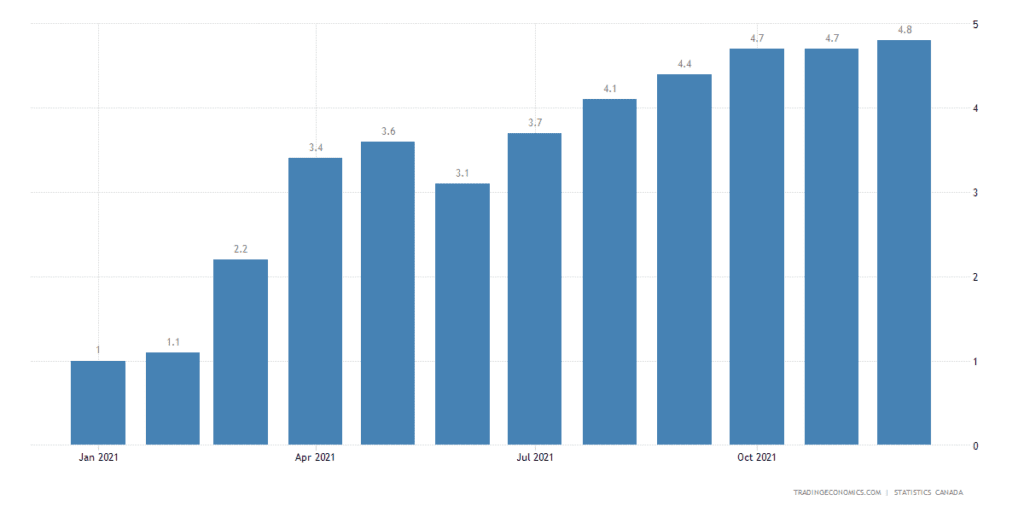

Canada Inflation Rate YoY JAN

Canada's Inflation Rate YoY to January, released very early Thursday morning, is forecast to remain flat at 4.8%.

Thursday’s result may force investors to reconsider their exodus from the CAD last week, as US Inflation hit a 40-year high and expectations for an aggressive US Federal Reserve response heightened.

The same forces could be in play this week but in the opposite direction. The Bank of Canada is on the edge of a more aggressive stance, and hotter than expected inflation could essentially guarantee that it enacts its first post-pandemic interest rate increase on Mar. 2.

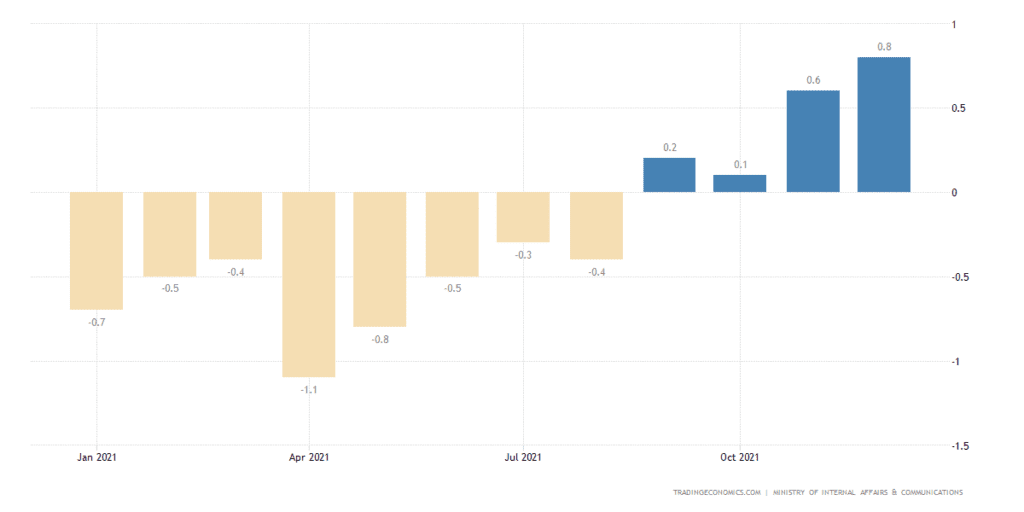

Japan Inflation Rate YoY JAN

Closing out the week is Japan's Inflation Rate YoY to January, released mid-day Friday. The market consensus is a mild increase to 0.9% from the current Inflation Rate of 0.8%.

As Japanese companies are extremely slow to hike prices, Japan's peak inflation may lag other nations and continue to rise above 0.9% in the ensuing months.

For one, the Bank of Japan is expecting inflation to hit 1.1% YoY to April, but still well under the Banks target annual inflation of 2.0%. Consequently, the Bank of Japan is expected to maintain its ultra-loose monetary policy and its -0.1% short-term benchmark interest rate for the foreseeable future.

As such, it might be a shock for the JPY to improve its position from its 5-year low against the US Dollar.