A month ago it was reasonable to wonder if the worst was over for fixed-income securities writ large. Four weeks later, Treasury prices are slightly higher, but the debate continues as investors consider how the Federal Reserve will adjust monetary policy, or not, in the weeks and months ahead.

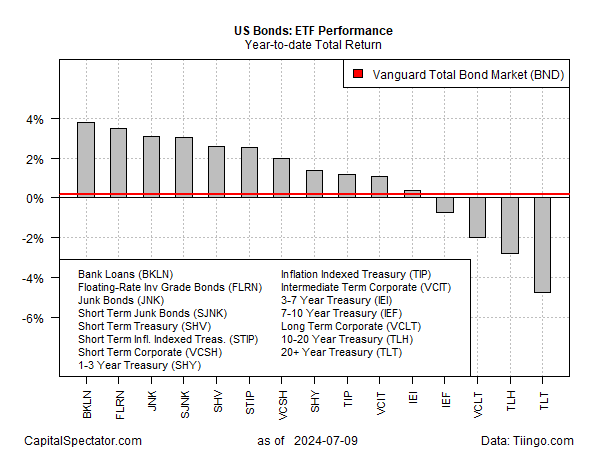

Meantime, most bonds sectors continue to post modest gains for the year to date, based on a set of ETFs. Not much has changed from early June, but it’s significant that the market hasn’t sold off. Long-term bonds are still under water for 2024, but the crowd continues to sniff out moderate odds that the central bank will soon start cutting interest rates, which is providing support for this year’s rally in several corners of fixed income.

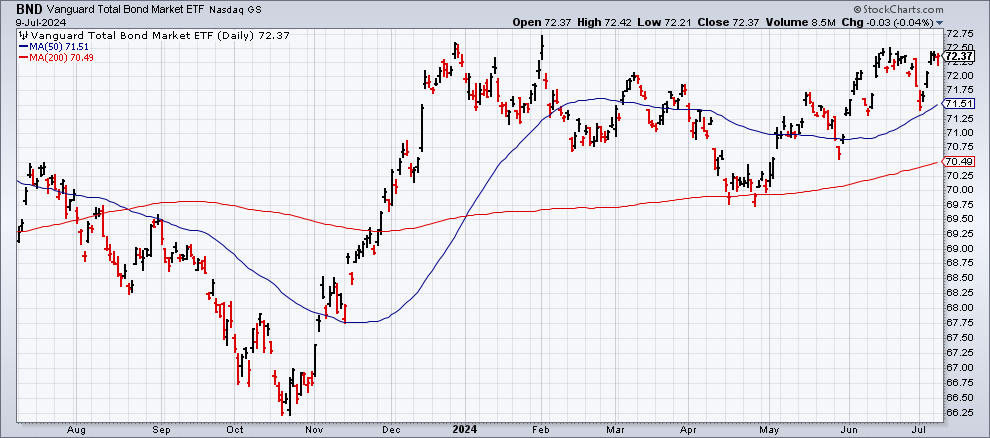

The US investment-grade benchmark for bonds (BND) is up a modest 0.2% this year. That’s a trivial gain, but it marks a sharp improvement from late-April, when the fund was, at one point, in the hole by 4.5% for 2024.

The key factor for bonds in the near term: incoming inflation data and expectations for Fed policy. On the inflation front, tomorrow’s consumer price data for June (July 11) is expected to post mixed results for the year-over-year comparisons. Headline CPI is projected to ease to 3.1% from 3.3% in May, based on Econoday.com’s consensus point forecast. Core CPI, by contrast, is expected to tick up to 3.5% from 3.4%.

Markets will be keenly focused on how the new CPI report influences expectations for Fed policy. At the moment, Fed funds futures are pricing in a 95% probability for no change in rates at the next FOMC meeting (July 31) and a moderate probability (75%) for a rate cut at the Sep. 18 meeting.

In comments yesterday on Capital Hill, Fed Chairman Jerome Powell offered a hint that a dovish policy shift may be near.

“In light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face,” he advised in prepared remarks. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

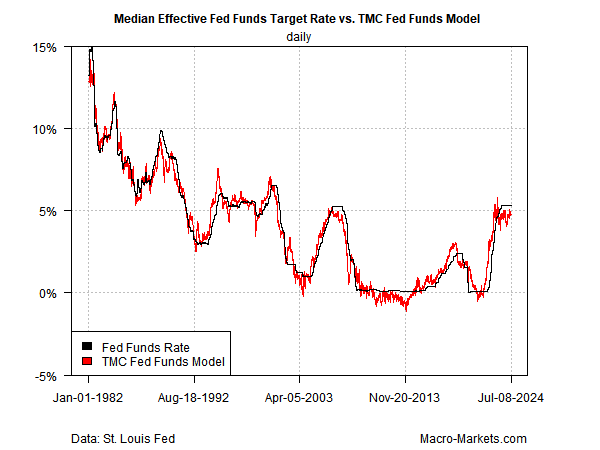

As CapitalSpectator.com reported yesterday, there are signs that the US economic activity is weakening. Meanwhile, an update of a Fed funds model I developed for TMC Research suggests the Federal Reserve’s target rate should be cut.

Adding to the pressure for a rate cut is a revised nowcast for the upcoming second-quarter GDP report. The Atlanta Fed’s GDPNow model currently estimates output will rise 1.6% increase (as of July 3) in the April-through-June period, marginally above Q1’s sluggish 1.4% advance.

The economic profile favors a cut, but there’s a more pressing question lurking: Will tomorrow’s CPI data continue to give the Fed room to ease policy?