Caterpillar Inc. (NYSE:CAT) is slated to report fourth-quarter 2017 results on Jan 25 before the opening bell. Notably, the company has outpaced earnings and revenue estimates in all the three quarters of 2017. After suffering a 36% drop in earnings in fiscal 2016 due to weak end-user demand in most of the industries it serves, Caterpillar has delivered continuous improvement over the course of 2017. This turnaround can be attributed to a continued improvement in the construction sector, pickup in Resource Industries as well as its disciplined cost-control efforts. Consequently, investors are keen to know whether Caterpillar will deliver fourth consecutive quarter of both top and bottom-line growth in the to-be-reported quarter.

iRobot Corporation (IRBT): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Donaldson Company, Inc. (DCI): Free Stock Analysis Report

Original post

Zacks Investment Research

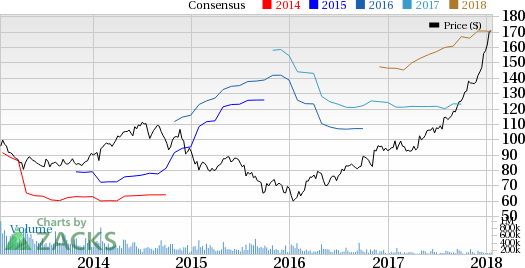

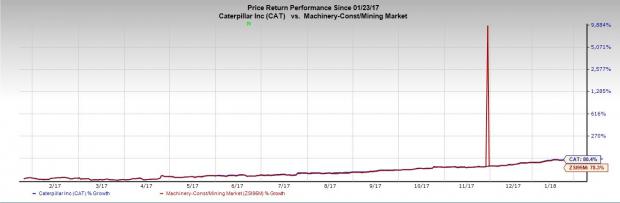

Given impressive results, Caterpillar’s share price has outperformed the industry in the past year. The shares gained 80.4%, ahead of the industry’s growth of 78.3%. An earnings beat will help the company sustain the price momentum.

Looking at the upbeat estimates for the both earnings and revenues for the fourth quarter, it seems likely that the company will deliver improved year-over-year earnings on both metrics. This is also supported by strong fourth-quarter projections for its segments — Machinery, Energy & Transportation which garners a major chunk of revenues and earnings. Notably, performance will be driven by both the Construction and Resource Industries segments.

Let’s delve deeper and take a look at factors that might influence the fourth-quarter results.

Segments Poised to Deliver Top-Line Growth

Per the Zacks Consensus Estimate, the Machinery, Energy & Transportation segment, which contributed approximately 94% of total revenues in third-quarter 2017, is expected to log year-over-year growth of 26% to $11.2 billion in the fourth quarter. We believe the company will witness growth in all its segments — Construction Industries, Resource Industries, Energy & Transportation.

The Zacks Consensus Estimate for total sales of $12.01 billion for the fourth quarter indicates 25.5% growth from the prior-year quarter.

In September 2015, Caterpillar set upon significant restructuring and cost reduction initiative, with actions expected through 2018. Once fully implemented, the plan would lower annual operating costs by about $1.5 billion. In fourth-quarter 2017, revenue growth along with cost reduction will lead to an improved bottom-line as well. The Zacks Consensus Estimate for Profit before Taxes for the Machinery, Energy & Transportation segment is pegged at $1.2 billion, a reversal from its year ago loss of $1.5 billion.

This will be driven by an impressive 164% rise in the Construction segment’s operating profit. Further, the Resource Industries segment will report an operating profit of $194 million in contrast to the operating loss of $711 million reported in fourth-quarter 2016. The Energy & Transportation segment is expected to report operating profit of $842 million, a 32% rise from the prior-year quarter.

Further, the Zacks Consensus Estimate for earnings of $1.77 for the fourth quarter reflects an improvement of 113.3% on a year-over-year basis.

Here is what our quantitative model predicts:

Caterpillar has the right combination of two main ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — which shows that it is likely to beat earnings in the to-be-reported quarter.

Zacks ESP: The Earnings ESP for Caterpillar is +6.22%. This is because the Most Accurate estimate of $1.88 is above the Zacks Consensus Estimate of $1.77. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Caterpillar carries a Zacks Rank #2 (Buy), which combined with a positive ESP makes us reasonably confident of a positive earnings surprise.

Other Stocks Worth a Look

Here are a few industrial products stocks worth considering as they have the right combination of elements to post an earnings beat this quarter.

Deere & Company (NYSE:DE) has an Earnings ESP of +2.65% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Deere’s shares have surged 59% in the past year.

The Earnings ESP for Donaldson Company, Inc. (NYSE:DCI) is +9.09%. It carries a Zacks Rank #2. Shares of Donaldson Company have gone up 25% in a year’s time.

iRobot Corporation (NASDAQ:IRBT) has an Earnings ESP of +20.00% and a Zacks Rank #2. Its shares have gone up 49% in a year’s time.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

iRobot Corporation (IRBT): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Donaldson Company, Inc. (DCI): Free Stock Analysis Report

Original post

Zacks Investment Research