iRobot Corporation (NASDAQ:IRBT) is scheduled to report second-quarter 2017 results after the market closes on Jul 25.

Over the trailing four quarters, the company recorded a positive average earnings surprise of 61.72%.

Let’s see how things are shaping up prior to this announcement.

Existing Scenario

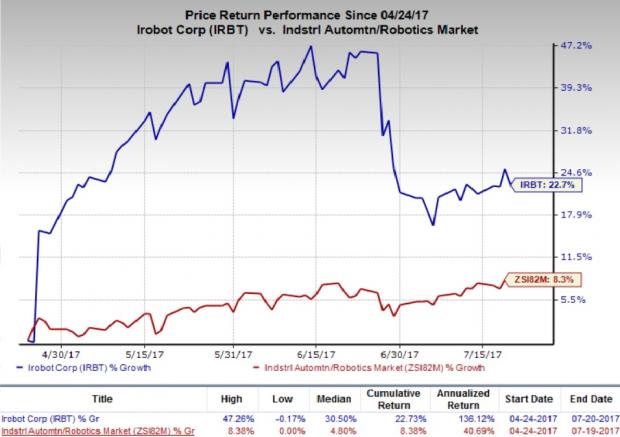

Over the last three months, iRobot’s shares yielded a return of 22.73%, outperforming 8.38% growth recorded by the industry.

Increased market penetration of popular home robotic products (like Roomba 900) will likely bolster iRobot’s revenues across all major end-markets located in China, Japan and Europe, the Middle East and Africa (EMEA) region. Moreover, sturdy market response of wi-fi enabled Roomba 690 and Roomba 890 robots (launched in May 2, 2017) is anticipated to boost sales in the to-be-reported quarter.

In addition, the company believes that the capital allocation program which is aimed at enhancing its competency in the field of robotic vacuum cleaning market, tap demand of Chinese robotic floor care market, reinforce the existing business infrastructure, innovate non-floor care home robotic products and lower operational costs will likely drive iRobot’s top- and bottom-line growth in the quarter to be reported.

However, we expect that the benefits generated by the aforementioned growth drivers might be offset by certain headwinds within the market. For instance, almost all the contract manufacturers of iRobot’s home robotic products belong to China. These producers provide basic raw inputs, labor resources and several other types of facilities to iRobot. If these dealers suddenly terminate their contract with the company or fail to offer good quality products on time, iRobot would fail to deliver innovative home robotics products in the market.

Furthermore, a stronger U.S. dollar, sudden input price inflation or extensive industry rivalry might dent the company’s revenues and profitability in the second quarter.

Earnings Whispers

Our proven model does not conclusively show that iRobot will beat on earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. That is not the case here as we will see below.

Zacks ESP: iRobot currently has an Earnings ESP of 0.00%. This is because both the Zacks Consensus Estimate and the Most Accurate estimate are both pegged at loss of 25 cents.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: iRobot carries a favorable Zacks Rank #3. However, a 0.00% ESP makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

It should be noted that we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are a few stocks that you may want to consider, as our model shows that they have the right combination of elements to report a positive surprise this quarter:

AGCO Corporation (NYSE:AGCO) , with an Earnings ESP of +1.92% and a Zacks Rank #1.

AptarGroup, Inc. (NYSE:ATR) , with an Earnings ESP of +1.03% and a Zacks Rank #2.

Avery Dennison Corporation (NYSE:AVY) , with an Earnings ESP of +1.68% and a Zacks Rank #2.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

AptarGroup, Inc. (ATR): Free Stock Analysis Report

iRobot Corporation (IRBT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Original post

Zacks Investment Research