The summer has been a dizzying one for commodities. The last four weeks have witnessed the price of corn soaring toward an all-time high due to withering heat in the Corn Belt states. At the same time, this weather-driven bull market in the grain market, as well as the recent oil price rally, has left investors wondering if this summer might finally be gold’s time to shine.

In the same period that the CRB Commodity Index has rallied off a 52-week low, the price of gold hasn’t made much headway at all. Gold remains stuck in neutral as both professional and retail traders have shown little inclination to bid up prices. The high frequency speculative crowd had its wings clipped last summer when CME Group initiated a series of margin requirement increases. Since then the momentum crowd has been conspicuously absent from the gold arena.

Small retail investors have also been missing in recent months. Gold purchases have fallen to levels not seen since before the 2008 financial crisis according to figures released by the world’s major mints. According to the U.S. Mint, second quarter sales of American Eagle gold coins fell more than 50 percent from the year-ago period to 127,500 ounces. This was the worst three months since the second quarter of 2008, just prior to the worst part of the global credit crisis.

Gold coin purchases are viewed as a fear gauge, and the decline in buying interest this year can partly be attributed to the run-up in equity prices since last October. It’s mostly a spillover consequence to the lack of a speculative interest in gold since last summer’s margin hikes. Indeed, the loss of the highly leveraged trading element in gold has taken a mighty toll on investor psychology which cannot be underestimated.

Shedding some light on the situation, bullion coin dealer Roy Friedman was quoted by Reuters as stating:

Many investors who have been in the market are taking a break right now, looking for other investment opportunities, waiting for a lower level to get back in, or waiting for some type of economic or political market event.

Friedman’s assessment of the current investor psychology in the gold market covers the three main explanations behind gold’s lagging performance. His first reason, namely that investors are looking for other opportunities, has already been addressed here. This only explains gold’s relative weakness in part, however, since gold was able to rally for many years along with stocks and other commodities without giving ground to its competition. Only since last summer has gold’s performance faltered relative to stocks.

Now what about Friedman’s second explanation, viz. that investors are waiting for a lower level before buying back in? Of the three explanations he provides, this one makes the least amount of sense. It is an established principle of investor behavior that most retail investors – and this includes most hedge fund traders – are only drawn to a market already in the process of moving higher. The savvy investors who buy at bottoms are in the extreme minority. Most participants require rising prices to attract their interest.

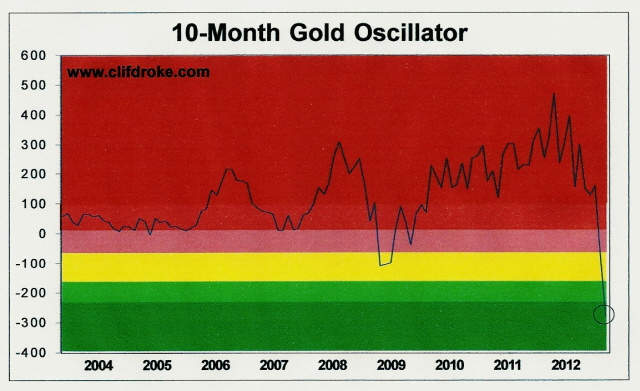

Indeed, gold is already technically “oversold” on a longer-term basis as we’ve discussed in recent commentaries. The 10-month price oscillator for gold has registered its most sold out reading for gold in 10 years (see chart below). While this is an important consideration for serious longer-term investors, it hasn’t done anything to attract the “hot money” crowd.

It’s evident that of the three factors listed by Friedman, the last one – that investors are “waiting for some type of economic or political market event” – is closest to the truth of the matter. Whether that market event is catalyzed by yet another crisis in Europe or the announcement of a major monetary stimulus program by the U.S. or European central bank is immaterial. The market (and by market I mean the typical retail investor and momentum trader) is waiting for gold to respond to an extra-market headline event. And it’s doubtful that gold will be shaken out of its torpor until this event occurs.

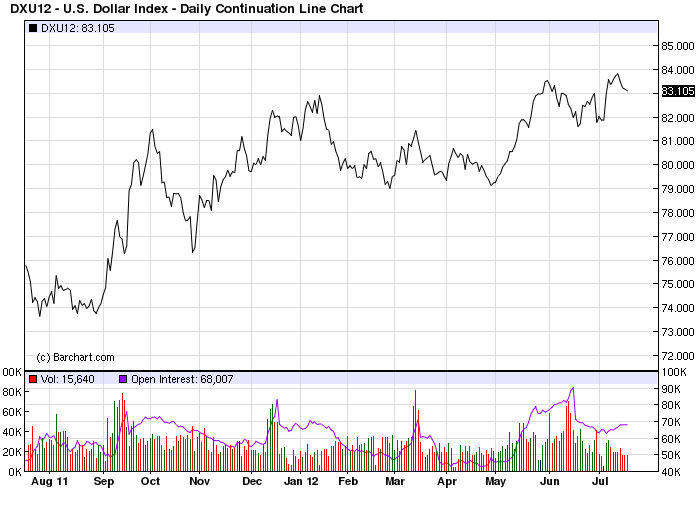

There are two major components of the gold price. The first one is monetary, the second is emotional. Both have served as powerful catalysts to a gold rally in the recent past. The monetary component is obvious to most observers in that a sizable increase in monetary liquidity tends to increase the gold price. The emotional component is mainly driven by fear – whether fear of a dollar collapse or some other market-related or political fear. Right now the fear element is muted since investors are too busy chasing high-yielding stocks to worry about impending economic collapse. The dollar has actually strengthened in the past year (see chart below), which gives investors even less reason to pile into gold. Until investors are given a serious reason for concern, they are likely to continue ignoring gold.

Gold’s best opportunity for a turnaround might not occur until later this year after the vaunted 4-year “presidential cycle” peaks. You’ll recall the last time gold launched a new bull market from a major decline was after the previous 4-year cycle peak in late 2008. After this year’s cycle peak in October, and especially after the U.S. presidential election, the economic “hat tricks” that have kept the U.S. economy buoyant this year will likely come to an end.

With the election behind, there will be no further need for artificial stimulants to keep things looking good on the surface. The period following the 4-year cycle peak and the entry of the final “hard down” phase of the Kress long-term yearly cycles in 2013-2014 should represent the ideal time for gold to regain its luster.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Will Gold’s Luster Be Restored This Summer?

Published 07/19/2012, 07:24 AM

Updated 07/09/2023, 06:31 AM

Will Gold’s Luster Be Restored This Summer?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.