There is no doubt gold started the year on the right foot. Gold prices have increased by 11 percent since the start of the year. But, will we see higher gold prices through the rest of 2014?

Gold is the only commodity where physical annual demand is only a tiny fraction of total supply available. This is not true for the rest of commodities, like industrial metals, where supply and demand are more balanced and actual shortages can develop. On the other hand, shortages of gold caused by physical demand never happen.

For these reasons, the price of gold is almost entirely dependent on psychology and the factors that drive psychology, such as inflation and the dollar. Despite all that, we still see analysts writing lengthy reports regarding such things as jewelry usage and annual gold production.

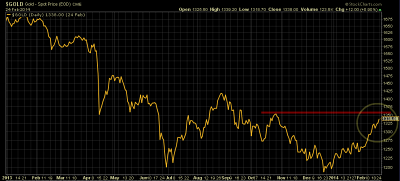

Gold spot price on the CME since 2013. Created using stockcharts.com

Like the rest of commodities, gold peaked in 2011, as the dollar pushed commodity prices down. Since then, gold prices have been weakening.

The recent increase in gold prices still needs to prove real strength. We would like to see if gold is able to keep going higher in the coming months, as it is about to meet resistance at $1,375 per ounce.

What This Means For Metal Buyers

Despite the recent increase in gold prices, gold remains in a falling market. Gold prices rising above $1,375 per ounce will be a bullish signal that buyers might want to consider.