Once again, analysts have to step up to the plate to make sense of an inane selloff in gold, when the yellow metal’s prices should be exploding after the abysmal US jobs report for August.

In the place of a boom, there’s a bust—not something unusual for gold, since it hit highs above $2,000 an ounce the first time ever some 13 months ago.

Tuesday’s weakness could be a “classic ‘give back’ of an overdone reaction,” analysts at Zaner said, referring to the $35, or 2%, drop, marking the sharpest one-day slide in a month for the most-active gold futures contract on New York’s COMEX, that also led to the lowest settlement since Aug. 26.

I would argue that it was selling that was overdone, considering that Friday’s rally on COMEX—the so-called trigger to the dump—was highly restrained, netting a gain of just $22, or 1.2%, for the most-active December contract.

Ross J. Burland, who blogs on gold at FXStreet, had a better description, saying “gold bulls have been denied a free lunch from weaker US data and instead are looking into the abyss once again.”

In Wednesday’s noon trade in Singapore, some eight hours ahead of the New York session, December gold hovered at $1,798.80, virtually flat from the previous day’s close, after spiking to $1,802.70 earlier in what appeared to be some makeup from Tuesday’s excessive downside.

Gold’s malaise came on the back of the dollar’s rebound as the greenback also put in a recovery after a six-day battering that climaxed with Friday’s US jobs report that came in almost 70% below target.

Rightly, gold should have retained its mojo from last week but yielded instead to the dollar, said Sunil Kumar Dixit of SK Charting in Kolkata, India.

“Gold’s path from here will depend on how DX acts,” Dixit said, using the trading symbol for the Dollar Index, which pits the greenback against six other forex majors.

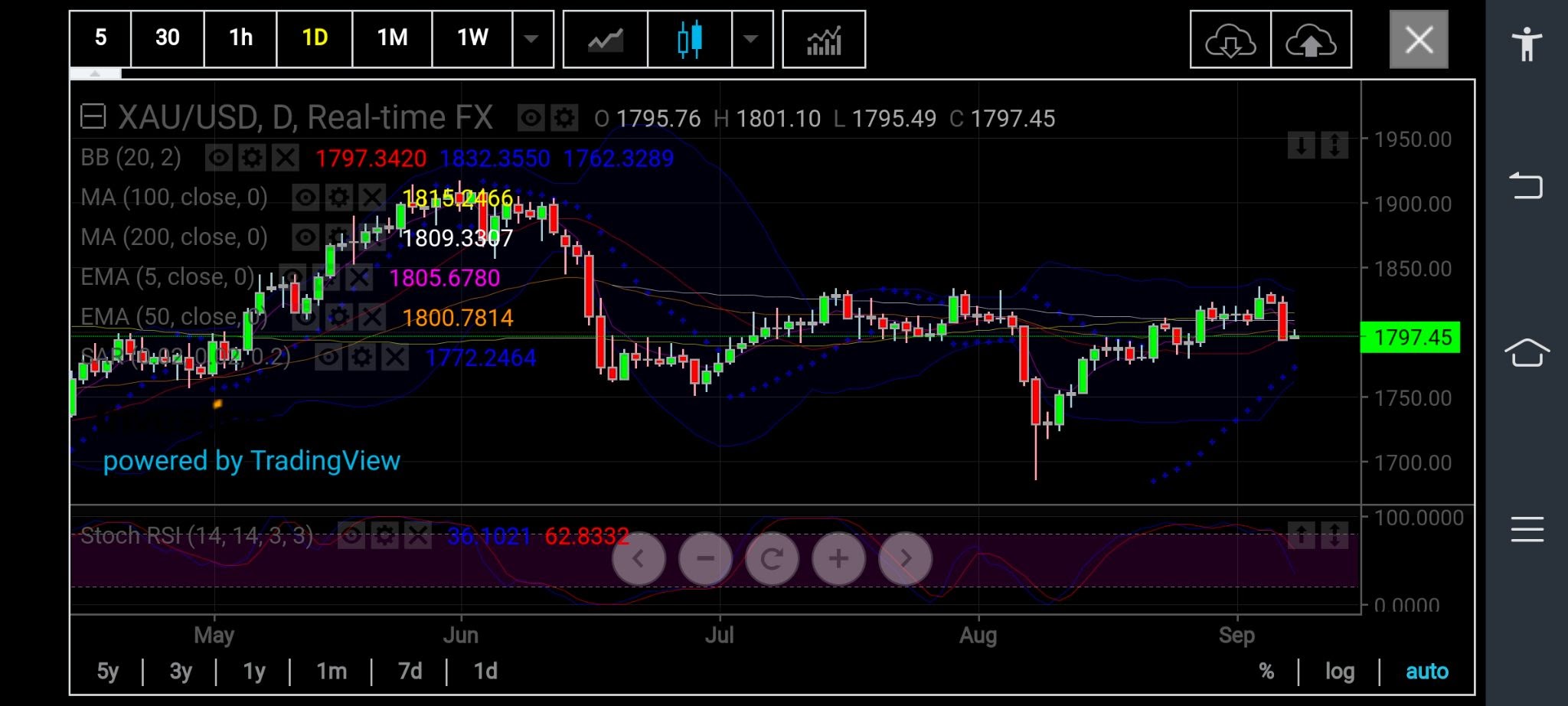

“Gold is currently trapped between $1,797 and $1,803. This six dollar range will decide how gold will perform next. If it continues going below $1797, it will likely be headed for $1,770. If it can sustain above $1,797 and break beyond $1,803, it can again climb to $1,825.”

Dixit said the price action of the last three months has established a strong wall of resistance at $1,835.

Thus, Tuesday’s crash to $1,792 in spot gold, before its daily close at $1,794 came below critical support at $1,797 which coincides with the middle Bollinger Band in the Daily Chart.

The 50-EMA, or Exponential Moving Average on the weekly chart and the 50% Fibonacci level of retracement measured from the $1,678 low of March 2021 to $1,916 high of May 2021, makes a case for extended corrections to $1,768 based on the 61.8% Fibonacci level.

It could go even lower to $1,750 on the horizontal static support area, Dixit said, adding:

“This has all the suppliers positioned at elevated levels ready and equipped to hammer the bulls down to the $1,750 and $1,670 areas, to refill the tanks and wait for the prey again as the climb uphill resumes.”

In the event gold sustains above $1,797, its next test would be the 5-week EMA of $1,803 and the 5-Day EMA of $1,805 before it reclaims the 100-Day SMA of $1,815 which would mark an acceleration point for the 38.2% Fibonacci level of $1,825.

“Main trend changes and a decisive close above the $,1835 obstacle will open the gates for a 23.6% Fibonacci level of $1,860 and critical top of $1,920,” Dixit said.

Burland, the gold blogger on FXStreet, concurred:

“From a technical perspective, gold price is clinging onto the 21-DMA (Daily Moving Average) support, having breached the 200-DMA at $1,810. A daily closing below the 21-DMA is likely to open floors towards the mid-August lows around $1,775.”

“Meanwhile, a lack of relevant US macro news will leave gold prices at the hands of the risk trends and dollar dynamics.”

Michael Armbruster, managing partner at Altavest, said if the Federal Reserve’s Beige Book report on Wednesday was to suggest a cooling of the US economy, then that could be bullish for gold.

“We still like buying gold on dips below $1,800,” he said.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.