Global trade growth has been deteriorating steadily since the financial crisis in 2008 and fell to a new low in 2016. However, recent data suggest that the persistent downward trend in global trade growth may have begun to reverse towards the end of 2016 and during early 2017. We expect global trade to recover in 2017 as the factors that drove the slowdown have gone into reverse, although some risks remain.

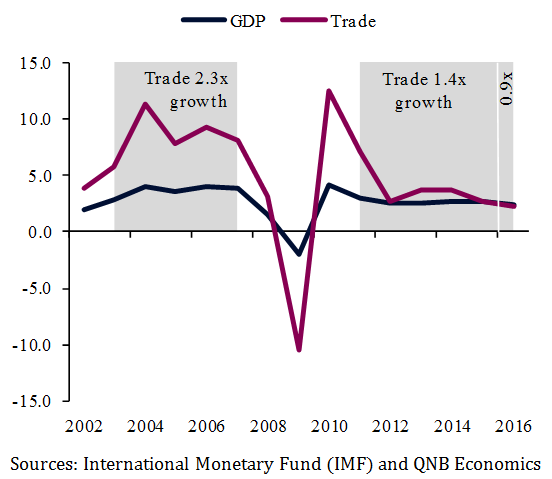

Global trade and GDP growth (% annual change)

Sources: International Monetary Fund (IMF) and QNB Economics

Global trade has been declining, even when compared to global GDP growth. Before the financial crisis, in 2003-07, global trade grew at more than twice the rate of global GDP, but this fell to 1.4 times global GDP in 2011-15 and to just 0.9 times in 2016. Real growth of global trade in goods and services has fallen from an average of 8.5% per year in the five years prior to the financial crisis to 4.0% since the financial crisis, during 2011-15. Furthermore, in 2016, it reached its lowest point since 2009 with growth of just 2.2%.

The slowdown in global trade growth is partly a function of slower global GDP growth, which has moved in a similar direction. However, a rising tide of protectionism has also dragged on growth in global trade. Since the financial crisis, almost 6,000 new trade discriminatory measures have been implemented by G20 countries.

More recently, in 2016, there were two main reasons for global trade performing particularly badly compared to global GDP growth. First, investment was weak in 2016. New research has shown that investment involves a higher proportion of trade than other components of GDP, mainly consumption. Sluggish investment in 2016 has, therefore, weakened global trade more than global GDP. A contraction in private investment in the US and the ongoing shift from investment to consumption in China were significant drags on global trade in 2016.

Second, low oil prices in 2016 had a negative impact on trade. This was partly related to the first factor as low oil prices led to low investment in the energy sector. But, additionally, lower oil prices reduced incomes in oil exporters, leading to lower consumption-related imports. Meanwhile, the expected corollary of this—higher consumption-related imports in oil importing countries—did not materialise.

The outlook for global trade in 2017 is significantly brighter as the factors that dragged on global trade in 2016 have reversed. The global economic outlook has improved as growth has picked up momentum since late 2016 leading to an increase in consensus forecasts for 2017. Investment recovered in the US towards the end of 2016 and during early 2017 and, in China,towards the end of 2016, the shift to consumption slowed as the authorities used investment to stimulate the economy. Finally, oil prices have recovered and we expect them to be 23% higher in 2017 than they were in 2016.

Indeed, the latest data point to an improvement in global trade. Trade in goods and services rose 11.6% year on year in January in value terms, according to the IMF, compared with an average contraction of 3% in 2016. This is unlikely to be totally due to oil price movements as trade in goods volumes was up 3.5% year on year in the first two months of 2017 compared with an average of 1.3% in 2016, according to the Netherlands Bureau for Economic Policy Analysis. Container throughput at ports reached all-time record levels in early 2017 and a survey-based purchasing managers’ index (PMI) of expected export orders reached its highest level since the financial crisis in April this year.

Nonetheless, a number of risks could still upset the recovery in global trade. If the upturn in world GDP turns out to be short-lived, global trade would also suffer. Rising protectionism could also hurt global trade. Two major developments could accelerate the rise of protectionism. First, President Trump’s “America First” policies have already prompted the G20 to drop its anti-protectionism commitment in its March communiqué and could lead to further protectionist measures.Second, potential failure of the Brexit negotiations could damage trade in Europe. However, global trade is likely to be resilient against protectionist efforts due to the interconnectedness of global supply chains, widespread membership of the WTO, which provides legal support to trade, and the existence of large regional trade agreements.

Global trade has undergone an extended slump since the financial crisis, even larger than the downturn in world GDP growth, and reaching a low in 2016. However, the trend now looks likely to be reversed in 2017. This should reinforce the recovery in the global economy as trade aids the spread of technology and wealth and allows individual economies to focus on what they do best.