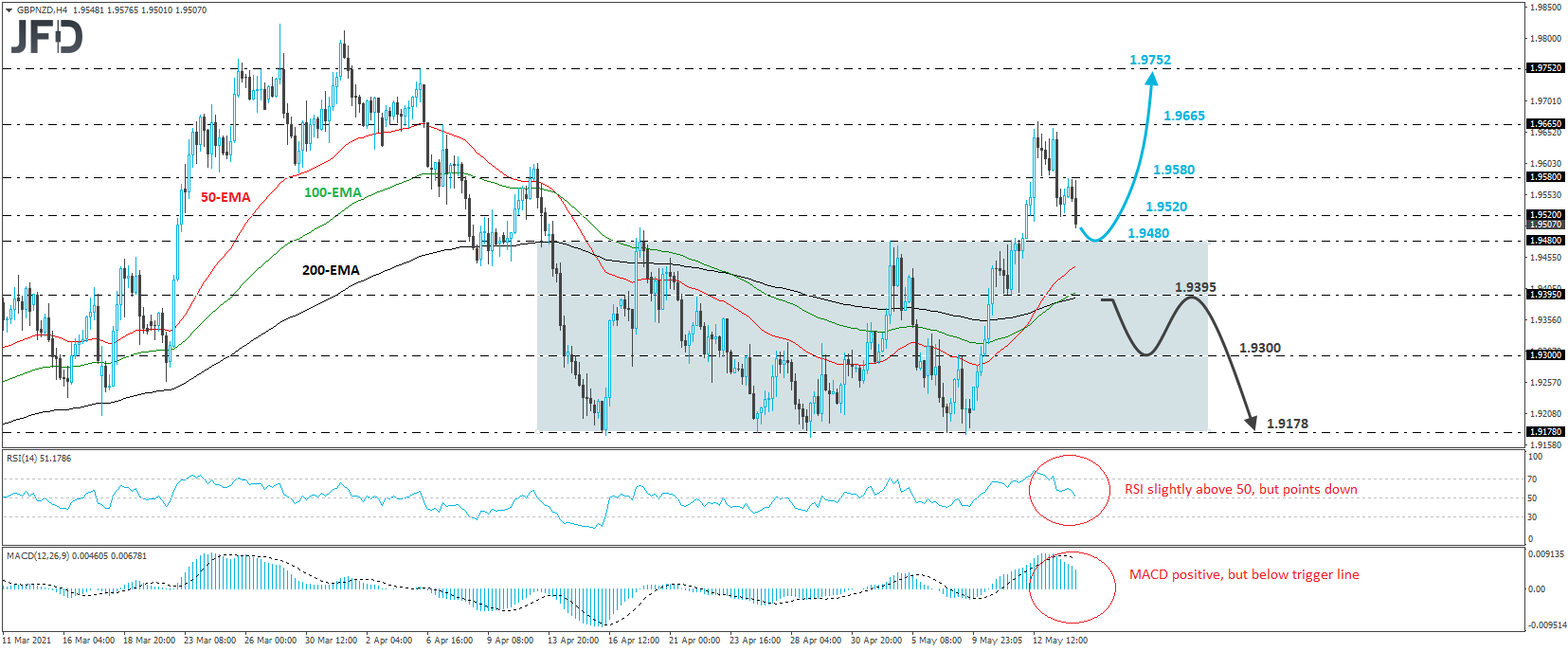

GBP/NZD traded lower today, after hitting resistance at 1.9580. The pair has been in a sliding mode since yesterday, but it is still trading above 1.9480, the upper bound of the prior range that’s been in place from Apr. 14 until Wednesday. Thus, with that in mind, we will adopt a cautiously positive stance for now.

The slide may continue for a while more, but if the bulls are strong enough to take charge from near the 1.9480 zone, we may see a rebound and another test near the 1.9665 zone, which is near Wednesday’s peak and is marked by the high of Apr. 7. A break above that zone will confirm a forthcoming higher high on both the 4-hour and daily charts and may extend the recovery towards the peak of Apr. 6, at 1.9752.

Shifting attention to our short-term oscillators, we see that the RSI, although slightly above 50, points down and appears ready to fall below that barrier soon. The MACD is positive, but lies below its trigger line, pointing south as well. Both indicators support the case for some further retreat before, and if, the bulls decide to take charge again.

However, in order to start examining the rate’s return within the pre-mentioned range, we would like to see a dip back below 1.9395. This may confirm that the outlook has turned back to neutral and may encourage some declines within the range, initially towards the 1.9300 zone, marked by the inside swing high of May 7, and then, towards the lower end of the range, at around 1.9178.