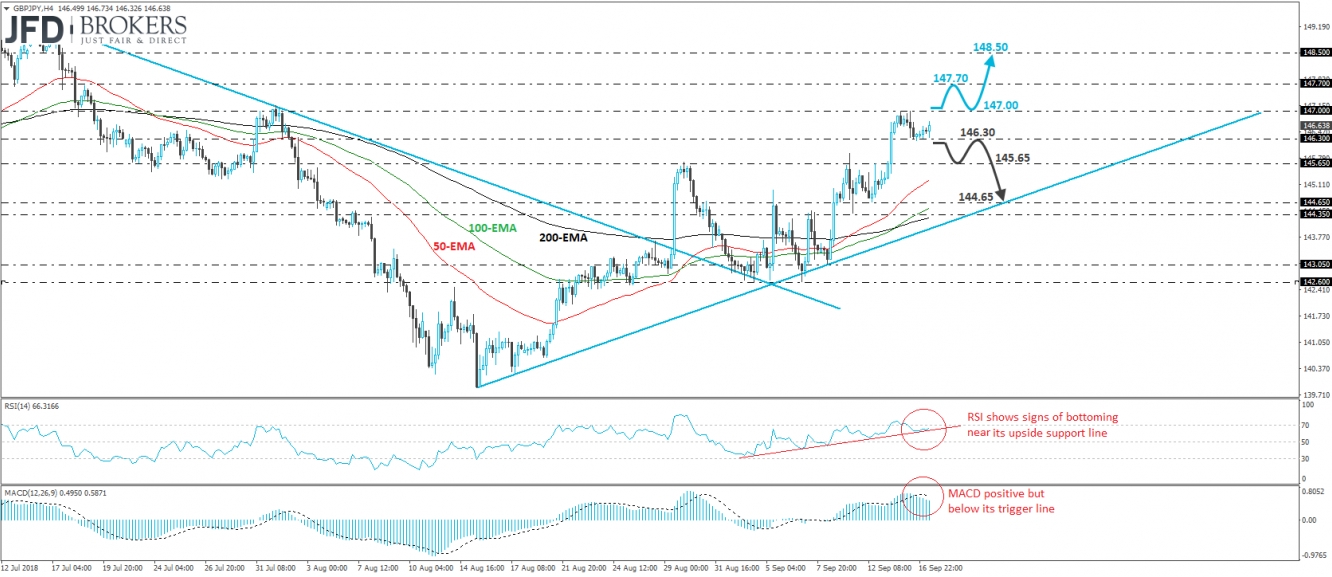

GBP/JPY surged on Thursday, but on Friday, it hit resistance near the 147.00 barrier and pulled back to find support at around the 146.30 level, where it paused for a while. Bearing in mind that the pair continues to trade above the upside support line drawn from the low of the 15th of August, we would consider the near-term outlook to be positive.

A clear and decisive break above 147.00 would confirm a forthcoming higher high on the 4-hour chart, perhaps initially aiming for our next resistance, near 147.70, defined by the peak of the 18th of July. Another break above that level could carry more bullish extensions and perhaps set the stage for the 148.50 hurdle, a resistance marked by the inside swing low of the 16th of July.

Shifting attention to our short-term oscillators, we see that the RSI shows signs of bottoming from near its respective upside support line. It could cross back above 70 soon. This supports the case for the pair to rebound and trade higher. However, the MACD, although positive, lies below its trigger line and points down, which make us cautious that a corrective retreat may be looming.

A dip below 146.30 could confirm the case for a setback and could open the path towards the 145.65 zone, where another break could see scope for declines towards the 144.65 barrier, or the aforementioned upside support line. That said, even if this is the case and the pair corrects lower, we would still consider the outlook to be cautiously positive as the bulls could take advantage of the rate’s proximity to the upside line. We would like to see a clear dip below 144.35 before we totally abandon the bullish case.