Investing.com’s stocks of the week

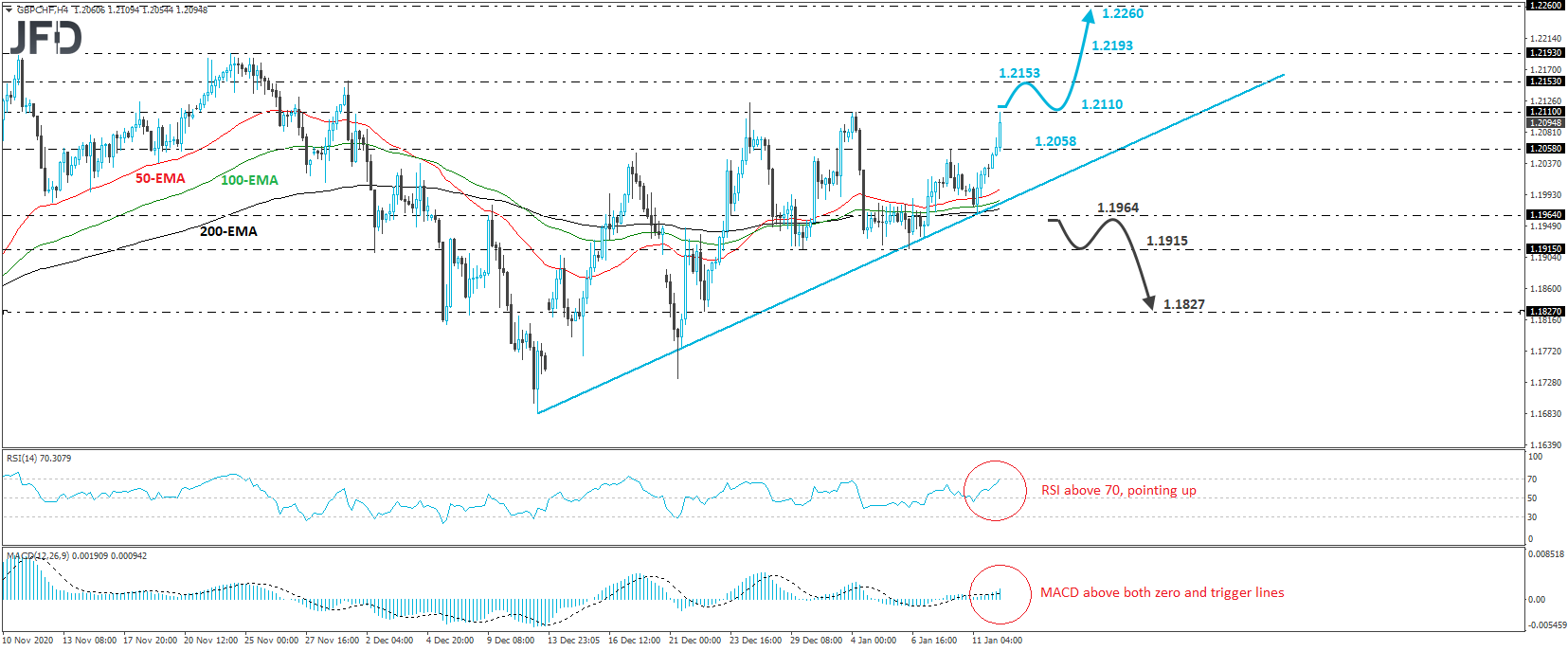

GBP/CHF has been in a rising mode since yesterday, when it hit support at 1.1964. Today, the pair tested the 1.2110 hurdle, marked by the high of Jan. 4, and then it retreated somewhat. Overall, the pair is trading above the tentative upside support line drawn from the low of Dec. 11, and thus we would consider the short-term outlook to be cautiously positive.

In order to get confident on larger advances, we would like to see a decisive break above the 1.2110 barrier. Such a move would confirm a forthcoming higher high on the daily chart, and may initially pave the way towards the high of Dec. 1, at 1.2153. If that level is not able to stop the uprise, then its break may drag the rate to the high of Nov. 24, at 1.2193. Another break, above 1.2193, could see scope for extensions towards the 1.2260 territory, defined as a resistance by the high of June 5.

Looking at our short-term oscillators, we see that the RIS has just poked its nose above its 70 line, and continues to point north, while the MACD stands above both its zero and trigger lines. Both indicators detect strong upside speed, suggesting that the rate may have the necessary momentum to overcome the 1.2110 barrier this time around.

On the downside, we would like to see a decisive dip below 1.1964 before we abandon the bullish case. This would not only confirm the break below the aforementioned upside support line, but would also confirm a forthcoming lower low. The bears may then target the 1.1915 level, marked by the low of Jan. 6, the break of which may carry larger bearish implications, perhaps paving the way towards the low of Dec. 22, at 1.1827.