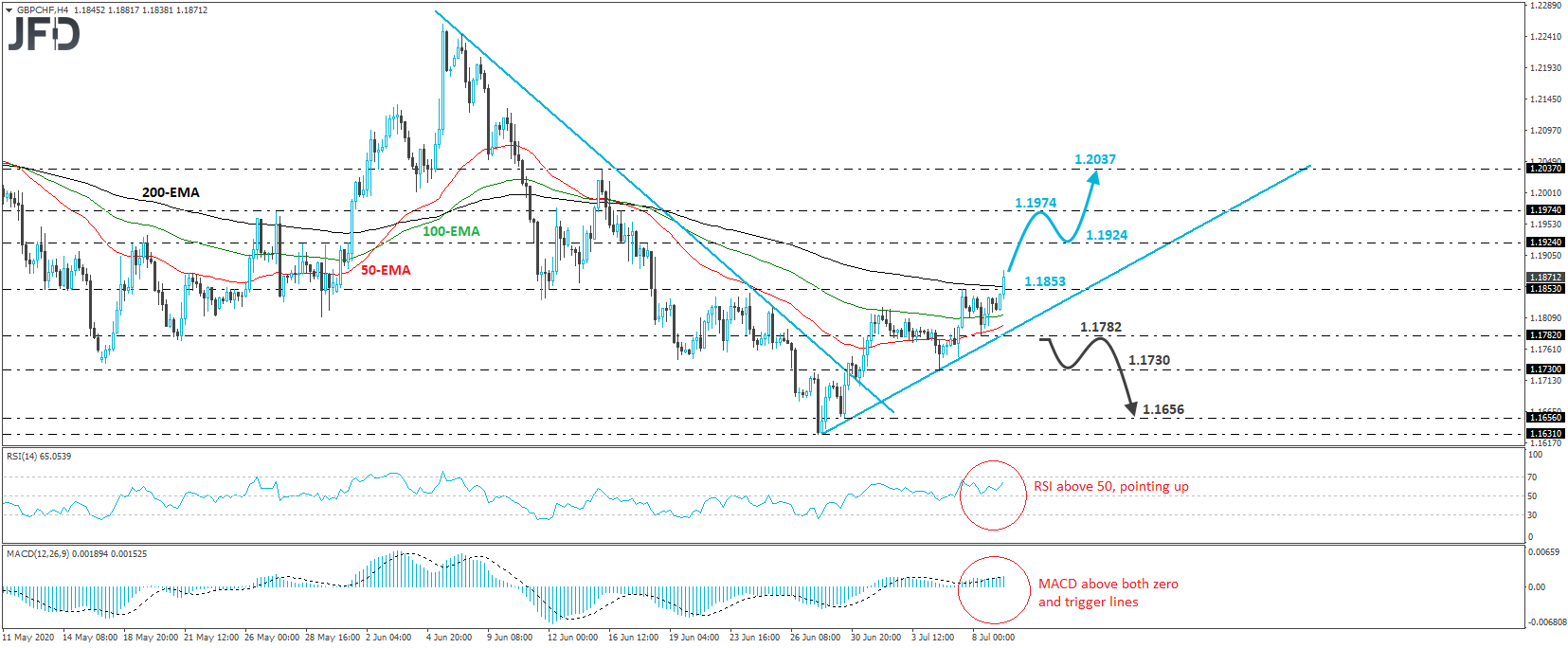

GBP/CHF traded higher on Thursday, breaking above Tuesday’s high of 1.1853. Overall, the rate continues to print higher highs and higher lows above an upside support line drawn from the low of June 29th, and thus, we would consider the short-term outlook to be positive for now.

The break above 1.1853 has confirmed a forthcoming higher high on the 4-hour chart, and in our view, it may allow the bulls to travel towards the high of June 18th, at around 1.1924. If that level is also broken, then the next stop could be at the high of the day before, near 1.1974. The bulls may decide to take a break after testing that zone, but if the rate continues to trade above the aforementioned upside line, we will see decent chances for another leg north. If this time the 1.1974 barrier surrenders, the road towards the high of June 16th, at 1.2037 may be opened.

Turning our gaze to our short-term momentum studies, we see that the RSI lies above 50 and points up, while the MACD runs above both its zero and trigger lines. Both indicators detect upside speed and support the notion for some further near-term advances in this exchange rate.

In order to abandon the bullish case, we would like to see a decisive dip below yesterday’s low of 1.1782. The pair would already be below the pre-discussed upside line and may encourage the bears to pull the trigger for declines towards Monday’s low, at 1.1730. Another break, below 1.1730, may see scope for extensions towards the low of June 30th, at 1.1656, or the low of the day before, at 1.1631.