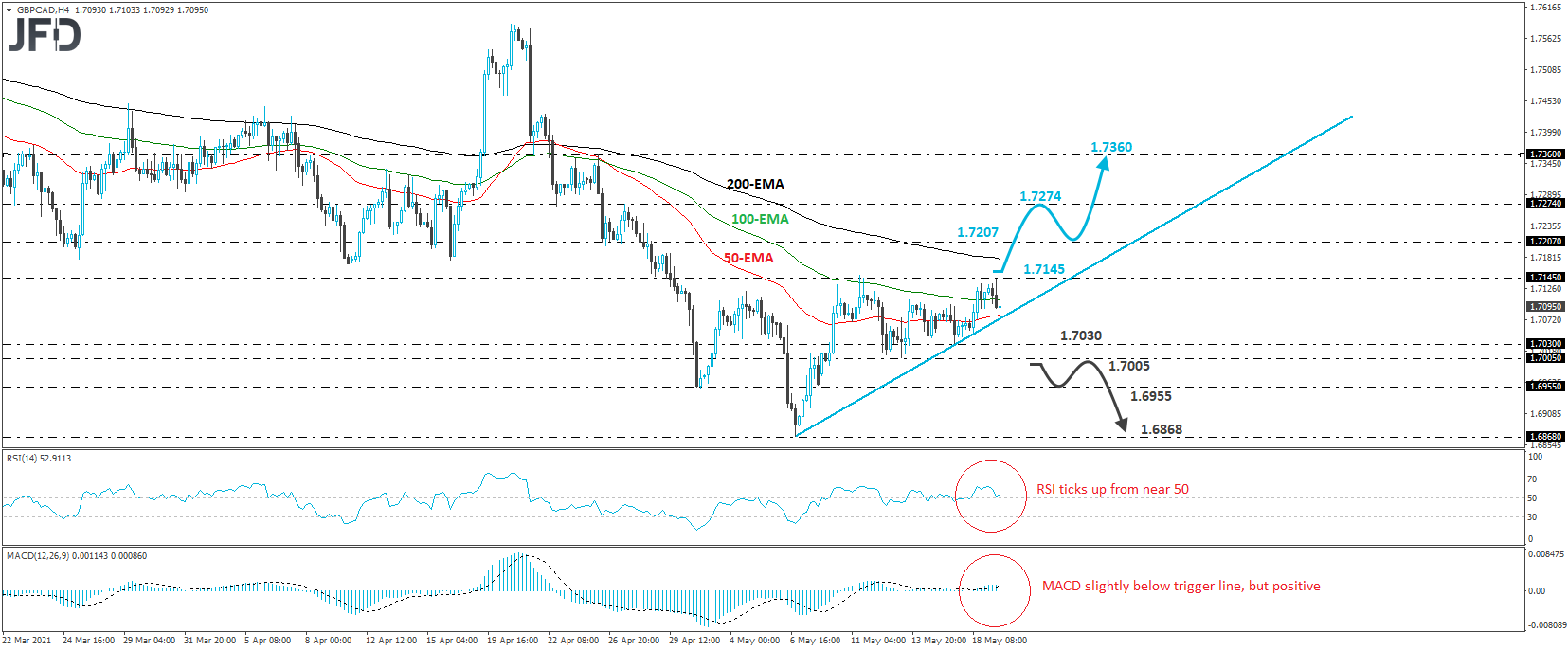

GBP/CAD traded higher yesterday, after it hit support at the tentative upside line drawn from the low of May 6. That said, today, the rate hit once again the 1.7145 resistance barrier and pulled back, but stayed above the upside line. As long as the rate remains above that line, we would consider the short-term outlook to be positive.

However, in order to start examining larger advances, we would like to see a strong break above 1.7145. This may encourage the bulls to take the action to the 1.7207 zone, marked by the inside swing lows of Apr. 26 and 27, the break of which could aim for the peak of the latter day, at 1.7274. If that barrier doesn’t hold either, then we could experience extensions towards the high of Apr. 26, at 1.7360.

Shifting attention to our short-term oscillators, we see that the RSI slid, but hit support near 50 and ticked up again, while the MACD, although below its trigger line, remains within the positive territory. In our view, this suggests that even if the current retreat continues for a while more, there is decent chance for the bulls to take back control, perhaps from near the pre-mentioned upside line.

In order to abandon the bullish case, we would like to see a decisive dip below the 1.7005 barrier, marked by the low of May 13. This would confirm a forthcoming lower low on the 4-hour chart and may initially target the low of Apr. 30, at 1.6955. Another break, below 1.6955, could extend the fall towards the low of May 6, at 1.6868.